A debit card, also known as a check card or bank card, is a payment card that can be used in place of cash to make purchases. The card usually consists of the bank's name, a card number, the cardholder's name, and an expiration date, on either the front or the back. Many new cards now have a chip on them, which allows people to use their card by touch (contactless), or by inserting the card and keying in a PIN as with swiping the magnetic stripe. Debit cards are similar to a credit card, but the money for the purchase must be in the cardholder's bank account at the time of the purchase and is immediately transferred directly from that account to the merchant's account to pay for the purchase.

Electronic Funds Transfer at Point Of Sale, abbreviated as EFTPOS; is the technical term referring to a type of payment transaction where electronic funds transfers (EFT) are processed at a point of sale (POS) system or payment terminal usually via payment methods such as payment cards. EFTPOS technology was developed during the 1980s.

Visa Inc. is an American multinational payment card services corporation headquartered in San Francisco, California. It facilitates electronic funds transfers throughout the world, most commonly through Visa-branded credit cards, debit cards and prepaid cards.

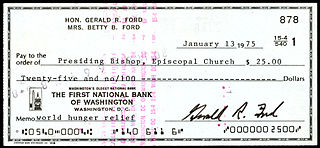

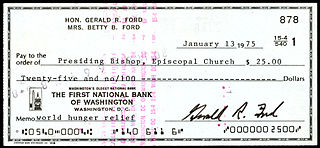

A cheque is a document that orders a bank, building society to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the drawer, has a transaction banking account where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the drawee, to pay the amount of money stated to the payee.

Dynamic currency conversion (DCC) or cardholder preferred currency (CPC) is a process whereby the amount of a credit card transaction is converted at the point of sale, ATM or internet to the currency of the card's country of issue. DCC is generally provided by third party operators in association with the merchant, and not by a card issuer. Card issuers permit DCC operators to offer DCC in accordance with the card issuers' processing rules. However, using DCC, the customer is usually charged an amount in excess of the transaction amount converted at the normal exchange rate, though this may not be obviously disclosed to the customer at the time. The merchant, the merchant's bank or ATM operator usually impose a markup on the transaction, in addition to the exchange rate that would normally apply, sometimes by as much as 18%.

A merchant account is a type of bank account that allows businesses to accept payments in multiple ways, typically debit or credit cards. A merchant account is established under an agreement between an acceptor and a merchant acquiring bank for the settlement of payment card transactions. In some cases a payment processor, independent sales organization (ISO), or member service provider (MSP) is also a party to the merchant agreement. Whether a merchant enters into a merchant agreement directly with an acquiring bank or through an aggregator, the agreement contractually binds the merchant to obey the operating regulations established by the card associations. A high-risk merchant account is a business account or merchant account that allows the business to accept online payments though they are considered to be of high-risk nature by the banks and credit card processors. The industries that possess this account are adult industry, travel, Forex trading business, multilevel marketing business. "High-Risk" is the term that is used by the acquiring banks to signify industries or merchants that are involved with the higher financial risk.

Payment cards are part of a payment system issued by financial institutions, such as a bank, to a customer that enables its owner to access the funds in the customer's designated bank accounts, or through a credit account and make payments by electronic transfer with a payment terminal and access automated teller machines (ATMs). Such cards are known by a variety of names, including bank cards, ATM cards, client cards, key cards or cash cards.

Network for Electronic Transfers, colloquially known as NETS, is a Singaporean electronic payment service provider. Founded in 1986 by a consortium of local banks, it aims to establish the debit network and drive the adoption of electronic payments in Singapore. It is owned by DBS Bank, OCBC Bank and United Overseas Bank (UOB).

ATM usage fees are what many banks and interbank networks charge for the use of their automated teller machines (ATMs). In some cases, these fees are assessed solely for non-members of the bank; in other cases, they apply to all users. There is usually a higher fee for use of White-label ATMs rather than bank owned ATMs.

Interchange fee is a term used in the payment card industry to describe a fee paid between banks for the acceptance of card-based transactions. Usually for sales/services transactions it is a fee that a merchant's bank pays a customer's bank.

Taxis in Australia are highly regulated by each Australian state and territory, with each state and territory having its own history and structure. In December 2014, there were 21,344 taxis in Australia. Taxis in Australia are required to be licensed and are typically required to operate and charge on a fitted taximeter. Taxi fare rates are set by State or Territory governments. A vehicle without a meter is generally not considered to be a taxi, and may be described, for example, as a hire car, limousine, carpool, etc. Most taxis today are fueled by liquid petroleum gas. A2B Australia owns and operates the Cabcharge payment system, which covers 98% of taxis in Australia, and operates one of Australia's largest taxi networks.

A payment terminal, also known as a point of sale (POS) terminal, credit card machine, card reader, PIN pad, EFTPOS terminal, is a device which interfaces with payment cards to make electronic funds transfers. The terminal typically consists of a secure keypad for entering PIN, a screen, a means of capturing information from payments cards and a network connection to access the payment network for authorization.

A credit card is a payment card, usually issued by a bank, allowing its users to purchase goods or services, or withdraw cash, on credit. Using the card thus accrues debt that has to be repaid later. Credit cards are one of the most widely used forms of payment across the world.

BPAY is an Australian electronic bill payment SaaS company which facilitates payments made through a financial institution's online, mobile or telephone banking facility to organisations which are registered BPAY billers.

The Taxi Industry Inquiry or the Fels Inquiry was an inquiry commissioned in 2011 into the taxi industry and taxi services in Victoria, Australia, by the Taxi Services Commission. The inquiry was headed by Professor Allan Fels assisted by Dr David Cousins.

A surcharge, also known as checkout fee, is an extra fee charged by a merchant when receiving a payment by cheque, credit card, charge card or debit card which at least covers the cost to the merchant of accepting that means of payment, such as the merchant service fee imposed by a credit card company. Retailers generally incur higher costs when consumers choose to pay by credit card due to higher merchant service fees compared to traditional payment methods such as cash.

In online retail, drip pricing is a sales technique where a headline price is advertised at the beginning of the purchase process, followed by the incremental disclosure of additional fees, taxes or charges. The objective of drip pricing is to gain a consumer's interest in a misleadingly low headline price without the true final price being disclosed until the consumer has invested time and effort in the purchase process and made a decision to purchase.

A2B Australia is an Australian based taxi operator.

ACCC v Cabcharge Australia Ltd is a 2010 decision of the Federal Court of Australia brought by the Australian Competition & Consumer Commission (ACCC) against Cabcharge. In June 2009, the ACCC began proceedings in the Federal Court against Cabcharge alleging that it had breached section 46 of the Commonwealth Trade Practices Act (TPA) by misusing its market power and entering into an agreement to substantially lessen competition. The action alleged predatory pricing by Cabcharge and centred on Cabcharge's conduct in refusing to deal with competing suppliers to allow Cabcharge payments to be processed through EFTPOS terminals provided by rival companies and supplying taxi meters and fare updates at below actual cost or at no cost.

Live group Pty Limited is a merchant services provider, accredited by Mastercard. Originally established by Macquarie Bank in 2006 as Live Payments, the company was privatised in 2008 and restructured as Live group.