Facts & procedural history

On April 28, 1936, the Federal Reserve Bank of Philadelphia mailed a check for $24.20, drawn on the Treasurer of the United States, to Clair Barner. The check was Barner's paycheck from the Works Progress Administration (WPA). Barner never received the check, which was stolen by an unknown party. The thief forged Barner's signature and cashed the check at the J.C. Penney department store in Clearfield, Pennsylvania, where the thief assumed the identity of Mr. Barner. J.C. Penney then turned the check over to Clearfield Trust Co. as its collection agent. Clearfield Trust Co. collected the check from the Federal Reserve Bank, knowing nothing about the forgery.

On May 10, 1936, Barner informed his supervisors at the WPA that he had not received his paycheck. His complaint made its way up the chain of command, and on November 30, 1936, Barner signed an affidavit alleging that the endorsement of his name on the check was forged. Neither J.C. Penney Co. nor Clearfield Trust Co. had any notice of the forgery until January 12, 1937, when the U.S. government sent its first notice about it. The United States sent its initial request for reimbursement on August 31, 1937, and filed suit against Clearfield Trust Co. in the United States District Court for the Western District of Pennsylvania on November 16, 1939. The government based its cause of action on the express guaranty of prior endorsements by Clearfield Trust Co.

The District Court determined that the dispute should be governed by the state law of Pennsylvania. It then dismissed the government's complaint on grounds of laches, holding that because the United States unreasonably delayed in notifying Clearfield Trust Co. of the forgery, it was barred from recovery. The United States Court of Appeals for the Third Circuit reversed the dismissal.

Decision

Justice Douglas, writing for a unanimous United States Supreme Court, first distinguished the case from Erie Railroad Co. v. Tompkins , holding that because the U.S. government was exercising a constitutionally-permitted function in disbursing its own funds and paying its debts, the commercial paper it issues should be governed by federal law rather than state law. Thus, the Erie doctrine rule -- that a United States District Court must apply the law of the state in which it is sitting -- did not apply. In the absence of an applicable Act of Congress, a federal court had the right to fashion a governing common law rule by its own standards.

While the Court's decision explicitly retained the option of applying state law in fashioning a federal common law rule, the Court chose instead to fashion its own rule based on prior decisions. Justice Douglas identified a major federal interest in permitting the Court to fashion its own rule: uniformity in dealing with the vast amount of negotiable instruments and commercial paper issued by the federal government. Douglas reasoned that if each transaction were subject to the application of a multiplicity of different state laws, confusion and uncertainty in the administration of federal programs would be the result.

Justice Douglas chose to follow the rule set forth in United States v. National Exchange Bank of Providence , 214 U.S. 302 (1909), in which the U.S. Supreme Court held that the U.S. government, “as drawee of commercial paper stands in no different light than any other drawee” and could recover on a check as a drawee from a person who had cashed a pension check with a forged endorsement, despite the government's protracted delay in giving notice of the forgery. The National Exchange Bank case held the government to conventional business terms, but said nothing about whether lack of prompt notice was a defense for nonpayment of a check. The Court held that the Pennsylvania state law -- requiring prompt notice from the drawee -- presumed injury to the defendant by the mere fact of delay. In this case, not only did Clearfield Trust Co. fail to demonstrate that it had suffered a loss because of the delay in notice, it could still recover the amount of the check from J.C. Penney, because none of its employees detected the fraud. The court chastised both companies for their "neglect and error" in accepting the forged check, and suggested that they should only be permitted to shift the loss to the drawee only when he can demonstrate that the delay in notice caused him damage.

The Constitution of the United States is the supreme law of the United States of America. It superseded the Articles of Confederation, the nation's first constitution, in 1789. Originally comprising seven articles, it delineates the national frame and constraints of government. The Constitution's first three articles embody the doctrine of the separation of powers, whereby the federal government is divided into three branches: the legislative, consisting of the bicameral Congress ; the executive, consisting of the president and subordinate officers ; and the judicial, consisting of the Supreme Court and other federal courts. Article IV, Article V, and Article VI embody concepts of federalism, describing the rights and responsibilities of state governments, the states in relationship to the federal government, and the shared process of constitutional amendment. Article VII establishes the procedure subsequently used by the 13 states to ratify it. The Constitution of the United States is the oldest and longest-standing written and codified national constitution in force in the world today.

The First Amendment to the United States Constitution prevents the government from making laws that regulate an establishment of religion, or that prohibit the free exercise of religion, or abridge the freedom of speech, the freedom of the press, the freedom of assembly, or the right to petition the government for redress of grievances. It was adopted on December 15, 1791, as one of the ten amendments that constitute the Bill of Rights.

Federal law is the body of law created by the federal government of a country. A federal government is formed when a group of political units, such as states or provinces join in a federation, delegating their individual sovereignty and many powers to the central government while retaining or reserving other limited powers. As a result, two or more levels of government exist within an established geographic territory. The body of law of the common central government is the federal law.

Bank fraud is the use of potentially illegal means to obtain money, assets, or other property owned or held by a financial institution, or to obtain money from depositors by fraudulently posing as a bank or other financial institution. In many instances, bank fraud is a criminal offence. While the specific elements of particular banking fraud laws vary depending on jurisdictions, the term bank fraud applies to actions that employ a scheme or artifice, as opposed to bank robbery or theft. For this reason, bank fraud is sometimes considered a white-collar crime.

The Preamble to the United States Constitution, beginning with the words We the People, is a brief introductory statement of the US Constitution's fundamental purposes and guiding principles. Courts have referred to it as reliable evidence of the Founding Fathers' intentions regarding the Constitution's meaning and what they hoped the Constitution would achieve.

Separation of powers is a political doctrine originating in the writings of Charles de Secondat, Baron de Montesquieu in The Spirit of the Laws, in which he argued for a constitutional government with three separate branches, each of which would have defined abilities to check the powers of the others. This philosophy heavily influenced the drafting of the United States Constitution, according to which the Legislative, Executive, and Judicial branches of the United States government are kept distinct in order to prevent abuse of power. The American form of separation of powers is associated with a system of checks and balances.

Wolf v. Colorado, 338 U.S. 25 (1949), was a United States Supreme Court case in which the Court held 6—3 that, while the Fourth Amendment was applicable to the states, the exclusionary rule was not a necessary ingredient of the Fourth Amendment's right against warrantless and unreasonable searches and seizures. In Weeks v. United States, 232 U.S. 383 (1914), the Court held that as a matter of judicial implication the exclusionary rule was enforceable in federal courts but not derived from the explicit requirements of the Fourth Amendment. The Wolf Court decided not to incorporate the exclusionary rule as part of the Fourteenth Amendment in large part because the states which had rejected the Weeks Doctrine had not left the right to privacy without other means of protection. However, because most of the states' rules proved to be ineffective in deterrence, the Court overruled Wolf in Mapp v. Ohio, 367 U.S. 643 (1961). That landmark case made history as the exclusionary rule enforceable against the states through the Due Process clause of the Fourteenth Amendment to the same extent that it applied against the federal government.

Article I, Section 10, Clause 1 of the United States Constitution, known as the Contract Clause, imposes certain prohibitions on the states. These prohibitions are meant to protect individuals from intrusion by state governments and to keep the states from intruding on the enumerated powers of the U.S. federal government.

Erie Railroad Co. v. Tompkins, 304 U.S. 64 (1938), was a landmark U.S. Supreme Court decision in which the Court held that there is no general American federal common law and that U.S. federal courts must apply state law, not federal law, to lawsuits between parties from different states that do not involve federal questions. In reaching this holding, the Court overturned almost a century of federal civil procedure case law, and established the foundation of what remains the modern law of diversity jurisdiction as it applies to United States federal courts.

Federal common law is a term of United States law used to describe common law that is developed by the federal courts, instead of by the courts of the various states. The United States is the only country to combine the creation of common law doctrines with a complete federalism, wherein the national supreme court has virtually no power to review state court decisions to determine whether the state courts have followed state laws. The High Court of Australia is sometimes said to have federal common law, but because all state and territorial courts are directly appealable to the High Court, this is indistinguishable from a general common law. In contrast, the United States Supreme Court has effectively barred the creation of federal common law in areas traditionally under the authority of state courts. Nevertheless, there are several areas where federal common law continues to govern.

John Michael Luttig is an American corporate lawyer and jurist who was a judge of the United States Court of Appeals for the Fourth Circuit from 1991 to 2006. Luttig resigned from the court of appeals in 2006 to become general counsel of Boeing, a position he held until 2019.

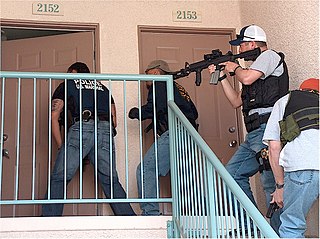

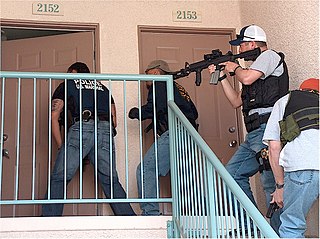

Knock-and-announce, in United States law criminal procedure, is an ancient common law principle, incorporated into the Fourth Amendment, which requires law enforcement officers to announce their presence and provide residents with an opportunity to open the door prior to a search.

This is a list of cases reported in volume 1 of United States Reports, decided by various Pennsylvania courts from 1754 to 1789.

This is a list of cases reported in volume 4 U.S. of United States Reports, decided by the Supreme Court of the United States in 1799 and 1800. Case reports from other tribunals also appear in 4 U.S..

Williamson County Regional Planning Commission v. Hamilton Bank of Johnson City, 473 U.S. 172 (1985), is a U.S. Supreme Court case that limited access to federal court for plaintiffs alleging uncompensated takings of private property under the Fifth Amendment. In June 2019, this case was overruled in part by the Court's decision in Knick v. Township of Scott, Pennsylvania.

The Supremacy Clause of the Constitution of the United States establishes that the Constitution, federal laws made pursuant to it, and treaties made under its authority, constitute the "supreme Law of the Land", and thus take priority over any conflicting state laws. It provides that state courts are bound by, and state constitutions subordinate to, the supreme law. However, federal statutes and treaties must be within the parameters of the Constitution; that is, they must be pursuant to the federal government's enumerated powers, and not violate other constitutional limits on federal power, such as the Bill of Rights—of particular interest is the Tenth Amendment to the United States Constitution, which states that the federal government has only those powers that are delegated to it by the Constitution.

Smith v. Kansas City Title & Trust Co., 255 U.S. 180 (1921), was a United States Supreme Court case that helped define the range and scope of federal question jurisdiction in state corporate law matters. The case dealt with whether or not a district court had the power to uphold the constitutional validity of the Federal Farm Loan Act of 1916.

The law of Pennsylvania consists of several levels, including constitutional, statutory, regulatory and case law. The Pennsylvania Consolidated Statutes form the general statutory law.

California Motor Transport Co. v. Trucking Unlimited, 404 U.S. 508 (1972), was a landmark decision of the US Supreme Court involving the right to make petitions to the government. The right to petition is enshrined in the First Amendment to the United States Constitution as: "Congress shall make no law...abridging...the right of the people...to petition the Government for a redress of grievances." This case involved an accusation that one group of companies was using state and federal regulatory actions to eliminate competitors. The Supreme Court ruled that the right to petition is integral to the legal system but using lawful means to achieve unlawful restraint of trade is not protected.

Marshall v. Holmes, 141 U.S. 589, is an 1891 decision of the United States Supreme Court on equitable relief, res judicata and fraud on the court in diversity jurisdiction. Justice John Marshall Harlan wrote for a unanimous Court that held it unconscionable to allow a state court's decision to stand that had been based on documents later exposed as forgeries. It permitted a federal case seeking to set that verdict aside to go forward.