Econometrics is an application of statistical methods to economic data in order to give empirical content to economic relationships. More precisely, it is "the quantitative analysis of actual economic phenomena based on the concurrent development of theory and observation, related by appropriate methods of inference." An introductory economics textbook describes econometrics as allowing economists "to sift through mountains of data to extract simple relationships." Jan Tinbergen is one of the two founding fathers of econometrics. The other, Ragnar Frisch, also coined the term in the sense in which it is used today.

Simultaneous equations models are a type of statistical model in which the dependent variables are functions of other dependent variables, rather than just independent variables. This means some of the explanatory variables are jointly determined with the dependent variable, which in economics usually is the consequence of some underlying equilibrium mechanism. Take the typical supply and demand model: whilst typically one would determine the quantity supplied and demanded to be a function of the price set by the market, it is also possible for the reverse to be true, where producers observe the quantity that consumers demand and then set the price.

Herman Ole Andreas Wold was a Norwegian-born econometrician and statistician who had a long career in Sweden. Wold was known for his work in mathematical economics, in time series analysis, and in econometric statistics.

Harry Max Markowitz was an American economist who received the 1989 John von Neumann Theory Prize and the 1990 Nobel Memorial Prize in Economic Sciences.

Tjalling Charles Koopmans was a Dutch-American mathematician and economist. He was the joint winner with Leonid Kantorovich of the 1975 Nobel Memorial Prize in Economic Sciences for his work on the theory of the optimum allocation of resources. Koopmans showed that on the basis of certain efficiency criteria, it is possible to make important deductions concerning optimum price systems.

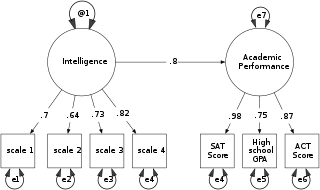

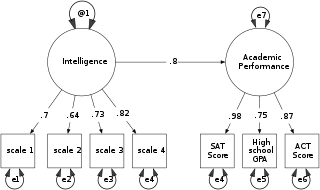

Structural equation modeling (SEM) is a diverse set of methods used by scientists doing both observational and experimental research. SEM is used mostly in the social and behavioral sciences but it is also used in epidemiology, business, and other fields. A definition of SEM is difficult without reference to technical language, but a good starting place is the name itself.

Takeshi Amemiya is an economist specializing in econometrics and the economy of ancient Greece.

Lars Peter Hansen is an American economist. He is the David Rockefeller Distinguished Service Professor in Economics, Statistics, and the Booth School of Business, at the University of Chicago and a 2013 recipient of the Nobel Memorial Prize in Economics.

In economics and econometrics, the parameter identification problem arises when the value of one or more parameters in an economic model cannot be determined from observable variables. It is closely related to non-identifiability in statistics and econometrics, which occurs when a statistical model has more than one set of parameters that generate the same distribution of observations, meaning that multiple parameterizations are observationally equivalent.

Alfred Cowles III was an American economist, businessman, and founder of the Cowles Commission for Research in Economics, an influential research institute which advanced the field of econometrics in the 20th century. When he established the Cowles Commission in 1932, he was intent on making economics more of a "science" by collecting data and applying modern mathematical and statistical techniques. Although he shared the same name as his father and grandfather, both of whom had been involved with the Chicago Tribune Company, he preferred to be known simply as Alfred Cowles.

Donald Wilfrid Kao Andrews is a Canadian economist. He is the Tjalling Koopmans Professor of Economics at the Cowles Foundation, Yale University. Born in Vancouver, he received his B.A. in 1977 at the University of British Columbia, his M.A. in 1980 in statistics at the University of California, Berkeley, and his Ph.D. in economics in 1982 also from the University of California, Berkeley.

The Ramsey–Cass–Koopmans model, or Ramsey growth model, is a neoclassical model of economic growth based primarily on the work of Frank P. Ramsey, with significant extensions by David Cass and Tjalling Koopmans. The Ramsey–Cass–Koopmans model differs from the Solow–Swan model in that the choice of consumption is explicitly microfounded at a point in time and so endogenizes the savings rate. As a result, unlike in the Solow–Swan model, the saving rate may not be constant along the transition to the long run steady state. Another implication of the model is that the outcome is Pareto optimal or Pareto efficient.

Leonid Hurwicz was a Polish–American economist and mathematician, known for his work in game theory and mechanism design. He originated the concept of incentive compatibility, and showed how desired outcomes can be achieved by using incentive compatible mechanism design. Hurwicz shared the 2007 Nobel Memorial Prize in Economic Sciences for his seminal work on mechanism design. Hurwicz was one of the oldest Nobel Laureates, having received the prize at the age of 90.

Structural estimation is a technique for estimating deep "structural" parameters of theoretical economic models. The term is inherited from the simultaneous equations model. Structural estimation is extensively using the equations from the economics theory, and in this sense is contrasted with "reduced form estimation" and other nonstructural estimations that study the statistical relationships between the observed variables while utilizing the economics theory very lightly. The idea of combining statistical and economic models dates to mid-20th century and work of the Cowles Commission.

Karl Gustav Jöreskog is a Swedish statistician. Jöreskog is a professor emeritus at Uppsala University, and a co-author of the LISREL statistical program. He is also a member of the Royal Swedish Academy of Sciences. Jöreskog received his bachelor's, master's, and doctoral degrees at Uppsala University. He is also a former student of Herman Wold. He was a statistician at Educational Testing Service (ETS) and a visiting professor at Princeton University.

The methodology of econometrics is the study of the range of differing approaches to undertaking econometric analysis.

John Denis Sargan, FBA was a British econometrician who specialized in the analysis of economic time-series.

Causation in economics has a long history with Adam Smith explicitly acknowledging its importance via his (1776) An Inquiry into the Nature and Causes of the Wealth of Nations and David Hume and John Stuart Mill (1848) both offering important contributions with more philosophical discussions. Hoover (2006) suggests that a useful way of classifying approaches to causation in economics might be to distinguish between approaches that emphasize structure and those that emphasize process and to add to this a distinction between approaches that adopt a priori reasoning and those that seek to infer causation from the evidence provided by data. He represented by this little table which useful identifies key works in each of the four categories.

Charles Frederick Roos was an American economist who made contributions to mathematical economics. He was one of the founders of the Econometric Society together with American economist Irving Fisher and Norwegian economist Ragnar Frisch in 1930. He served as secretary-treasurer during the first year of the society and was elected as president in 1948. He was director of research of the Cowles Commission from September 1934 to January 1937.

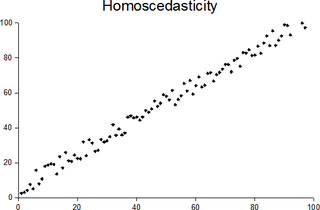

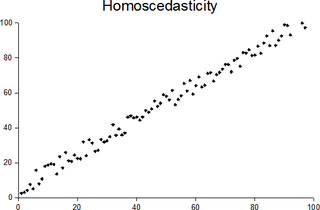

In statistics, a sequence of random variables is homoscedastic if all its random variables have the same finite variance; this is also known as homogeneity of variance. The complementary notion is called heteroscedasticity, also known as heterogeneity of variance. The spellings homoskedasticity and heteroskedasticity are also frequently used. Assuming a variable is homoscedastic when in reality it is heteroscedastic results in unbiased but inefficient point estimates and in biased estimates of standard errors, and may result in overestimating the goodness of fit as measured by the Pearson coefficient.