The Export Credits Guarantee Department (ECGD), branded as UK Export Finance (UKEF), is the export credit agency and a ministerial department of the Government of the United Kingdom.

Financial services are economic services tied to finance provided by financial institutions. Financial services encompass a broad range of service sector activities, especially as concerns financial management and consumer finance.

The Export–Import Bank of the United States (EXIM) is the official export credit agency (ECA) of the United States federal government. Operating as a wholly owned federal government corporation, the bank "assists in financing and facilitating U.S. exports of goods and services", particularly when private sector lenders are unable or unwilling to provide financing. Its current chairman and president, Reta Jo Lewis, was confirmed by the Senate on February 9, 2022.

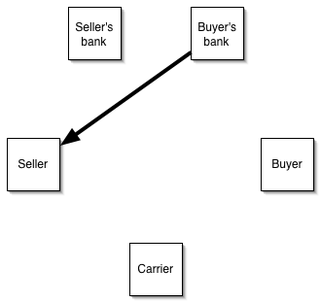

A letter of credit (LC), also known as a documentary credit or bankers commercial credit, or letter of undertaking (LoU), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Letters of credit are used extensively in the financing of international trade, when the reliability of contracting parties cannot be readily and easily determined. Its economic effect is to introduce a bank as an underwriter that assumes the counterparty risk of the buyer paying the seller for goods.

ICICI Bank Limited is an Indian multinational bank and financial services company headquartered in Mumbai with a registered office in Vadodara. It offers a wide range of banking and financial services for corporate and retail customers through various delivery channels and specialized subsidiaries in the areas of investment banking, life, non-life insurance, venture capital and asset management.

Life Insurance Corporation of India (LIC) is an Indian multinational public sector life insurance company headquartered in Mumbai. It is India's largest insurance company as well as the largest institutional investor with total assets under management worth ₹49.24 trillion (US$620 billion) as of March 2023. It is under the ownership of Government of India and administrative control of the Ministry of Finance.

An export credit agency or investment insurance agency is a private or quasi-governmental institution that acts as an intermediary between national governments and exporters to issue export insurance solutions and guarantees for financing. The financing can take the form of credits or credit insurance and guarantees or both, depending on the mandate the ECA has been given by its government. ECAs can also offer credit or cover on their own account. This does not differ from normal banking activities. Some agencies are government-sponsored, others private, and others a combination of the two.

Kotak Mahindra Bank Limited is an Indian banking and financial services company headquartered in Mumbai. It offers banking products and financial services for corporate and retail customers in the areas of personal finance, investment banking, life insurance, and wealth management. It is India's third largest private sector bank by market capitalisation after HDFC Bank and ICICI Bank. As of December 31, 2023, Kotak Mahindra Bank Ltd has 1,869 branches, 3,239 ATMs, and branches in GIFT City and DIFC (Dubai)

In trade finance, forfaiting is a service providing medium-term financial support for export/import of capital goods. The third party providing the support is termed the forfaiter. The forfaiter provides medium-term finance to, and will commonly also take on certain risks from, the importer; and takes on all risk from the exporter, in return for a margin. Payment may be by negotiable instrument, enabling the forfaiter to lay off some risks. Like factoring, forfaiting involves sale of financial assets from the seller's receivables. Key differences are that forfait supports the buyer (importer) as well as the seller (exporter), and is available only for export/import transactions and in relation to capital goods. The word forfaiting is derived from the French word forfait, meaning to relinquish the right.

Axis Bank Limited, formerly known as UTI Bank (1993–2007), is an Indian multinational banking and financial services company headquartered in Mumbai, Maharashtra. It is India's third largest private sector bank by assets and Fourth largest by Market capitalisation. It sells financial services to large and mid-size companies, SMEs and retail businesses.

The Multilateral Investment Guarantee Agency (MIGA) is an international financial institution which offers political risk insurance and credit enhancement guarantees. These guarantees help investors protect foreign direct investments against political and non-commercial risks in developing countries. MIGA is a member of the World Bank Group and is headquartered in Washington, D.C. in the United States.

Buyer credit is a term credit available to an importer (buyer) from overseas lenders such as banks and other financial institution for goods they are importing. In simple words it is the credit that is given by a bank to a foreign buyer where funds are paid directly to the buyer through a lending bank. The overseas banks usually lend the importer (buyer) based on the letter of comfort issued by the importer's bank. For this service the importer's bank or buyer's credit consultant charges a fee called an arrangement fee.

Trade finance is a phrase used to describe different strategies that are employed to make international trade easier. It signifies financing for trade, and it concerns both domestic and international trade transactions. A trade transaction requires a seller of goods and services as well as a buyer. Various intermediaries such as banks and financial institutions can facilitate these transactions by financing the trade. Trade finance manifest itself in the form of letters of credit (LOC), guarantees or insurance and is usually provided by intermediaries.

Infrastructure Leasing & Financial Services Limited (IL&FS) is an Indian state-funded infrastructure development and finance company. It was created by public sector banks and insurance companies.

All India Financial Institutions (AIFI) is a group composed of financial regulatory bodies that play a pivotal role in the financial markets. Also known as "financial instruments", the financial institutions assist in the proper allocation of resources, sourcing from businesses that have a surplus and distributing to others who have deficits - this also assists with ensuring the continued circulation of money in the economy. Possibly of greatest significance, the financial institutions act as an intermediary between borrowers and final lenders, providing safety and liquidity. This process subsequently ensures earnings on the investments and savings involved. In Post-Independence India, people were encouraged to increase savings, a tactic intended to provide funds for investment by the Indian government. However, there was a huge gap between the supply of savings and demand for the investment opportunities in the country.

China Export & Credit Insurance Corporation is a major Chinese state owned enterprise (SOE) under the administration of Ministry of Finance of the People's Republic of China serving as the provider of export credit insurance, in particular coverage for the export of high-value added goods in China.

Public Sector Undertakings (PSU) or Public Sector Enterprises (PSE) in India are government-owned enterprises in which 51 percent or more share capital is held by the Government of India or state governments or joint ventures between multiple Public Sector Enterprises. Depending on the level of government ownership, they can be broadly categorised as Central PSUs or State PSUs. These entities include government companies, statutory corporations, banking institutions, and departmentally run companies. PSUs are officially classified into three categories, which are Central Public Sector Enterprises (CPSE) and Public Sector Banks (PSB) owned by the central government or other CPSEs/PSBs, and State Level Public Enterprises (SLPE) owned by state governments or other SLPEs. CPSE is further classified into Strategic Sector and Non-Strategic Sector. Depending on their financial performance and progress, CPSEs are granted the status of Maharatna, Navaratna, and Miniratna.

Piramal Capital and Housing Finance Limited is a non-deposit taking housing finance company, headquartered in Mumbai with branches in major cities across India. DHFL was established to enable access to economical housing finance to the lower and middle income groups in semi-urban and rural parts of India. DHFL is the second housing finance company to be established in the country. The company also leases commercial and residential premises. DHFL is among the 50 biggest financial companies in India.

The African Trade and Investment Development Insurance (ATIDI) is an investment, trade and political risk-mitigation institution on the African continent intended to provide insurance against political and commercial risks in order to attract foreign direct investment to the region. ATIDI was founded in 2001 by seven COMESA countries, with technical and financial backing of The World Bank.

The Export-Import Bank of India is a specialized financial institution in India that was established in 1982. The bank's primary function is to finance, facilitate and promote India's international trade. It is owned by the Government of India and operates as a statutory corporation. Its operations are governed by the Export-Import Bank of India Act, 1981.