Related Research Articles

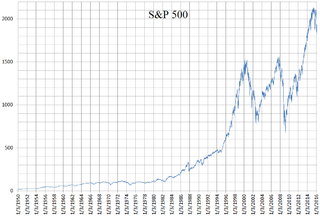

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies.

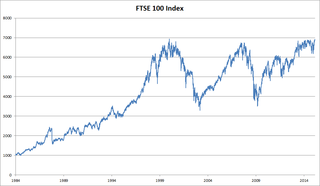

The Financial Times Stock Exchange 100 Index, also called the FTSE 100 Index, FTSE 100, FTSE, or, informally, the "Footsie", is a share index of the 100 companies listed on the London Stock Exchange with the highest market capitalisation. The index is maintained by the FTSE Group, a subsidiary of the London Stock Exchange Group.

Russell indexes are a family of global stock market indices from FTSE Russell that allow investors to track the performance of distinct market segments worldwide. Many investors use mutual funds or exchange-traded funds based on the FTSE Russell Indexes as a way of gaining exposure to certain portions of the U.S. stock market. Additionally, many investment managers use the Russell Indexes as benchmarks to measure their own performance. Russell's index design has led to more assets benchmarked to its U.S. index family than all other U.S. equity indexes combined.

Jakarta Stock Exchange was a stock exchange based in Jakarta, Indonesia, before it merged with the Surabaya Stock Exchange to form the Indonesia Stock Exchange.

The Straits Times Index is a capitalisation-weighted measurement stock market index that is regarded as the benchmark index for the stock market in Singapore. It tracks the performance of the top 30 companies that are listed on the Singapore Exchange (SGX).

The Bucharest Stock Exchange is the stock exchange of Romania located in Bucharest. In 2023, the BVB's market capitalization increased by 52.7% to $64.9 billion. As of 2023, there were 85 companies listed on the BVB.

In investing, a developed market is a country that is most developed in terms of its economy and capital markets. The country must be high income, but this also includes openness to foreign ownership, ease of capital movement, and efficiency of market institutions. This term is contrasted with developing market.

The FTSE AIM All-Share Index was revised from the previous FTSE AIM Index on 16 May 2005, and is a stock market index consisting of all companies quoted on the Alternative Investment Market which meet the requirements for liquidity and free float.

Indonesia Stock Exchange (IDX) is a stock exchange based in Jakarta, Indonesia. It was previously known as the Jakarta Stock Exchange (JSX) before its name changed in 2007 after merging with the Surabaya Stock Exchange (SSX). In recent years, the Indonesian Stock Exchange has seen the fastest membership growth in Asia. As of 2023, the Indonesia Stock Exchange had 833 listed companies, and total stock investors were about 6.4 million, compared to 2.5 million at the end of 2019. Indonesia Market Capitalization accounted for 45.2% of its nominal GDP in December 2020. Founded on 30 November 2007, it is ASEAN's largest market capitalization at US$744 billion as of 15 December 2023.

The S&P/ASX 200 index is a market-capitalization weighted and float-adjusted stock market index of stocks listed on the Australian Securities Exchange. The index is maintained by Standard & Poor's and is considered the benchmark for Australian equity performance. It is based on the 200 largest ASX listed stocks, which together account for about 82% of Australia's share market capitalization.

Ho Chi Minh Stock Exchange, formerly the HCMC Securities Trading Center (HoSTC), is a stock exchange in Ho Chi Minh City, Vietnam. It was established in 1998 under Decision No. 127/1998/QD-TTg of the Prime Minister of Vietnam. HCM Securities Trading Center officially opened on July 20, 2000, and had its first trading session on July 28, 2000, with two listed companies and six security company members.

A capitalization-weightedindex, also called a market-value-weighted index is a stock market index whose components are weighted according to the total market value of their outstanding shares. Every day an individual stock's price changes and thereby changes a stock index's value. The impact that individual stock's price change has on the index is proportional to the company's overall market value, in a capitalization-weighted index. In other types of indices, different ratios are used.

CIMB Group Holdings Berhad is a Malaysian universal bank headquartered in Kuala Lumpur and operating in high growth economies in ASEAN. CIMB Group is an indigenous ASEAN investment bank. CIMB has a wide retail branch network with 1,080 branches across the region.

The FTSE Bursa Malaysia Index is a comprehensive range of real-time indices, which cover all eligible companies listed on the Bursa Malaysia Main Board which was introduced to Bursa Malaysia's investors in 2006.

The S&P/ASX 300, or simply, ASX 300, is a stock market index of Australian stocks listed on the Australian Securities Exchange (ASX). The index is market-capitalisation weighted, meaning each company included is in proportion to the indexes total market value, and float-adjusted, meaning the index only considers shares available to public investors.

In finance, a stock index, or stock market index, is an index that measures the performance of a stock market, or of a subset of a stock market. It helps investors compare current stock price levels with past prices to calculate market performance.

The TA-125 Index, typically referred to as the Tel Aviv 125 and formerly the TA-100 Index, is a stock market index of the 125 most highly capitalised companies listed on the Tel Aviv Stock Exchange (TASE). The index began on 1 January 1992 with a base level of 100. The highest value reached to date is 2152.16, in January 2022. On 12 February 2017, the index was expanded to include 125 instead of 100 stocks, in an attempt to improve stability and therefore reduce risk for trackers and encourage foreign investment.

The PSI-20 is a benchmark stock market index of companies that trade on Euronext Lisbon, the main stock exchange of Portugal. The index tracks the prices of the twenty listings with the largest market capitalisation and share turnover in the PSI Geral, the general stock market of the Lisbon exchange. It is one of the main national indices of the pan-European stock exchange group Euronext alongside Brussels' BEL20, Paris's CAC 40 and Amsterdam's AEX.

ASEAN Exchanges is a collaboration of the 7 exchanges from Malaysia, Vietnam, Indonesia, Philippines, Thailand and Singapore to promote the growth of the ASEAN capital market by bringing more ASEAN investment opportunities to more investors.

References

- 1 2 3 "FTSE Bursa Malaysia KLCI Factsheet" (PDF). FTSE.

- 1 2 FTSE Bursa Malaysia KLCI Index Research Paper (PDF), 2009, p. 1, archived from the original (PDF) on 23 November 2010

- ↑ Meridian Securities Markets, Electronic Commerce Inc.: World Stock Exchange Fact Book, Electronic Commerce Inc., Morris Plains NJ 1995, ISBN 1-891518-19-4

- ↑ "FTSE Bursa Index (Malaysia) Yearly Stock Returns". www.1stock1.com. Retrieved 9 February 2024.

- ↑ "Bursa Malaysia FBMKLCI Companies" (PDF).

- ↑ Bloomberg.com. KLCI:IND KUALA LUMPUR COMP INDEX