The Federal Trade Commission (FTC) is an independent agency of the United States government whose principal mission is the enforcement of civil (non-criminal) antitrust law and the promotion of consumer protection. The FTC shares jurisdiction over federal civil antitrust law enforcement with the Department of Justice Antitrust Division. The agency is headquartered in the Federal Trade Commission Building in Washington, DC.

Sales promotion is one of the elements of the promotional mix. The primary elements in the promotional mix are advertising, personal selling, direct marketing and publicity/public relations. Sales promotion uses both media and non-media marketing communications for a pre-determined, limited time to increase consumer demand, stimulate market demand or improve product availability. Examples include contests, coupons, freebies, loss leaders, point of purchase displays, premiums, prizes, product samples, and rebates.

The list price, also known as the manufacturer's suggested retail price (MSRP), or the recommended retail price (RRP), or the suggested retail price (SRP) of a product is the price at which its manufacturer notionally recommends that a retailer sell the product.

In lending, a pre-approval is the pre-qualification for a loan or mortgage of a certain value range.

In the United States, a car dealership is a business that sells cars. A car dealership can either be a franchised dealership selling new and used cars, or a used car dealership, selling only used cars. In most cases, dealerships provide car maintenance and repair services as well as trade-in, leasing, and financing options for customers.

A certificate of deposit (CD) is a time deposit sold by banks, thrift institutions, and credit unions in the United States. CDs typically differ from savings accounts because the CD has a specific, fixed term before money can be withdrawn without penalty and generally higher interest rates. The bank expects the CDs to be held until maturity, at which time they can be withdrawn and interest paid.

Predatory lending refers to unethical practices conducted by lending organizations during a loan origination process that are unfair, deceptive, or fraudulent. While there are no internationally agreed legal definitions for predatory lending, a 2006 audit report from the office of inspector general of the US Federal Deposit Insurance Corporation (FDIC) broadly defines predatory lending as "imposing unfair and abusive loan terms on borrowers", though "unfair" and "abusive" were not specifically defined. Though there are laws against some of the specific practices commonly identified as predatory, various federal agencies use the phrase as a catch-all term for many specific illegal activities in the loan industry. Predatory lending should not be confused with predatory mortgage servicing which is mortgage practices described by critics as unfair, deceptive, or fraudulent practices during the loan or mortgage servicing process, post loan origination.

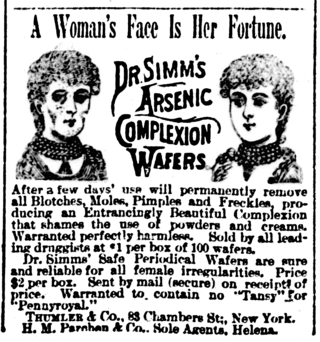

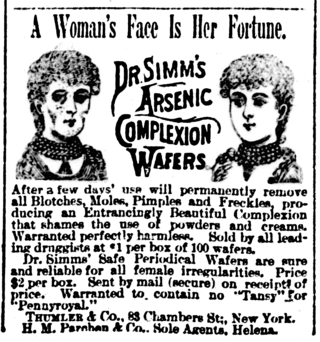

False advertising is the act of publishing, transmitting, or otherwise publicly circulating an advertisement containing a false claim, or statement, made intentionally to promote the sale of property, goods, or services. A false advertisement can be classified as deceptive if the advertiser deliberately misleads the consumer, rather than making an unintentional mistake. A number of governments use regulations to limit false advertising.

Business-to-business is a situation where one business makes a commercial transaction with another. This typically occurs when:

Universal default is a now-banned practice in the United States financial services industry whereby a creditor would change the terms of a loan from the normal terms to the default terms when that lender is informed that their customer has defaulted with another unrelated lender, even though the customer has not defaulted with the first lender.

In marketing, a rebate is a form of buying discount and is an amount paid by way of reduction, return, or refund that is paid retrospectively. It is a type of sales promotion that marketers use primarily as incentives or supplements to product sales. Rebates are also used as a means of enticing price-sensitive consumers into purchasing a product. The mail-in rebate (MIR) is the most common. A MIR entitles the buyer to mail in a coupon, receipt, and barcode in order to receive a check for a particular amount, depending on the particular product, time, and often place of purchase. Rebates are offered by either the retailer or the product manufacturer. Large stores often work in conjunction with manufacturers, usually requiring two or sometimes three separate rebates for each item, and sometimes are valid only at a single store. Rebate forms and special receipts are sometimes printed by the cash register at time of purchase on a separate receipt or available online for download. In some cases, the rebate may be available immediately, in which case it is referred to as an instant rebate. Some rebate programs offer several payout options to consumers, including a paper check, a prepaid card that can be spent immediately without a trip to the bank, or even as a PayPal payout.

Payment protection insurance (PPI), also known as credit insurance, credit protection insurance, or loan repayment insurance, is an insurance product that enables consumers to ensure repayment of credit if the borrower dies, becomes ill or disabled, loses a job, or faces other circumstances that may prevent them from earning income to service the debt. It is not to be confused with income protection insurance, which is not specific to a debt but covers any income. PPI was widely sold by banks and other credit providers as an add-on to the loan or overdraft product.

Loan origination is the process by which a borrower applies for a new loan, and a lender processes that application. Origination generally includes all the steps from taking a loan application up to disbursal of funds. For mortgages, there is a specific mortgage origination process. Loan servicing covers everything after disbursing the funds until the loan is fully paid off. Loan origination is a specialized version of new account opening for financial services organizations. Certain people and organizations specialize in loan origination. Mortgage brokers and other mortgage originator companies serve as a prominent example.

Movieland, also known as Movieland.com, Moviepass.tv and Popcorn.net, was a subscription-based movie download service that has been the subject of thousands of complaints to the Federal Trade Commission, the Washington State Attorney General's Office, the Better Business Bureau, and other agencies by consumers who said they were held hostage by its repeated pop-up windows and demands for payment, triggered after a free 3-day trial period. Many said they had never even heard of Movieland until they saw their first pop-up. Movieland advertised that the service had "no spyware", and that no personal information would need to be filled out to begin the free trial.

The Funeral Rule, enacted by the Federal Trade Commission on April 30, 1984, and amended effective 1994, was designed to protect consumers by requiring that they receive adequate information concerning the goods and services they may purchase from a funeral provider.

In the middle of 2009 the Federal Trade Commission filed a complaint against Sears Holdings Management Corporation (SHMC) for unfair or deceptive acts or practices affecting commerce. SHMC operates the sears.com and kmart.com retail websites for Sears Holdings Corporation. As part of a marketing effort, some users of sears.com and kmart.com were invited to download an application developed for SHMC that ran in the background on users' computers collecting information on nearly all internet activity. The tracking aspects of the program were only disclosed in legalese in the middle of the End User License Agreement. The FTC found this was insufficient disclosure given consumers expectations and the detailed information being collected. On September 9, 2009 the FTC approved a consent decree with SHMC requiring full disclosure of its activities and destruction of previously obtained information.

A resort fee, also called a facility fee, a destination fee, an amenity fee, an urban fee, or a resort charge, or a hidden hotel booking fee is an additional fee that a guest is charged by an accommodation provider, usually calculated on a per day basis, in addition to a base room rate.

Native advertising, also called sponsored content, partner content, and branded journalism, is a type of paid advertising that appears in the style and format of the content near the advertisement's placement. It manifests as a post, image, video, article or editorial piece of content. In some cases it functions like an advertorial. The word native refers to this coherence of the content with the other media that appear on the platform.

Jesse Willms is a Canadian entrepreneur and businessman who has founded several companies, including eDirect Software, Car History Group, and Just Think Media.

In online retail, drip pricing is a sales technique where a headline price is advertised at the beginning of the purchase process, followed by the incremental disclosure of additional fees, taxes or charges. The objective of drip pricing is to gain a consumer's interest in a misleadingly low headline price without the true final price being disclosed until the consumer has invested time and effort in the purchase process and made a decision to purchase. Naïve consumers will purchase based on headline price and sophisticated consumers will consider total cost when comparing offers. Drip pricing can distort competition because it can make it difficult for businesses with more transparent pricing practices to compete on a level playing field.