An auction is usually a process of buying and selling goods or services by offering them up for bids, taking bids, and then selling the item to the highest bidder or buying the item from the lowest bidder. Some exceptions to this definition exist and are described in the section about different types. The branch of economic theory dealing with auction types and participants' behavior in auctions is called auction theory.

A Dutch auction is one of several similar types of auctions for buying or selling goods. Most commonly, it means an auction in which the auctioneer begins with a high asking price in the case of selling, and lowers it until some participant accepts the price, or it reaches a predetermined reserve price. This type of price auction is most commonly used for goods that are required to be sold quickly such as flowers, fresh produce, or tobacco. A Dutch auction has also been called a clock auction or open-outcry descending-price auction. This type of auction shows the advantage of speed since a sale never requires more than one bid. It is strategically similar to a first-price sealed-bid auction.

A Vickrey auction or sealed-bid second-price auction (SBSPA) is a type of sealed-bid auction. Bidders submit written bids without knowing the bid of the other people in the auction. The highest bidder wins but the price paid is the second-highest bid. This type of auction is strategically similar to an English auction and gives bidders an incentive to bid their true value. The auction was first described academically by Columbia University professor William Vickrey in 1961 though it had been used by stamp collectors since 1893. In 1797 Johann Wolfgang von Goethe sold a manuscript using a sealed-bid, second-price auction.

An English auction is an open-outcry ascending dynamic auction. It proceeds as follows.

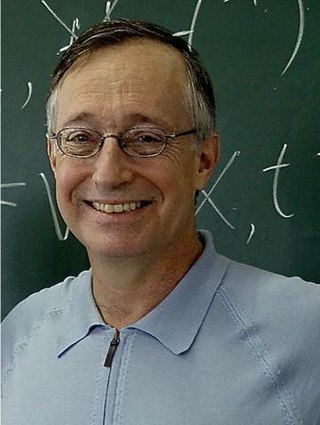

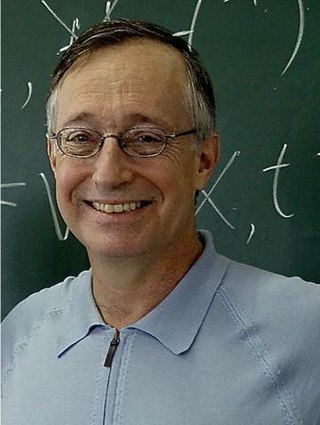

Paul Robert Milgrom is an American economist. He is the Shirley and Leonard Ely Professor of Humanities and Sciences at the Stanford University School of Humanities and Sciences, a position he has held since 1987. He is a professor in the Stanford School of Engineering as well and a Senior Fellow at the Stanford Institute for Economic Research. Milgrom is an expert in game theory, specifically auction theory and pricing strategies. He is the winner of the 2020 Nobel Memorial Prize in Economic Sciences, together with Robert B. Wilson, "for improvements to auction theory and inventions of new auction formats".

In common valueauctions the value of the item for sale is identical amongst bidders, but bidders have different information about the item's value. This stands in contrast to a private value auction where each bidder's private valuation of the item is different and independent of peers' valuations.

A Japanese auction is a dynamic auction format. It proceeds in the following way.

In game theory, the war of attrition is a dynamic timing game in which players choose a time to stop, and fundamentally trade off the strategic gains from outlasting other players and the real costs expended with the passage of time. Its precise opposite is the pre-emption game, in which players elect a time to stop, and fundamentally trade off the strategic costs from outlasting other players and the real gains occasioned by the passage of time. The model was originally formulated by John Maynard Smith; a mixed evolutionarily stable strategy (ESS) was determined by Bishop & Cannings. An example is a second price all-pay auction, in which the prize goes to the player with the highest bid and each player pays the loser's low bid.

A double auction is a process of buying and selling goods with multiple sellers and multiple buyers. Potential buyers submit their bids and potential sellers submit their ask prices to the market institution, and then the market institution chooses some price p that clears the market: all the sellers who asked less than p sell and all buyers who bid more than p buy at this price p. Buyers and sellers that bid or ask for exactly p are also included. A common example of a double auction is stock exchange.

Auction theory is an applied branch of economics which deals with how bidders act in auction markets and researches how the features of auction markets incentivise predictable outcomes. Auction theory is a tool used to inform the design of real-world auctions. Sellers use auction theory to raise higher revenues while allowing buyers to procure at a lower cost. The conference of the price between the buyer and seller is an economic equilibrium. Auction theorists design rules for auctions to address issues which can lead to market failure. The design of these rulesets encourages optimal bidding strategies among a variety of informational settings. The 2020 Nobel Prize for Economics was awarded to Paul R. Milgrom and Robert B. Wilson “for improvements to auction theory and inventions of new auction formats.”

The revelation principle is a fundamental principle in mechanism design. It states that if a social choice function can be implemented by an arbitrary mechanism, then the same function can be implemented by an incentive-compatible-direct-mechanism with the same equilibrium outcome (payoffs).

A first-price sealed-bid auction (FPSBA) is a common type of auction. It is also known as blind auction. In this type of auction, all bidders simultaneously submit sealed bids so that no bidder knows the bid of any other participant. The highest bidder pays the price that was submitted.

In economics and game theory, an all-pay auction is an auction in which every bidder must pay regardless of whether they win the prize, which is awarded to the highest bidder as in a conventional auction. As shown by Riley and Samuelson (1981), equilibrium bidding in an all pay auction with private information is revenue equivalent to bidding in a sealed high bid or open ascending price auction.

Revenue equivalence is a concept in auction theory that states that given certain conditions, any mechanism that results in the same outcomes also has the same expected revenue.

Market design is a practical methodology for creation of markets of certain properties, which is partially based on mechanism design. In some markets, prices may be used to induce the desired outcomes — these markets are the study of auction theory. In other markets, prices may not be used — these markets are the study of matching theory.

The generalized second-price auction (GSP) is a non-truthful auction mechanism for multiple items. Each bidder places a bid. The highest bidder gets the first slot, the second-highest, the second slot and so on, but the highest bidder pays the price bid by the second-highest bidder, the second-highest pays the price bid by the third-highest, and so on. First conceived as a natural extension of the Vickrey auction, it conserves some of the desirable properties of the Vickrey auction. It is used mainly in the context of keyword auctions, where sponsored search slots are sold on an auction basis. The first analyses of GSP are in the economics literature by Edelman, Ostrovsky, and Schwarz and by Varian. It is used by Google's AdWords technology and Facebook.

A sponsored search auction (SSA), also known as a keyword auction, is an indispensable part of the business model of modern web hosts. It refers to results from a search engine that are not output by the main search algorithm, but rather clearly separate advertisements paid for by third parties. These advertisements are typically related to the terms for which the user searched. They come in the form of a link and some information, with the hope that a search user will click on the link and buy something from the advertiser. In sponsored search auctions, there are typically some fixed number of slots for advertisements and more advertisers that want these slots than there are slots. The advertisers have different valuations for these slots and slots are a scarce resource, so an auction is done to determine how the slots will be assigned.

A sequential auction is an auction in which several items are sold, one after the other, to the same group of potential buyers. In a sequential first-price auction (SAFP), each individual item is sold using a first price auction, while in a sequential second-price auction (SASP), each individual item is sold using a second price auction.

The Prize in Game Theory and Computer Science in Honour of Ehud Kalai is an award given by the Game Theory Society. The prize is awarded for outstanding articles at the interface of game theory and computer science. Following the eligibility rules of the Gödel Prize, preference is given to authors who are 45 years old or younger at the time of the award. It was established in 2008 by a donation from Yoav Shoham in honor of the Ehud Kalai's contributions in bridging these two fields.

The Price of Anarchy (PoA) is a concept in game theory and mechanism design that measures how the social welfare of a system degrades due to selfish behavior of its agents. It has been studied extensively in various contexts, particularly in auctions.