A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the late 1920s to 1932 as well as from 1944 until 1971 when the United States unilaterally terminated convertibility of the US dollar to gold, effectively ending the Bretton Woods system. Many states nonetheless hold substantial gold reserves.

The Bank for International Settlements (BIS) is an international financial institution which is owned by member central banks. Its primary goal is to foster international monetary and financial cooperation while serving as a bank for central banks. With its establishment in 1929, its initial purpose was to oversee the settlement of World War I war reparations.

The Bretton Woods system of monetary management established the rules for commercial relations among the United States, Canada, Western European countries, and Australia among 44 other countries after the 1944 Bretton Woods Agreement. The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent states. The Bretton Woods system required countries to guarantee convertibility of their currencies into U.S. dollars to within 1% of fixed parity rates, with the dollar convertible to gold bullion for foreign governments and central banks at US$35 per troy ounce of fine gold. It also envisioned greater cooperation among countries in order to prevent future competitive devaluations, and thus established the International Monetary Fund (IMF) to monitor exchange rates and lend reserve currencies to nations with balance of payments deficits.

The causes of the Great Depression in the early 20th century in the United States have been extensively discussed by economists and remain a matter of active debate. They are part of the larger debate about economic crises and recessions. The specific economic events that took place during the Great Depression are well established.

The Long Depression was a worldwide price and economic recession, beginning in 1873 and running either through March 1879, or 1896, depending on the metrics used. It was most severe in Europe and the United States, which had been experiencing strong economic growth fueled by the Second Industrial Revolution in the decade following the American Civil War. The episode was labeled the "Great Depression" at the time, and it held that designation until the Great Depression of the 1930s. Though it marked a period of general deflation and a general contraction, it did not have the severe economic retrogression of the Great Depression.

In the history of the 20th century, the interwar period lasted from 11 November 1918 to 1 September 1939 – from the end of World War I to the beginning of World War II.

Charles Poor Kindleberger was an American economic historian and author of over 30 books. His 1978 book Manias, Panics, and Crashes, about speculative stock market bubbles, was reprinted in 2000 after the dot-com bubble. He is well known for his role in developing what would become hegemonic stability theory, arguing that a hegemonic power was needed to maintain a stable international monetary system. He has been referred to as "the master of the genre" on financial crisis by The Economist.

Peter Temin is an economist and economic historian, currently Gray Professor Emeritus of Economics, MIT and former head of the Economics Department.

Historians and other scholars disagree on the question of whether a specifically fascist type of economic policy can be said to exist. David Baker argues that there is an identifiable economic system in fascism that is distinct from those advocated by other ideologies, comprising essential characteristics that fascist nations shared. Payne, Paxton, Sternhell et al. argue that while fascist economies share some similarities, there is no distinctive form of fascist economic organization. Gerald Feldman and Timothy Mason argue that fascism is distinguished by an absence of coherent economic ideology and an absence of serious economic thinking. They state that the decisions taken by fascist leaders cannot be explained within a logical economic framework.

Barry Julian Eichengreen is an American economist and economic historian who holds the title of George C. Pardee and Helen N. Pardee Professor of Economics and Political Science at the University of California, Berkeley, where he has taught since 1987. Eichengreen currently serves as a research associate at the National Bureau of Economic Research and as a Research Fellow at the Centre for Economic Policy Research.

Monetary hegemony is an economic and political concept in which a single state has decisive influence over the functions of the international monetary system. A monetary hegemon would need:

Gottfried von Haberler was an Austrian-American economist. He worked in particular on international trade. One of his major contributions was reformulating the Ricardian idea of comparative advantage in a neoclassical framework, abandoning the labor theory of value for an opportunity cost concept.

A Monetary History of the United States, 1867–1960 is a book written in 1963 by Nobel Prize–winning economist Milton Friedman and Anna J. Schwartz. It uses historical time series and economic analysis to argue the then-novel proposition that changes in the money supply profoundly influenced the U.S. economy, especially the behavior of economic fluctuations. The implication they draw is that changes in the money supply had unintended adverse effects, and that sound monetary policy is necessary for economic stability. Orthodox economic historians see it as one of the most influential economics books of the century. The chapter dealing with the causes of the Great Depression was published as a stand-alone book titled The Great Contraction, 1929–1933.

Hyperinflation affected the German Papiermark, the currency of the Weimar Republic, between 1921 and 1923, primarily in 1923. It caused considerable internal political instability in the country, led to the occupation of the Ruhr by France and Belgium after Germany defaulted on its war reparations.

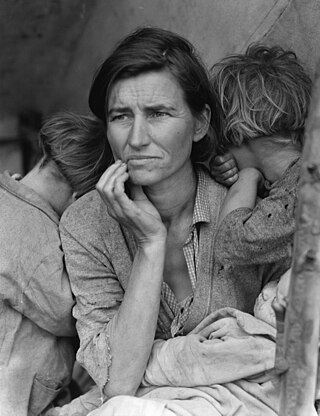

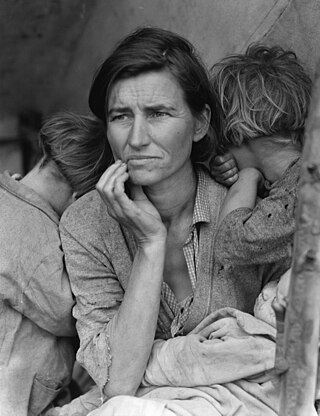

The Great Depression (1929–1939) was an economic shock that affected most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagion began around September 1929 and led to the Wall Street stock market crash of 24 October. It was the longest, deepest, and most widespread depression of the 20th century.

Hans-Joachim Voth is a German economic historian. He joined the University of Zurich economics faculty in 2014 and has been the Scientific Director of the UBS Center for Economics in Society since 2017. In 2022, he was elected as a Fellow of the Econometric Society.

The European Association for Banking and Financial History (eabh) is an independent, non-profit association based in Frankfurt am Main. Founded in 1990, the eabh aims to promote research on banking history; support the preservation historically valuable archive material of public and private banking institutions; and facilitate dialogue on key challenges and opportunities to the historical study of finance, insurance, and globalization. It maintains a global network of financial professionals and academics who meet to discuss and encourage projects in the field of financial and banking history. The eabh currently has 80 member organisations.

The European banking crisis of 1931 was a major episode of financial instability that peaked with the collapse of several major banks in Austria and Germany, including Creditanstalt on 11 May 1931, Landesbank der Rheinprovinz on 11 July 1931, and Danat-Bank on 13 July 1931. It triggered the exit of Germany from the gold standard on 15 July 1931, followed by the UK on 19 September 1931, and extensive losses in the U.S. financial system that contributed to the Great Depression. The crisis has been widely associated with the subsequent rise of the Nazi Party in Germany and its eventual takeover of government in early 1933, as well as the emergence of Austrofascism in Austria and other authoritarian developments in Central Europe.

The Euro and the Battle of Ideas is a book by Markus Brunnermeier, Professor of Economics at Princeton University; Harold James, Professor of History at Princeton University; and Jean-Pierre Landau, a former Deputy Governor of the Bank of France, a member of the board of directors of the Bank for International Settlements (BIS). The book is about the philosophical differences between countries in the European Union, particularly Germany and France, and how their contrasting outlooks on political philosophy have shaped the Eurozone. The book also provides context to how the ideas that led to the creation of the European Union have influenced and been influenced by ideas in the United States, the United Kingdom, the International Monetary Fund (IMF), and the European Central Bank (ECB).