A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the late 1920s to 1932 as well as from 1944 until 1971 when the United States unilaterally terminated convertibility of the US dollar to gold, effectively ending the Bretton Woods system. Many states nonetheless hold substantial gold reserves.

The Bank for International Settlements (BIS) is an international financial institution which is owned by member central banks. Its primary goal is to foster international monetary and financial cooperation while serving as a bank for central banks. With its establishment in 1929, its initial purpose was to oversee the settlement of World War I war reparations.

A reserve currency is a foreign currency that is held in significant quantities by central banks or other monetary authorities as part of their foreign exchange reserves. The reserve currency can be used in international transactions, international investments and all aspects of the global economy. It is often considered a hard currency or safe-haven currency.

The Bretton Woods Conference, formally known as the United Nations Monetary and Financial Conference, was the gathering of 730 delegates from all 44 allied nations at the Mount Washington Hotel, in Bretton Woods, New Hampshire, United States, to regulate the international monetary and financial order after the conclusion of World War II.

The global financial system is the worldwide framework of legal agreements, institutions, and both formal and informal economic action that together facilitate international flows of financial capital for purposes of investment and trade financing. Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets. In the late 1800s, world migration and communication technology facilitated unprecedented growth in international trade and investment. At the onset of World War I, trade contracted as foreign exchange markets became paralyzed by money market illiquidity. Countries sought to defend against external shocks with protectionist policies and trade virtually halted by 1933, worsening the effects of the global Great Depression until a series of reciprocal trade agreements slowly reduced tariffs worldwide. Efforts to revamp the international monetary system after World War II improved exchange rate stability, fostering record growth in global finance.

The Bretton Woods system of monetary management established the rules for commercial relations among the United States, Canada, Western European countries, and Australia among 44 other countries after the 1944 Bretton Woods Agreement. The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent states. The Bretton Woods system required countries to guarantee convertibility of their currencies into U.S. dollars to within 1% of fixed parity rates, with the dollar convertible to gold bullion for foreign governments and central banks at US$35 per troy ounce of fine gold. It also envisioned greater cooperation among countries in order to prevent future competitive devaluations, and thus established the International Monetary Fund (IMF) to monitor exchange rates and lend reserve currencies to nations with balance of payments deficits.

International finance is the branch of financial economics broadly concerned with monetary and macroeconomic interrelations between two or more countries. International finance examines the dynamics of the global financial system, international monetary systems, balance of payments, exchange rates, foreign direct investment, and how these topics relate to international trade.

The history of the United States dollar began with moves by the Founding Fathers of the United States of America to establish a national currency based on the Spanish silver dollar, which had been in use in the North American colonies of the Kingdom of Great Britain for over 100 years prior to the United States Declaration of Independence. The new Congress's Coinage Act of 1792 established the United States dollar as the country's standard unit of money, creating the United States Mint tasked with producing and circulating coinage. Initially defined under a bimetallic standard in terms of a fixed quantity of silver or gold, it formally adopted the gold standard in 1900, and finally eliminated all links to gold in 1971.

The Economic and Financial Conference was a formal conclave of representatives from 34 European countries held in the ancient Palazzo San Giorgio of Genoa, Italy, from 10 April to 19 May 1922.

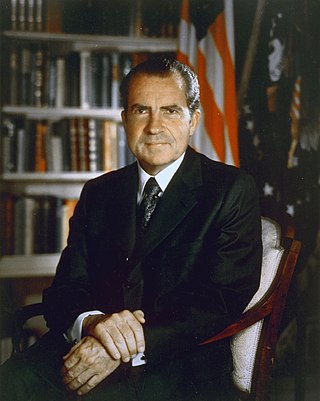

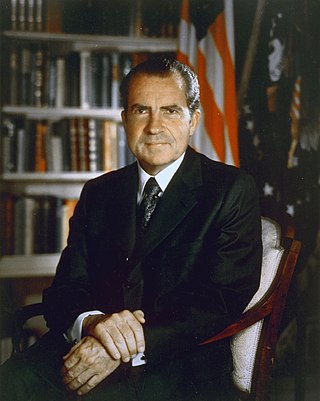

The Nixon shock was a series of economic measures undertaken by United States President Richard Nixon in 1971, in response to increasing inflation, the most significant of which were wage and price freezes, surcharges on imports, and the unilateral cancellation of the direct international convertibility of the United States dollar to gold.

Monetary hegemony is an economic and political concept in which a single state has decisive influence over the functions of the international monetary system. A monetary hegemon would need:

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are: medium of exchange, a unit of account, a store of value and sometimes, a standard of deferred payment.

The United States dollar is the official currency of the United States and several other countries. The Coinage Act of 1792 introduced the U.S. dollar at par with the Spanish silver dollar, divided it into 100 cents, and authorized the minting of coins denominated in dollars and cents. U.S. banknotes are issued in the form of Federal Reserve Notes, popularly called greenbacks due to their predominantly green color.

An international monetary system is a set of internationally agreed rules, conventions and supporting institutions that facilitate international trade, cross border investment and generally the reallocation of capital between states that have different currencies. It should provide means of payment acceptable to buyers and sellers of different nationalities, including deferred payment. To operate successfully, it needs to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade, and to provide means by which global imbalances can be corrected. The system can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, it can arise from a single architectural vision, as happened at Bretton Woods in 1944.

Fiat money is a type of currency that is not backed by a commodity, such as gold or silver. It is typically designated by the issuing government to be legal tender, and is authorized by government regulation. Since the end of the Bretton Woods system in 1971, the major currencies in the world are fiat money.

The London Gold Pool was the pooling of gold reserves by a group of eight central banks in the United States and seven European countries that agreed on 1 November 1961 to cooperate in maintaining the Bretton Woods System of fixed-rate convertible currencies and defending a gold price of US$35 per troy ounce by interventions in the London gold market.

Monetary policy in the United States is associated with interest rates and availability of credit.

The United States was a founding member of the International Monetary Fund (IMF), having hosted the other countries at the IMF’s founding conference, the Bretton Woods Conference, in 1944. The US delegation played an integral role in the establishment of the basic tenets of the IMF and maintains a large presence in the workings of the organization.

The International Monetary Conference was held in Paris from 17 June to 6 July 1867, the first of a series of international monetary conferences.

The International Monetary Conference of 1892 was the fourth of a series of international monetary conferences, held in Brussels in November and December 1892. It was chaired by Belgian Senator Georges Montefiore-Levi.