Related Research Articles

Investment banking pertains to certain activities of a financial services company or a corporate division that consist in advisory-based financial transactions on behalf of individuals, corporations, and governments. Traditionally associated with corporate finance, such a bank might assist in raising financial capital by underwriting or acting as the client's agent in the issuance of debt or equity securities. An investment bank may also assist companies involved in mergers and acquisitions (M&A) and provide ancillary services such as market making, trading of derivatives and equity securities, FICC services or research. Most investment banks maintain prime brokerage and asset management departments in conjunction with their investment research businesses. As an industry, it is broken up into the Bulge Bracket, Middle Market, and boutique market.

The Goldman Sachs Group, Inc. is an American multinational investment bank and financial services company. Founded in 1869, Goldman Sachs is headquartered at 200 West Street in Lower Manhattan, with regional headquarters in London, Warsaw, Bangalore, Hong Kong, Tokyo, Dallas and Salt Lake City, and additional offices in other international financial centers. Goldman Sachs is the second largest investment bank in the world by revenue and is ranked 55th on the Fortune 500 list of the largest United States corporations by total revenue. It is considered a systemically important financial institution by the Financial Stability Board.

Deutsche Bank AG, sometimes referred to simply as Deutsche, is a German multinational investment bank and financial services company headquartered in Frankfurt, Germany, and dual-listed on the Frankfurt Stock Exchange and the New York Stock Exchange. It was founded in 1870 and grew through multiple acquisitions, including Disconto-Gesellschaft in 1929, Bankers Trust in 1998, and Deutsche Postbank in 2010.

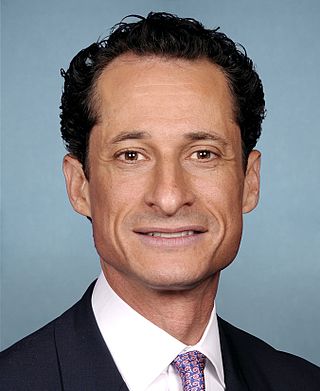

Anthony David Weiner is an American former politician who served as the U.S. representative for New York's 9th congressional district from 1999 until his resignation in 2011. A member of the Democratic Party, he consistently carried the district with at least 60% of the vote. Weiner resigned from Congress in June 2011 after it was revealed he sent sexually suggestive photos of himself to different women.

Capital One Financial Corporation is an American bank holding company specializing in credit cards, auto loans, banking, and savings accounts, headquartered in McLean, Virginia with operations primarily in the United States. It is on the list of largest banks in the United States and has developed a reputation for being a technology-focused bank.

Genworth Financial, headquartered in Richmond, Virginia, provides life insurance, long-term care insurance, mortgage insurance, and annuities.

The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 2007–2008 global financial crisis. The crisis led to a severe economic recession, with millions of people losing their jobs and many businesses going bankrupt. The U.S. government intervened with a series of measures to stabilize the financial system, including the Troubled Asset Relief Program (TARP) and the American Recovery and Reinvestment Act (ARRA).

Huma Mahmood Abedin is an American political staffer who was vice chair of Hillary Clinton's 2016 campaign for President of the United States. Before that, Abedin was deputy chief of staff to Clinton when she was U.S. Secretary of State from 2009 to 2013. She was also the traveling chief of staff and former assistant to Clinton during her 2008 presidential campaign for the Democratic nomination in the 2008 presidential election.

LendingClub is a financial services company headquartered in San Francisco, California. It was the first peer-to-peer lender to register its offerings as securities with the Securities and Exchange Commission (SEC), and to offer loan trading on a secondary market. At its height, LendingClub was the world's largest peer-to-peer lending platform. The company reported that $15.98 billion in loans had been originated through its platform up to December 31, 2015.

Société Générale S.A., colloquially known in English speaking countries as SocGen, is a French-based multinational financial services company founded in 1864, registered in downtown Paris and headquartered nearby in La Défense.

Wells Fargo & Company is an American multinational financial services company with a significant global presence. The company operates in 35 countries and serves over 70 million customers worldwide. It is a systemically important financial institution by the Financial Stability Board and is considered one of the "Big Four Banks" in the United States, alongside JPMorgan Chase, Bank of America, and Citigroup.

The bankruptcy of Lehman Brothers on September 15, 2008, was the climax of the subprime mortgage crisis. After the financial services firm was notified of a pending credit downgrade due to its heavy position in subprime mortgages, the Federal Reserve summoned several banks to negotiate financing for its reorganization. These discussions failed, and Lehman filed a Chapter 11 petition that remains the largest bankruptcy filing in U.S. history, involving more than US$600 billion in assets.

Many factors directly and indirectly serve as the causes of the Great Recession that started in 2008 with the US subprime mortgage crisis. The major causes of the initial subprime mortgage crisis and the following recession include lax lending standards contributing to the real-estate bubbles that have since burst; U.S. government housing policies; and limited regulation of non-depository financial institutions. Once the recession began, various responses were attempted with different degrees of success. These included fiscal policies of governments; monetary policies of central banks; measures designed to help indebted consumers refinance their mortgage debt; and inconsistent approaches used by nations to bail out troubled banking industries and private bondholders, assuming private debt burdens or socializing losses.

Teneo is a public relations and advisory company. The company was founded in June 2011 by Declan Kelly, Paul Keary, and Doug Band, and currently has more than 1,450 employees located in 40 offices. In 2019, Teneo sold a majority stake to CVC Capital Partners, at a total valuation of around $700 million. Today the company is led by Chairwoman Ursula Burns and CEO Paul Keary.

James A. Harmon is chairman of the Egyptian-American Enterprise Fund, and an American fund manager; founder, chairman and chief investment officer of Caravel Management LLC; longtime investment banker; and co-chairman of the World Resources Institute. He was the 18th chairman and president of the Export–Import Bank of the United States, and has served on numerous public and private boards of directors.

PJT Partners, Inc. is a global advisory-focused investment bank, founded in October 2015 as part of The Blackstone Group's spin-off of its financial and strategic advisory services businesses. The firm was founded by Paul J Taubman after his 30-year tenure at Morgan Stanley, where he served as Global Head of Mergers and Acquisitions, Global Head of Investment Banking and until the end of 2012, Co-President of the Institutional Securities Group, which included Investment Banking as well as Sales and Trading.

Weiner is a 2016 American fly-on-the-wall political documentary film by Josh Kriegman and Elyse Steinberg about Anthony Weiner's campaign for Mayor of New York City during the 2013 mayoral election.

Declan Kelly is an Irish-American business executive, entrepreneur, and philanthropist. He is the founder, Chairman and CEO of The Consello Group, a specialized investing and financial services platform. Declan is best known as the founder, former chairman and CEO of Teneo, an international consulting company based in New York City.

During Hillary Clinton's tenure as Secretary of State, a number of individuals, organizations, and countries allegedly contributed to the Clinton Foundation either before, or while, pursuing interests through ordinary channels with the U.S. State Department.

The U.S. Russia Investment Fund (TUSRIF) was an investment fund from 1995 to 2008. It was established by the United States government to make private investments in the Russian economy. By 2005, it had invested $300 million in 44 Russian companies, including DeltaBank, the first bank to sell credit cards in Russia, and DeltaCredit, the first bank to sell residential mortgages in Russia. TUSRIF was replaced by the U.S. Russia Foundation (USRF) in 2008, while its financial arm, Delta Private Equity Partners, was purchased by Deutsche Bank in 2009.

References

- 1 2 3 "James Bernard Cook". Bloomberg. Retrieved October 22, 2016.

- 1 2 3 4 5 6 7 8 "James Cook, Father of the Russian Mortgage". Passport Magazine. May 2007. Retrieved October 22, 2016.

- 1 2 Chipman, Andrea (October 30, 2000). "Small Businesses Redeem Reputation Of the West's Russian Loan Programs". The Wall Street Journal. Retrieved October 30, 2016.

"The crisis was the best thing that could have happened to us," said James Cook, Delta Capital's senior vice president. "It was really a good demonstration to commercial banks of how well they could diversify their risks," with smaller borrowers.

- ↑ Chazan, Guy (July 30, 1999). "Mortgage Loans Sweep Russia; New Concept Yet to Be Tested". The Wall Street Journal. Retrieved October 29, 2016.

"We've estimated that it's a multitrillion-dollar market," says TUSRIF Senior Vice President James Cook.

- ↑ Ritson, Alex (July 2, 2002). "Ex-KGB agents assist mortgage boom". BBC. Retrieved October 22, 2016.

- ↑ "Company Overview of Aurora Russia Limited". Bloomberg. Retrieved October 30, 2016.

- ↑ "AIM – Suspension – Aurora Russia Limited". London Stock Exchange. March 6, 2016. Retrieved October 30, 2016.

- ↑ "Company Overview of Kreditmart, OOO". Bloomberg. Retrieved October 30, 2016.

- ↑ Teddy, Alexander (June 16, 2010). "How to Hand Out Cash". The Moscow Times. Retrieved October 22, 2016.

- ↑ Bennett, Kate (September 24, 2015). "Huma Abedin hosts a Paris soiree with Anna Wintour". Politico. Retrieved October 22, 2016.

One thousand dollars buys entry to "An Evening with Huma Abedin and Anna Wintour" on Oct. 4, according to the invitation obtained by KGB File, at the Paris home of James Cook, an American-born financial businessman dubbed "the father of the Russian mortgage" by Passport Magazine, a publication for expats in Russia.

- ↑ Cohan, William D. (February 2016). "IS HUMA ABEDIN HILLARY CLINTON'S SECRET WEAPON OR HER NEXT BIG PROBLEM?". Vanity Fair. Retrieved October 31, 2016.

- ↑ Ostermann, Ophélie (September 29, 2015). "Paris Fashion Week : Anna Wintour collecte des fonds pour Hillary Clinton". Le Figaro Madame. Retrieved October 31, 2016.