The Waste Electrical and Electronic Equipment Directive is a European Community Directive, numbered 2012/19/EU, concerned with waste electrical and electronic equipment (WEEE). Together with the RoHS Directive 2011/65/EU, it became European Law in February 2003. The WEEE Directive set collection, recycling and recovery targets for all types of electrical goods, with a minimum rate of 4 kilograms (9 lb) per head of population per annum recovered for recycling by 2009. The RoHS Directive set restrictions upon European manufacturers as to the material content of new electronic equipment placed on the market.

Directive 2004/48/EC of the European Parliament and of the Council of 29 April 2004 on the enforcement of intellectual property rights is a European Union directive in the field of intellectual property law, made under the Single Market provisions of the Treaty of Rome. The directive covers civil remedies only—not criminal ones.

Markets in Financial Instruments Directive 2014, commonly known as MiFID 2, is a legal act of the European Union (EU). Together with Regulation No 600/2014 it provides a legal framework for securities markets, investment intermediaries, in addition to trading venues. The directive provides harmonised regulation for investment services of the member states of the European Economic Area — the EU member states plus Iceland, Norway and Liechtenstein. Its main objectives are to increase competition and investor protection, as well as level the playing field for market participants in investment services. It repeals Directive 2004/39/EC.

The Undertakings for Collective Investment in Transferable Securities Directive (UCITS) 2009/65/EC is a consolidated EU directive that allows collective investment schemes to operate freely throughout the EU on the basis of a single authorisation from one member state. EU member states are entitled to have additional regulatory requirements for the benefit of investors.

The Single Euro Payments Area (SEPA) is a payment integration initiative of the European Union for simplification of bank transfers denominated in euro. As of 2020, there were 36 members in SEPA, consisting of the 27 member states of the European Union, the four member states of the European Free Trade Association, and the United Kingdom. Some microstates participate in the technical schemes: Andorra, Monaco, San Marino, and Vatican City.

Government procurement or public procurement is undertaken by the public authorities of the European Union (EU) and its member states in order to award contracts for public works and for the purchase of goods and services in accordance with principles derived from the Treaties of the European Union. Such procurement represents 13.6% of EU GDP as of 2018, and has been the subject of increasing European regulation since the 1970s because of its importance to the European single market.

The Energy Performance of Buildings Directive is the European Union's main legislative instrument aiming to promote the improvement of the energy performance of buildings within the European Union. It was inspired by the Kyoto Protocol which commits the EU and all its parties by setting binding emission reduction targets.

The European Union value-added tax is a value added tax on goods and services within the European Union (EU). The EU's institutions do not collect the tax, but EU member states are each required to adopt in national legislation a value added tax that complies with the EU VAT code. Different rates of VAT apply in different EU member states, ranging from 17% in Luxembourg to 27% in Hungary. The total VAT collected by member states is used as part of the calculation to determine what each state contributes to the EU's budget.

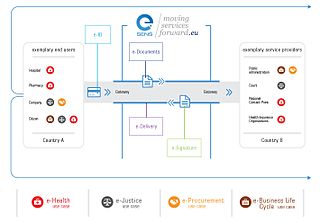

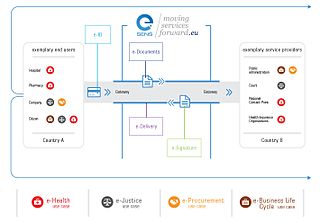

The Revised Payment Services Directive (PSD2, Directive (EU) 2015/2366, which replaced the Payment Services Directive (PSD), Directive 2007/64/EC) is an EU Directive, administered by the European Commission (Directorate General Internal Market) to regulate payment services and payment service providers throughout the European Union (EU) and European Economic Area (EEA). The PSD's purpose was to increase pan-European competition and participation in the payments industry also from non-banks, and to provide for a level playing field by harmonizing consumer protection and the rights and obligations for payment providers and users. The key objectives of the PSD2 directive are creating a more integrated European payments market, making payments more secure and protecting consumers.

Council Implementing Regulation (EU) No. 282/2011 was adopted by the Council of the European Union on 15 March 2011. This was mainly because the terms and wording of Directive 2006/112/EC have been inconclusive in some cases. The Regulation provided new implementing measures for the VAT Directive. Especially due to the amendment of the VAT Directive itself and the consistent case-law of the European Court of Justice, the former Implementing Regulation (EC) No. 1777/2005 had to be recast and clarified in certain aspects. This Implementing Regulation became effective on 1 July 2011 and does not have to be transported into national legislation of the individual member states of the European Union and thus is directly applicable.

Strong customer authentication (SCA) is a requirement of the EU Revised Directive on Payment Services (PSD2) on payment service providers within the European Economic Area. The requirement ensures that electronic payments are performed with multi-factor authentication, to increase the security of electronic payments. Physical card transactions already commonly have what could be termed strong customer authentication in the EU, but this has not generally been true for Internet transactions across the EU prior to the implementation of the requirement, and many contactless card payments do not use a second authentication factor.

On 6 May 2015, the European Commission, led at the time by Jean-Claude Juncker, established the Digital Single Market strategy, intended to remove virtual borders, boost digital connectivity, and make it easier for consumers to access cross-border online content across the European Union. The Digital Single Market, which is one of the Commission's 10 political priorities, aims to fit the EU's single market for the digital age, moving from 28 national digital markets to a single one, and then opening up digital services to all citizens and strengthen business competitiveness in the digital economy. In other words, the Digital Single Market is a market characterized by ensuring the free movement of people, services and capital and allowing individuals and businesses to seamlessly access and engage in online activities irrespective of their nationality or place of residence. Fair competition conditions and a high level of protection of personal and consumer data are applied.

The Small Business Act for Europe(SBA) is a package of principles put forward by the European Commission in 2008, designed to assist small businesses within the European Union (EU). The package contains ten "guiding principles intended for adoption "at the highest political level" across the EU. It is not a legislative act as such.

European company law is the part of European Union law which concerns the formation, operation and insolvency of companies in the European Union. The EU creates minimum standards for companies throughout the EU, and has its own corporate forms. All member states continue to operate separate companies acts, which are amended from time to time to comply with EU Directives and Regulations. There is, however, also the option of businesses to incorporate as a Societas Europaea (SE), which allows a company to operate across all member states.

The Mortgage Credit Directive (MCD) is a body of European legislation for the regulation of first- and second charge mortgages and consumer buy-to-let (CBTL) lending. It was originally adopted by the European Commission on 4 February 2014 and Member states had to transpose the regulations in their national law by March 2016. The European Commission is currently planning to propose amendments to the directive in Q1 2024.

Banking as a service (BaaS) is the provision of banking products to non-bank third parties through APIs.

The Directorate-General for Defence Industry and Space is a department of the European Commission.

The Capital Markets Union (CMU) is an economic policy initiative launched by the former president of the European Commission, Jean-Claude Junker in the initial exposition of his policy agenda on 15 July 2014. The main target was to create a single market for capital in the whole territory of the EU by the end of 2019. The reasoning behind the idea was to address the issue that corporate finance relies on debt (i.e. bank loans) and the fact that capital markets in Europe were not sufficiently integrated so as to protect the EU and especially the Eurozone from future crisis. The Five Presidents Report of June 2015 proposed the CMU in order to complement the Banking union of the European Union and eventually finish the Economic and Monetary Union (EMU) project. The CMU is supposed to attract 2000 billion dollars more on the European capital markets, on the long-term.

At around £290 billion every year, public sector procurement accounts for around a third of all public expenditure in the UK. EU-based laws continue to apply to government procurement: procurement is governed by the Public Contracts Regulations 2015, Part 3 of the Small Business, Enterprise and Employment Act 2015, and the Public Contracts (Scotland) Regulations of 2015 and 2016. These regulations implement EU law, which applied in the UK prior to Brexit, and also contain rules known as the "Lord Young Rules" promoting access for small and medium enterprise (SMEs) to public sector contracts, based on Lord Young's Review Growing Your Business, published in 2013.