A poll tax, also known as head tax or capitation, is a tax levied as a fixed sum on every liable individual, without reference to income or resources.

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer by a governmental organization in order to fund government spending and various public expenditures, and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs.

The goods and services tax is a value added tax introduced in Canada on January 1, 1991, by the government of Prime Minister Brian Mulroney. The GST, which is administered by Canada Revenue Agency (CRA), replaced a previous hidden 13.5% manufacturers' sales tax (MST);

In Canada, there are two types of sales taxes levied. These are :

A property tax or millage rate is an ad valorem tax on the value of a property.

Taxation in Canada is a prerogative shared between the federal government and the various provincial and territorial legislatures.

Taxation in the United Kingdom may involve payments to at least three different levels of government: central government, devolved governments and local government. Central government revenues come primarily from income tax, National Insurance contributions, value added tax, corporation tax and fuel duty. Local government revenues come primarily from grants from central government funds, business rates in England, Council Tax and increasingly from fees and charges such as those for on-street parking. In the fiscal year 2014–15, total government revenue was forecast to be £648 billion, or 37.7 per cent of GDP, with net taxes and National Insurance contributions standing at £606 billion.

The Climate Change Levy (CCL) is a tax on energy delivered to non-domestic users in the United Kingdom.

An indirect tax is a tax that is levied upon goods and services before they reach the customer who ultimately pays the indirect tax as a part of market price of the good or service purchased. Alternatively, if the entity who pays taxes to the tax collecting authority does not suffer a corresponding reduction in income, i.e., impact and tax incidence are not on the same entity meaning that tax can be shifted or passed on, then the tax is indirect.

Taxation in France is determined by the yearly budget vote by the French Parliament, which determines which kinds of taxes can be levied and which rates can be applied.

Income taxes in Canada constitute the majority of the annual revenues of the Government of Canada, and of the governments of the Provinces of Canada. In the fiscal year ending 31 March 2018, the federal government collected just over three times more revenue from personal income taxes than it did from corporate income taxes.

Income taxes are the most significant form of taxation in Australia, and collected by the federal government through the Australian Taxation Office. Australian GST revenue is collected by the Federal government, and then paid to the states under a distribution formula determined by the Commonwealth Grants Commission.

Taxes in India are levied by the Central Government and the State Governments by virtue of powers conferred to them from the Constitution of India. Some minor taxes are also levied by the local authorities such as the Municipality.

An excise, or excise tax, is any duty on manufactured goods that is levied at the moment of manufacture rather than at sale. Excises are often associated with customs duties ; customs are levied on goods that become taxable items at the border, while excise is levied on goods that came into existence inland.

Taxes provide the most important revenue source for the Government of the People's Republic of China. Tax is a key component of macro-economic policy, and greatly affects China's economic and social development. With the changes made since the 1994 tax reform, China has sought to set up a streamlined tax system geared to a socialist market economy.

Due to the absence of the tax code in Argentina, the tax regulation takes place in accordance with separate laws, which, in turn, are supplemented by provisions of normative acts adopted by the executive authorities. The powers of the executive authority include levying a tax on profits, property and added value throughout the national territory. In Argentina, the tax policy is implemented by the Federal Administration of Public Revenue, which is subordinate to the Ministry of Economy. The Federal Administration of Public Revenues (AFIP) is an independent service, which includes: the General Tax Administration, the General Customs Office and the General Directorate for Social Security. AFIP establishes the relevant legal norms for the calculation, payment and administration of taxes:

The northwestern U.S. state of Washington's economy grew 3.7% in 2016, nearly two and a half times the national rate. Average income per head in 2009 was $41,751, 12th among states of the U.S.

In Albania, taxes are levied by both national and local governments. Most important revenue sources, include the income tax, social security, corporate tax and the value added tax, which are all applied on the federal level. The Albanian Taxation Office is the revenue service of Albania.

Taxation may involve payments to a minimum of two different levels of government: central government through SARS or to local government. Prior to 2001 the South African tax system was "source-based", wherein income is taxed in the country where it originates. Since January 2001, the tax system was changed to "residence-based" wherein taxpayers residing in South Africa are taxed on their income irrespective of its source. Non residents are only subject to domestic taxes.

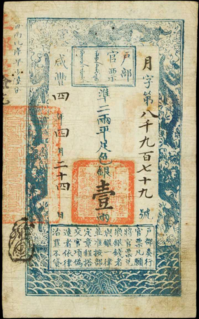

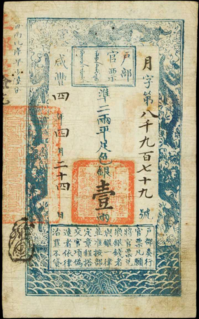

The Hubu Guanpiao is the name of two series of banknotes produced by the Qing dynasty, the first series was known as the Chaoguan (鈔官) and was introduced under the Shunzhi Emperor during the Qing conquest of the Ming dynasty but was quickly abandoned after this war ended, it was introduced amid residual ethnic Han resistance to the Manchu invaders. It was produced on a small scale, amounting to 120,000 strings of cash coins annually, and only lasted between 1651 and 1661. After the death of the Shunzhi Emperor in the year 1661, calls for resumption of banknote issuance weakened, although they never completely disappeared.