Mining is the extraction of valuable geological materials and minerals from the surface of the Earth. Mining is required to obtain most materials that cannot be grown through agricultural processes, or feasibly created artificially in a laboratory or factory. Ores recovered by mining include metals, coal, oil shale, gemstones, limestone, chalk, dimension stone, rock salt, potash, gravel, and clay. The ore must be a rock or mineral that contains valuable constituent, can be extracted or mined and sold for profit. Mining in a wider sense includes extraction of any non-renewable resource such as petroleum, natural gas, or even water.

Sasol Limited is an integrated energy and chemical company based in Sandton, South Africa. The company was formed in 1950 in Sasolburg, South Africa, and built on processes that German chemists and engineers first developed in the early 1900s. Today, Sasol develops and commercializes technologies, including synthetic fuel technologies, and produces different liquid fuels, chemicals, coal tar, and electricity.

Vale, formerly Companhia Vale do Rio Doce, is a Brazilian multinational corporation engaged in metals and mining and one of the largest logistics operators in Brazil. Vale is the largest producer of iron ore and nickel in the world. It also produces manganese, ferroalloys, copper, bauxite, potash, kaolin, and cobalt, currently operating nine hydroelectricity plants, and a large network of railroads, ships, and ports used to transport its products.

Iron Ore Company of Canada is a Canadian-based producer of iron ore. The company was founded in 1949 from a partnership of Canadian and American firms, the largest being the M.A. Hanna Company. It is now owned by a new consortium, including the Mitsubishi and Rio Tinto corporations. Rio Tinto is the majority shareholder in the venture, with 58.7% of the joint stock as of October 2013. Mitsubishi controlled 26.2% of the investment as of March 2013.

The Lake Superior and Ishpeming Railroad, is a U.S. railroad offering service from Marquette, Michigan, to nearby locations in Michigan's Upper Peninsula. It began operations in 1896. The LS&I continues to operate as an independent railroad from its headquarters in Marquette.

Sherritt International is a Canadian resource company, based in Toronto, Ontario. Sherritt is a world leader in the mining and refining of nickel and cobalt – metals essential for the growing adoption of electric vehicles. Its Technologies Group creates innovative, proprietary solutions for oil and mining companies around the world to improve environmental performance and increase economic value. Sherritt is also the largest independent energy producer in Cuba. Sherritt’s common shares are listed on the Toronto Stock Exchange under the symbol “S”.

Sinosteel Corporation is a state-owned enterprise, primarily in mining, trading, equipment manufacturing and engineering. Founded in 1993 and based in the People's Republic of China, it is the country's second largest importer of iron ore. The company used to be under the direct supervision of the State-owned Assets Supervision and Administration Commission. In 2022, it was acquired by state-owned steel conglomerate Baowu.

Mining in Western Australia, together with the petroleum industry in the state, accounted for 94% of the State's and 46% of Australia's income from total merchandise exports in 2019–20. The state of Western Australia hosted 123 predominantly higher value and export-oriented mining projects and hundreds of smaller quarries and mines. The principal projects produced more than 99 per cent of the industry's total sales value.

The economy of Minnesota produced US$312 billion of gross domestic product in 2014. Minnesota headquartered 31 publicly traded companies in the top 1,000 U.S. companies by revenue in 2011. This includes such large companies as Target and UnitedHealth Group. The per capita personal income in 2016 was $51,990, ranking sixteenth in the nation. The median household income in 2013 ranked eleventh in the nation at $60,900.

Cleveland-Cliffs Inc. (CCI), formerly Cliffs Natural Resources, is a Cleveland, Ohio-based steelmaking company. They specialize in the mining, beneficiation, and pelletizing of iron ore, as well as steelmaking, including stamping and tooling. It is the largest flat-rolled steel producer in North America.

Mitsui & Co., Ltd. is one of the largest sogo shosha in Japan; it is part of the Mitsui Group.

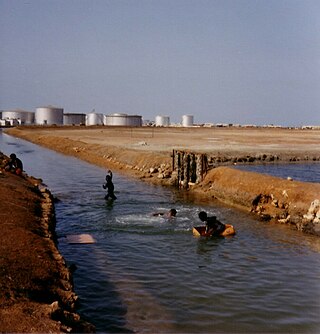

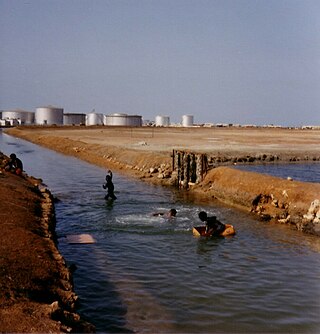

Hydrocarbons are the leading sector in Algeria's mineral industry, which includes diverse but modest production of metals and industrial minerals. In 2006, helium production in Algeria accounted for about 13% of total world output. Hydrocarbons produced in Algeria accounted for about 2.9% of total world natural gas output and about 2.2% of total world crude oil output in 2006. Algeria held about 21% of total world identified resources of helium, 2.5% of total world natural gas reserves, and about 1% of total world crude oil reserves.

The mining industry of Botswana has dominated the national economy of Botswana since the 1970s. Diamond has been the leading component of the mineral sector since large-scale diamond production began in 1972 by Debswana. Most of Botswana's diamond production is of gem quality, resulting in the country's position as the world's leading producer of diamond by value. Copper, gold, nickel, coal and soda ash production also has held significant, though smaller, roles in the economy.

The mining of minerals in Nigeria accounts for only 0.3% of its gross domestic product, due to the influence of its vast oil resources. The domestic mining industry is underdeveloped, leading to Nigeria having to import minerals that it could produce domestically, such as salt or iron ore. The rights to ownership of mineral resources is held by the Federal Government of Nigeria, which grants titles to organizations to explore, mine, and sell mineral resources. Organized mining began in 1903, when the Mineral Survey of the Northern Protectorates was created by the British colonial government. A year later, the Mineral Survey of the Southern Protectorates was founded. By the 1940s, Nigeria was a major producer of tin, columbite, and coal. The discovery of oil in 1956 hurt the mineral extraction industries, as government and industry both began to focus on this new resource. The Nigerian Civil War in the late 1960s led many expatriate mining experts to leave the country. Mining regulation is handled by the Ministry of Solid Minerals Development, who are tasked with the responsibility of overseeing the management of all mineral resources in Nigeria. Mining law is codified in the Federal Minerals and Mining Act of 1999. Historically, Nigeria's mining industry was monopolized by state-owned public corporations. This led to a decline in productivity in almost all mineral industries. The Obasanjo administration began a process of selling off government-owned corporations to private investors in 1999. The Nigerian Mining Industry has picked up since the "Economic Diversification Agenda", from Oil & Gas, to Agriculture, Mining, etc., began in the country.

In 2006, Cambodia's mineral resources remained, to a large extent, unexplored. Between 2003 and 2006, however, foreign investors from Australia, China, South Korea, Thailand, and the United States began to express their interest in Cambodia's potential for offshore oil and gas as well as such land-based metallic minerals as bauxite, copper, gold, and iron ore, and such industrial minerals as gemstones and limestone.

The mineral industry of Peru has played an important role in the nation's history and been integral to the country's economic growth for several decades. The industry has also contributed to environmental degradation and environmental injustice; and is a source of environmental conflicts that shape public debate on good governance and development.

Avient Corporation is a global manufacturer of specialized polymer materials headquartered in Avon Lake, Ohio. Its products include thermoplastic compounds, plastic colorants and additives, thermoplastic resins, vinyl resins, thermoplastic composites and specialty thermoset composite materials.

Mining in North Korea is important to the country's economy. North Korea is naturally abundant in metals such as magnesite, zinc, tungsten, and iron; with magnesite resources of 6 billion tonnes, particularly in the North and South Hamgyong Province and Chagang Province. However, often these cannot be mined due to the acute shortage of electricity in the country, as well as the lack of proper tools to mine these materials and an antiquated industrial base. Coal, iron ore, limestone, and magnesite deposits are larger than other mineral commodities. Mining joint ventures with other countries include China, Canada, Egypt, and South Korea.

The mining industry of Sudan is mostly driven by extraction fuel minerals, with petroleum accounting for a substantial contribution to the country's economy, until the autonomous region of Southern Sudan became an independent country in July 2011. Gold, iron ore, and base metals are mined in the Hassai Gold Mine and elsewhere. Chromite is another important mineral extracted from the Ingessana Hills. Other minerals extracted are gypsum, salt, and cement. Phosphate is found in Mount Kuoun and Mount Lauro in eastern Nuba. Reserves of zinc, lead, aluminium, cobalt, nickel in the form of block sulfides, and uranium are also established. Large reserves of iron ore have been established.

The Pickands Mather Group is an American company which provides shipping of coal and other bulk commodities, and the purchase, sale, and marketing of bulk coal. Founded in 1883 as Pickands Mather & Company, it once had the second largest shipping fleet on the Great Lakes in the 1910s and 1920s. The company was purchased by the Diamond Shamrock Corporation in 1968, which in turn sold it to the Moore-McCormack Resources in 1973. Moore-McCormack sold Pickands Mather's mining interests to Cleveland-Cliffs in 1986. Moore-McCormack then spun off the Interlake Steamship Company to James Barker and Paul R. Tregurtha in 1987. Pickands Mather was sold to a management group in 1992, and continues to operate as a private company.