A monopoly is as described by Irving Fisher, a market with the "absence of competition", creating a situation where a specific person or enterprise is the only supplier of a particular thing. This contrasts with a monopsony which relates to a single entity's control of a market to purchase a good or service, and with oligopoly and duopoly which consists of a few sellers dominating a market. Monopolies are thus characterized by a lack of economic competition to produce the good or service, a lack of viable substitute goods, and the possibility of a high monopoly price well above the seller's marginal cost that leads to a high monopoly profit. The verb monopolise or monopolize refers to the process by which a company gains the ability to raise prices or exclude competitors. In economics, a monopoly is a single seller. In law, a monopoly is a business entity that has significant market power, that is, the power to charge overly high prices, which is associated with a decrease in social surplus. Although monopolies may be big businesses, size is not a characteristic of a monopoly. A small business may still have the power to raise prices in a small industry.

An oligopoly is a market structure in which a market or industry is dominated by a small number of large sellers or producers.

In economics, specifically general equilibrium theory, a perfect market, also known as an atomistic market, is defined by several idealizing conditions, collectively called perfect competition, or atomistic competition. In theoretical models where conditions of perfect competition hold, it has been demonstrated that a market will reach an equilibrium in which the quantity supplied for every product or service, including labor, equals the quantity demanded at the current price. This equilibrium would be a Pareto optimum.

In economics, profit maximization is the short run or long run process by which a firm may determine the price, input and output levels that lead to the highest profit. Neoclassical economics, currently the mainstream approach to microeconomics, usually models the firm as maximizing profit.

In economics, economic equilibrium is a situation in which economic forces such as supply and demand are balanced and in the absence of external influences the values of economic variables will not change. For example, in the standard text perfect competition, equilibrium occurs at the point at which quantity demanded and quantity supplied are equal. Market equilibrium in this case is a condition where a market price is established through competition such that the amount of goods or services sought by buyers is equal to the amount of goods or services produced by sellers. This price is often called the competitive price or market clearing price and will tend not to change unless demand or supply changes, and quantity is called the "competitive quantity" or market clearing quantity. But the concept of equilibrium in economics also applies to imperfectly competitive markets, where it takes the form of a Nash equilibrium.

In economics, the marginal cost is the change in the total cost that arises when the quantity produced is incremented, the cost of producing additional quantity. In some contexts, it refers to an increment of one unit of output, and in others it refers to the rate of change of total cost as output is increased by an infinitesimal amount. As Figure 1 shows, the marginal cost is measured in dollars per unit, whereas total cost is in dollars, and the marginal cost is the slope of the total cost, the rate at which it increases with output. Marginal cost is different from average cost, which is the total cost divided by the number of units produced.

Managerial economics is a branch of economics involving the application of economic methods in the managerial decision-making process.And, Managerial Economics is the integration of economic theory with business practice for the purpose of facilitating Decision making and forward planning by the Management. Managerial economics aims to provide a framework for decision making which are directed to maximise the profits and outcomes of a company. Managerial economics focuses on increasing the efficiency of organizations by employing all possible business resources to increase output while decreasing unproductive activities. The two main purposes of managerial economics are:

- To optimize decision making when the firm is faced with problems or obstacles, with the consideration of macro and microeconomic theories and principles.

- To analyse the possible effects and implications of both short and long-term planning decisions on the revenue and profitability of the Business.

Output in economics is the "quantity of goods or services produced in a given time period, by a firm, industry, or country", whether consumed or used for further production. The concept of national output is essential in the field of macroeconomics. It is national output that makes a country rich, not large amounts of money.

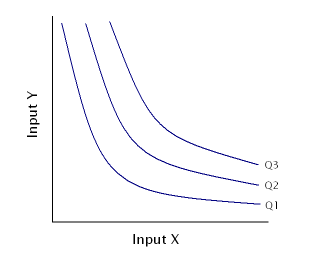

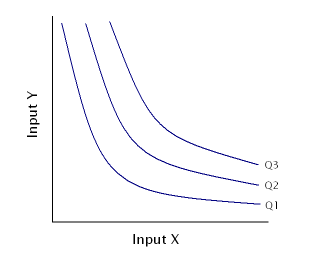

An isoquant, in microeconomics, is a contour line drawn through the set of points at which the same quantity of output is produced while changing the quantities of two or more inputs. The x and y axis on an isoquant represent two relevant inputs, which are usually a factor of production such as labour, capital, land, or organisation. An isoquant may also be known as an “Iso-Product Curve”, or an “Equal Product Curve”.

Marginal revenue is a central concept in microeconomics that describes the additional total revenue generated by increasing product sales by 1 unit. To derive the value of marginal revenue, it is required to examine the difference between the aggregate benefits a firm received from the quantity of a good and service produced last period and the current period with one extra unit increase in the rate of production. Marginal revenue is a fundamental tool for economic decision making within a firm's setting, together with marginal cost to be considered.

The marginal revenue productivity theory of wages is a model of wage levels in which they set to match to the marginal revenue product of labor, , which is the increment to revenues caused by the increment to output produced by the last laborer employed. In a model, this is justified by an assumption that the firm is profit-maximizing and thus would employ labor only up to the point that marginal labor costs equal the marginal revenue generated for the firm. This is a model of the neoclassical economics type.

In economics, a cost curve is a graph of the costs of production as a function of total quantity produced. In a free market economy, productively efficient firms optimize their production process by minimizing cost consistent with each possible level of production, and the result is a cost curve. Profit-maximizing firms use cost curves to decide output quantities. There are various types of cost curves, all related to each other, including total and average cost curves; marginal cost curves, which are equal to the differential of the total cost curves; and variable cost curves. Some are applicable to the short run, others to the long run.

In economics, total cost (TC) is the minimum dollar cost of producing some quantity of output. This is the total economic cost of production and is made up of variable cost, which varies according to the quantity of a good produced and includes inputs such as labor and raw materials, plus fixed cost, which is independent of the quantity of a good produced and includes inputs that cannot be varied in the short term such as buildings and machinery, including possibly sunk costs.

In economics, demand is the quantity of a good that consumers are willing and able to purchase at various prices during a given period of time. The relationship between price and quantity demand is also called the demand curve. Demand for a specific item is a function of an item's perceived necessity, price, perceived quality, convenience, available alternatives, purchasers' disposable income and tastes, and many other options.

In economics, the marginal product of capital (MPK) is the additional production that a firm experiences when it adds an extra unit of capital. It is a feature of the production function, alongside the labour input.

A firm will choose to implement a shutdown of production when the revenue received from the sale of the goods or services produced cannot even cover the variable costs of production. In that situation, the firm will experience a higher loss when it produces, compared to not producing at all.

In economics, the marginal product of labor (MPL) is the change in output that results from employing an added unit of labor. It is a feature of the production function, and depends on the amounts of physical capital and labor already in use.

In any technical subject, words commonly used in everyday life acquire very specific technical meanings, and confusion can arise when someone is uncertain of the intended meaning of a word. This article explains the differences in meaning between some technical terms used in economics and the corresponding terms in everyday usage.

The socially optimal firm size is the size for a company in a given industry at a given time which results in the lowest production costs per unit of output.

A monopoly price is set by a monopoly. A monopoly occurs when a firm lacks any viable competition and is the sole producer of the industry's product. Because a monopoly faces no competition, it has absolute market power and can set a price above the firm's marginal cost. Since marginal cost is the increment in total cost required to produce an additional unit of the product, the firm can make a positive economic profit if it produces a greater quantity of the product and sells it at a lower price.