Related Research Articles

A binary option is a financial exotic option in which the payoff is either some fixed monetary amount or nothing at all. The two main types of binary options are the cash-or-nothing binary option and the asset-or-nothing binary option. The former pays some fixed amount of cash if the option expires in-the-money while the latter pays the value of the underlying security. They are also called all-or-nothing options, digital options, and fixed return options (FROs).

The Chicago Board Options Exchange (CBOE), located at 433 West Van Buren Street in Chicago, is the largest U.S. options exchange with an annual trading volume of around 1.27 billion at the end of 2014. CBOE offers options on over 2,200 companies, 22 stock indices, and 140 exchange-traded funds (ETFs).

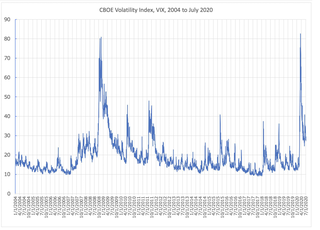

VIX is the ticker symbol and the popular name for the Chicago Board Options Exchange's CBOE Volatility Index, a popular measure of the stock market's expectation of volatility based on S&P 500 index options. It is calculated and disseminated on a real-time basis by the CBOE, and is often referred to as the fear index or fear gauge.

Options Clearing Corporation (OCC) is a United States clearing house based in Chicago. It specializes in equity derivatives clearing, providing central counterparty (CCP) clearing and settlement services to 16 exchanges. It was started by Wayne Luthringshausen and carried on by Michael Cahill. Its instruments include options, financial and commodity futures, security futures, and securities lending transactions.

In finance, an option is a contract which conveys to its owner, the holder, the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset and have a valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in over-the-counter (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts.

The Options Price Reporting Authority (OPRA) oversees the Securities Information Processor (SIP) that provides last sale information and current options quotations from a committee of participant exchanges. In turn, this committee is designated as the Options Price Reporting Authority.

BATS Global Markets is a global stock exchange operator founded in Lenexa, Kansas, with additional offices in London, New York, Chicago, and Singapore. BATS was founded in June 2005, became an operator of a licensed U.S. stock exchange in 2008 and opened its pan-European stock market in October 2008. As of February 2016, it operated four U.S. stock exchanges, two U.S. equity options exchanges, the pan-European stock market, and a global market for the trading of foreign exchange products. BATS was acquired by Cboe Global Markets in 2017.

High-frequency trading (HFT) is a type of algorithmic trading in finance characterized by high speeds, high turnover rates, and high order-to-trade ratios that leverages high-frequency financial data and electronic trading tools. While there is no single definition of HFT, among its key attributes are highly sophisticated algorithms, co-location, and very short-term investment horizons in trading securities. HFT uses proprietary trading strategies carried out by computers to move in and out of positions in seconds or fractions of a second.

Flash trading, otherwise known as a flash order, is a marketable order sent to a market center that is not quoting the industry's best price or that cannot fill that order in its entirety. The order is then flashed to recipients of the venue's proprietary data feed to see if any of those firms wants to take the other side of the order.

The May 6, 2010, flash crash, also known as the crash of 2:45 or simply the flash crash, was a United States trillion-dollar flash crash which started at 2:32 p.m. EDT and lasted for approximately 36 minutes.

Gemini Trust Company, LLC (Gemini) is an American cryptocurrency exchange and custodian bank. It was founded in 2014 by Cameron and Tyler Winklevoss.

Optiver Holding B.V. is a proprietary trading firm and market maker for various exchange-listed financial instruments. Its name derives from the Dutch optieverhandelaar, or "option trader". The company is privately owned. Optiver trades listed derivatives, cash equities, exchange-traded funds, bonds, and foreign exchange.

Securities market participants in the United States include corporations and governments issuing securities, persons and corporations buying and selling a security, the broker-dealers and exchanges which facilitate such trading, banks which safe keep assets, and regulators who monitor the markets' activities. Investors buy and sell through broker-dealers and have their assets retained by either their executing broker-dealer, a custodian bank or a prime broker. These transactions take place in the environment of equity and equity options exchanges, regulated by the U.S. Securities and Exchange Commission (SEC), or derivative exchanges, regulated by the Commodity Futures Trading Commission (CFTC). For transactions involving stocks and bonds, transfer agents assure that the ownership in each transaction is properly assigned to and held on behalf of each investor.

Cboe Global Markets is an American company that owns the Chicago Board Options Exchange and the stock exchange operator BATS Global Markets.

The Members Exchange (MEMX) is an American technology-driven stock exchange founded by its members to serve the interest of its founders and their collective client base. The founding members, which include nine major financial organizations, claim they seek to transform markets around the goals of transparency, innovation, and competition in order to align exchange services with the interests of market participants. It is a member-formed equities trading platform, and competes with the major equity exchanges: NYSE, Nasdaq, and CBOE.

Jump Trading LLC is a proprietary trading firm with a focus on algorithmic and high-frequency trading strategies. The firm has over 700 employees in Chicago, New York, Austin, London, Tel Aviv, Singapore, Shanghai, Bristol, Gurgaon, Gandhinagar, Sydney, Amsterdam, Hong Kong, and Paris and is active in futures, options, cryptocurrency, and equities markets worldwide.

Citadel Securities LLC is an American market making firm headquartered in Miami. It is one of the largest market makers in the world, and is active in more than 50 countries. It is the largest designated market maker on the New York Stock Exchange.

Mark P. Wetjen is an American lawyer. In 2011, he was nominated by Barack Obama to serve a five-year term as a Commissioner of the Commodity Futures Trading Commission (CFTC). He also served for five months as acting chairman of the CFTC upon the departure of his predecessor, Gary Gensler.

A securities information processor (SIP) is a part of the infrastructure of public market data providers in the United States that process, consolidate, and disseminate quotes and trade data from different US securities exchanges and market centers. An important purpose of the SIPs for US securities is to publish the prevailing National Best Bid Offer (NBBO).

MIAX Pearl Equities (MIAX), is an American stock exchange headquartered in Princeton, New Jersey. The exchange also has offices in Miami, Florida, where its parent company Miami International Holdings is based.

References

- ↑ "About MIAX". Archived from the original on 2023-01-14. Retrieved 2023-01-14.

- ↑ "LedgerX gets U.S. approval for derivatives on digital currencies". Reuters.

- 1 2 "A New Options Trading Floor Could Be Coming to Miami". WSJ. Wall Street Journal.

- ↑ "ISE files for second US options exchange". Financial Times.

- ↑ "Nasdaq to launch third options exchange". Financial Times.

- ↑ "MIAX to launch 16th US stock exchange following SEC approval". S&P Global.

- ↑ Osipovich, Alexander; Banerji, Gunjan (4 March 2019). "As Stock Exchanges Multiply, Miami Wants In on the Game". Wall Street Journal.

- ↑ "Miami International to launch cash equities exchange".

- ↑ "MIAX acquires CFTC-registered FCM Dorman Trading". 24 October 2022.

- ↑ "Traders Magazine". 24 October 2022.

- ↑ "MIAX-parent Miami International Holdings confidentially files for U.S. IPO". Reuters. 6 May 2022.

- ↑ "MIAX Exchange Group Has Record Volumes". Markets Media Group. 11 January 2023.

- ↑ "FTX's LedgerX Derivatives Exchange Sold to Miami International Holdings in Bankruptcy Auction". 25 April 2023.

- ↑ "MIAX Sapphire, LLC; Notice of Filing of Application for Registration as a National Securities Exchange Under Section 6 of the Securities Exchange Act of 1934". Federal Register.

- ↑ "Miami Exchange Preps Trading Floor in Wynwood During Options Boom". Bloomberg.

- ↑ "Miami-based securities exchange company secures 38,000-square-foot office in Wynwood". South Florida Business Journal.

- ↑ "Miami Exchange Names Citadel Securities' Kane Head of Futures". Bloomberg.

- ↑ "VIX Fear Competitor Gets Three More Months to Fight for Survival". Bloomberg.

- ↑ "Nasdaq v. IEX Group: Nasdaq sues (again) a fledgling stock-exchange operator". Harvard Journal of Law & Technology. 13 April 2018.

- ↑ "Nasdaq Avoids Dismissal of Trade Secrets Suit Against Rival MIAX". Bloomberg Law.

- ↑ "Nasdaq Sues Rival Exchange, Alleging Stolen Tech Secrets". Bloomberg.

- ↑ "Nasdaq Options Trading Patents Challenged by Rival MIAX Exchange". Bloomberg.

- ↑ "VIX Fear Gauge's Only Competitor Set to Vanish From the Market". Bloomberg.