This article needs additional citations for verification .(January 2020) |

Russia's monetary reform of 1993 took place from 26 July to 7 August 1993.

This article needs additional citations for verification .(January 2020) |

Russia's monetary reform of 1993 took place from 26 July to 7 August 1993.

Russia's 1993 currency reform was intended to tame inflation and exchange the banknotes remaining in circulation from 1961 to 1992 for banknotes of a new design. The reform was confiscatory, as there were a number of restrictions on the exchange of banknotes. In addition, the reform was carried out during the summer holidays, which created additional problems for citizens. The Central Bank of the Russian Federation issued a clarification that the exchange of banknotes after 1 October 1993 would be made exclusively on presentation of documents that proved the impossibility of exchange in a timely manner.

That restriction was also aimed at combating the influx of currency notes from the former Soviet republics, as the central banks of the Republics ceased to look to Russia's State Bank and started printing their own money. [1] In 1993, the central banks of the former member states began issue of their national currencies to replace the former Soviet ruble, which was a threat to Russia since the old rubles could be sent to Russia and would destabilise its financial system.

The official aims of the reform were the fight against inflation, the retirement of the old treasury bills of the State Bank of the USSR and the separation of the monetary systems of Russia and the other Commonwealth of Independent States countries. The ruble would be a means of payment in only domestic money circulation.

In fact, on 17 July 1993, Russia withdrew from the ruble zone of the CIS, the ruble as a means of payment in the interconnected CIS economy virtually ceased to exist, Viktor Chernomyrdin's government deprived Russia of its ability to control all the cash and the issue of the economy depended on it republics of the ruble zone. Non-cash rubles in payments between the republics also ceased to exist.

The terms of monetary reform were set out in a telegram to the Central Bank of the Russian Federation N 131-93 of July 24, 1993, signed by the Chairman of the Bank of Russia, Viktor Gerashchenko:

The Central Bank of the Russian Federation in accordance with the Law of the Russian Federation "On the monetary system of the Russian Federation" and the RSFSR Law "On the Central Bank of the Russian Federation" in order to prevent multiple modifications of the same value of banknotes in circulation and due to the sufficiency of reserves in bank notes and coins of the Bank of Russia of 1993 stops with zero hours (local time) on 26 July 1993 on the treatment of the entire territory of the Russian Federation government treasury bills of the USSR, the USSR State Bank of tickets and bank notes of the Bank of Russia of 1961-1992 years.

Initially, the exchange limit was set at 35,000 non-denominated rubles (at the time, about US$35). The country started to panic. Two days later, President Boris Yeltsin issued a decree where the exchange amount was increased to 100,000 rubles (about US$100) per person, and the deadline was extended until August 1993.

Citizens of Russia (according to registration in the internal passport) could change the amount of 100,000 rubles, as stamped in passports. Rumours of reform went ahead, the authorities denied them and the reform was carried out during the holiday season, when many were away from their place of residence. The limitation was also aimed at combating the influx of currency notes from the former Soviet republics. As a result, many people did not physically have time to exchange their cash savings, and their money was gone.

Enterprises could exchange cash within cash balances at the beginning of the day on July 26 and had to surrender them to the bank for the banking day on July 26. Amount of money handed over was not to exceed the limit set for the box office of the organization, and the amount of sales proceeds received by the cashier at the end of the day on July 25.

The reform did not strengthen the ruble. In fact, it led to serious complications with its neighbours, as their currencies were tied to the ruble. The central bank had to transfer some of the new banknotes to Kazakhstan and Belarus. In the second half of 1993, Russia tried to negotiate with the neighbors on the establishment of a new type of ruble zone, but only Belarus signed an agreement to combine their monetary systems in the future.

The ruble or rouble is the currency of the Russian Federation. The ruble is subdivided into 100 kopecks. It is used in Russia as well as in the parts of Ukraine under Russian military occupation and in Russian-occupied parts of Georgia.

The tenge is the currency of Kazakhstan. It is divided into 100 tiyn.

The Lithuanian litas (ISO currency code LTL, symbolized as Lt; plural litai or litų was the currency of Lithuania, until 1 January 2015, when it was replaced by the euro. It was divided into 100 centų. The litas was first introduced on 2 October 1922 after World War I, when Lithuania declared independence, and was reintroduced on 25 June 1993 following a period of currency exchange from the Soviet ruble to the litas with the temporary talonas then in place. The name was modeled after the name of the country. From 1994 to 2002, the litas was pegged to the U.S. dollar at the rate of 4 to 1. The litas was pegged to the euro at the rate of 3.4528 to 1 since 2002. The euro was expected to replace the litas by 1 January 2007, but persistent high inflation and the economic crisis delayed the switch. On 1 January 2015 the litas was switched to the euro at the rate of 3.4528 to 1.

The Armenian dram is the currency of the Republic of Armenia. It was historically subdivided into 100 luma. The Central Bank of Armenia is responsible for issuance and circulation of dram banknotes and coins, as well as implementing the monetary policy of Armenia.

The hryvnia has been the national currency of Ukraine since 2 September 1996. The hryvnia is divided into 100 kopiyok. It is named after a measure of weight used in Kievan Rus'.

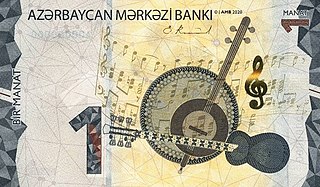

The manat is the currency of Azerbaijan. It is subdivided into 100 gapiks.

The Latvian ruble was the name of two currencies of Latvia: the Latvian ruble, in use from 1919 to 1922, and the second Latvian ruble, in use from 1992 to 1993.

The Transnistrian ruble is the currency of the internationally unrecognized state of Transnistria and is divided into 100 kopecks.

The som is the currency of Kyrgyzstan.

The sum is the official currency of Uzbekistan. Uzbekistan replaced the ruble with the sum at par in on July 16, 1994. No subdivisions of this sum were issued and only banknotes were produced, in denominations of 1, 3, 5, 10, 25, 50, 100, 200, 500, 1,000, 5,000, and 10,000 sum. Because it was meant to be a transitional currency, the design was rather simplistic.

The ruble, rouble or rubel is the currency of Belarus. It is subdivided into 100 kopecks.

The ruble or rouble was the currency of the Soviet Union. It was introduced in 1922 and replaced the Imperial Russian ruble. One ruble was divided into 100 kopecks. Soviet banknotes and coins were produced by the Federal State Unitary Enterprise in Moscow and Leningrad.

The ruble was the currency of Tajikistan between 10 May 1995 and 29 October 2000. It was ostensibly subdivided into 100 tanga, although no coins or banknotes were issued denominated in tanga. The currency was only issued as paper money, with denominations to up to 10,000 rubles.

The Central Bank of Armenia is the central bank of Armenia with its headquarters in Yerevan. The CBA is an independent institution responsible for issuing all banknotes and coins in the country, overseeing and regulating the banking sector and keeping the government's currency reserves. The CBA is also the sole owner of the Armenian Mint.

Chervonets is the traditional Russian name for large foreign and domestic gold coins. The name comes from the Russian term червонное золото, meaning 'red gold' – the old name of a high-grade gold type.

The National Bank of the Kyrgyz Republic is the central bank of Kyrgyzstan and is primarily responsible for the strategic monetary policy planning of the country as well as the issuance of the national currency, the Som.

In monetary economics, the currency in circulation in a country is the value of currency or cash that has ever been issued by the country’s monetary authority less the amount that has been removed. More broadly, money in circulation is the total money supply of a country, which can be defined in various ways, but always includes currency and also some types of bank deposits, such as deposits at call.

Monetary reform of 1991 was the last such reform in the Soviet Union. The reform retired and confiscated large-denomination bills to attempt to dampen inflation and combat the black market within the Soviet Union. It began on January 22, 1991. Its architect was Minister of Finance Valentin Pavlov, who was to become the last prime minister of the Soviet Union on January 14, 1991.

Russia launched a monetary reform on January 1, 1998. Preparation started in August 1997. Replacement of the old banknotes occurred gradually, until 2002.

The monetary reform in the Soviet Union of 1947 was carried out during December 16–19, 1947. It was the second Soviet monetary reform. At the same time the post-World War II rationing system was discontinued. The reform was a combination of redenomination and confiscation, the latter depending on the amount exchanged and whether the monies were kept at sberkassa or not. Amounts under 3,000 Rbls in private bank accounts were not revalued while cash had to be exchanged 10:1 for new roubles. State bonds were exchanged as well, under more favourable to government (politburo) rules of denomination. The confiscative character was attributed to large amounts of counterfeit money produced by Nazi Germany, as well as to the desire to devalue the savings of the profiteers and enrich the government.