Related Research Articles

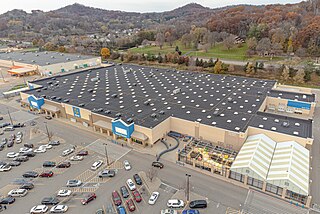

Walmart Inc. is an American multinational retail corporation that operates a chain of hypermarkets, discount department stores, and grocery stores in the United States, headquartered in Bentonville, Arkansas. The company was founded by brothers Sam and James "Bud" Walton in nearby Rogers, Arkansas in 1962 and incorporated under Delaware General Corporation Law on October 31, 1969. It also owns and operates Sam's Club retail warehouses.

Synovus Financial Corp., formerly the Columbus Bank and Trust Company, is a financial services company with approximately $62 billion in assets based in Columbus, Georgia. Synovus provides commercial and retail banking, investment, and mortgage services through 249 branches and 335 ATMs in Georgia, Alabama, South Carolina, Florida, and Tennessee.

The Kroger Company, or simply Kroger, is an American retail company that operates supermarkets and multi-department stores throughout the United States.

Harris Teeter Supermarkets, LLC., also known as Harris Teeter Neighborhood Food & Pharmacy, is an American supermarket chain based in Matthews, North Carolina, a suburb of Charlotte. As of February 2024, the chain operates 259 stores in seven South Atlantic states and Washington, D.C. Supermarket News ranked Harris Teeter No. 34 in the 2012 "Top 75 Retailers & Wholesalers" based on 2011 fiscal year sales of $4.3 billion.

SunTrust Banks, Inc. was an American bank holding company with SunTrust Bank as its largest subsidiary and assets of US$199 billion as of March 31, 2018. The bank's most direct corporate parent was established in 1891 in Atlanta, where it was headquartered.

Truist Financial Corporation is an American bank holding company headquartered in Charlotte, North Carolina. The company was formed in December 2019 as the result of the merger of BB&T and SunTrust Banks. Its bank operates 2,781 branches in 15 states and Washington, D.C., offering consumer and commercial banking, securities brokerage, asset management, mortgage, and insurance products and services. It is on the list of largest banks in the United States by assets; as of August 2023, it is the 9th largest bank with $514 billion in assets. As of January 2021, Truist Insurance Holdings is the seventh largest insurance broker in the world, with $2.27 billion in annual revenue.

SouthTrust Corporation was a banking company headquartered in Birmingham, Alabama. In 2004, SouthTrust reached an agreement to merge with Wachovia in a stock-for-stock deal. At the time of the merger with Wachovia was completed, SouthTrust had $53 Billion in assets. SouthTrust was listed on the NASDAQ exchange under the ticker symbol SOTR. The company was headquartered in the SouthTrust Tower, now known as the Shipt Tower. SouthTrust had branches in Alabama, Florida, Georgia, Mississippi, North Carolina, South Carolina, Tennessee, Texas and Virginia. By the end of 2005, all former SouthTrust branches that remained open carried the Wachovia name.

First Union Corporation was a bank holding company that provided commercial and retail banking services in eleven states in the eastern U.S. First Union also provided various other financial services, including mortgage banking, credit card, investment banking, investment advisory, home equity lending, asset-based lending, leasing, insurance, international and securities brokerage services and private equity through First Union Capital Partners, and through other subsidiaries.

Citizens and Southern National Bank (C&S) began as a Georgia institution that expanded into South Carolina, Florida and into other states via mergers. Headquartered in Atlanta, Georgia; it was the largest bank in the Southeast for much of the 20th century. C&S merged with Sovran Bank in 1990 to form C&S/Sovran in hopes of fending off a hostile takeover attempt by NCNB Corporation. Only a year later, however, C&S/Sovran merged with NCNB to form NationsBank, which forms the core of today's Bank of America.

The history of Walmart, an American discount department store chain, began in 1950 when businessman Sam Walton purchased a store from Luther E. Harrison in Oklahoma City, Oklahoma, and opened Walton's 5 & 10. The Walmart chain proper was founded in 1962 with a single store in Rogers, expanding inside Oklahoma by 1968 and throughout the rest of the Southern United States by the 1980s, ultimately operating a store in every state of the United States, plus its first stores in Canada, by 1995. The expansion was largely fueled by new store construction, although the chains Mohr-Value and Kuhn's Big K were also acquired.

Wachovia was a diversified financial services company based in Charlotte, North Carolina. Before its acquisition by Wells Fargo and Company in 2008, Wachovia was the fourth-largest bank holding company in the United States, based on total assets. Wachovia provided a broad range of banking, asset management, wealth management, and corporate and investment banking products and services. At its height, it was one of the largest providers of financial services in the United States, operating financial centers in 21 states and Washington, D.C., with locations from Connecticut to Florida and west to California. Wachovia provided global services through more than 40 offices around the world.

United Community Banks, Inc. is an American bank. United is one of the largest full-service financial institutions in the Southeast, with $25.9 billion in assets, and 161 offices in Alabama, Florida, Georgia, North Carolina, South Carolina and Tennessee.

First Charter Bank was an American bank headquartered in Charlotte, North Carolina, United States. From its 1888 founding as Concord National Bank until its 2001 move to Charlotte, the bank was headquartered in Concord, North Carolina and was a subsidiary of First Charter Corporation. The bank became part of Fifth Third Bank in 2008.

Capital Bank Financial Corporation was a bank holding company headquartered in Charlotte, North Carolina with $10 billion in assets as of first quarter 2017 and 193 branches. Former Bank of America vice chairman Gene Taylor was chief executive, former Bank of America executive and Fifth Third Bank CFO, Chris Marshall was CFO and former Bank of America executive, R. Bruce Singletary was Chief Risk Officer. Former Morgan Stanley specialty finance research analyst, Kenneth Posner, managed corporate strategy and investor relations. North American Financial Holdings (NAFH) original purpose was to take over banks that had difficulties due to the financial crisis of 2007–2010. The company's main interest was banks in the Carolinas and Florida, but in 2011, NAFH moved into Tennessee and Virginia. Despite buying seven distressed, money losing banks, NAFH's Capital Bank was consistently profitable during the duration of its existence and consistently posted improved returns for each of its five years of operations. Capital Bank completed a successful IPO in September 2012, and used to trade on the NASDAQ under the ticker CBF until its acquisition by First Horizon National Corporation in December 2017.

Central Carolina Bank and Trust (CCB) was a bank headquartered in Durham, North Carolina. It began in 1961 with the merger of Durham Bank & Trust and University National Bank of Chapel Hill, North Carolina. Central Carolina Bank and Trust merged with SunTrust Banks of Atlanta, Georgia in 2005, which in turn merged with BB&T to form Truist Financial. Its headquarters was the historic 17-story Hill Building in North Carolina.

Southern National Bank was a bank headquartered first in Lumberton, North Carolina and then in Winston-Salem, North Carolina. It joined with BB&T in 1995.

HomeTrust Bancshares Inc. is an Asheville, North Carolina-based bank holding company with $4.3 billion in assets and 33 branches in North and South Carolina, Georgia and Tennessee. It is the parent of seven community banks—HomeTrust Bank, Tryon Federal Bank, Shelby Savings Bank, Home Savings Bank, Industrial Federal Bank, Cherryville Federal Bank and Rutherford County Bank.

Carl Douglas McMillon is an American businessman, and the president and chief executive officer (CEO) of Walmart Inc. He sits on the retailer's board of directors. Having first joined the company as a summer associate in high school, he became the company's fifth CEO in 2014. He previously led the company's Sam's Club division, from 2005 to 2009, and Walmart International, from 2009 to 2013.

SouthState Bank, based in Winter Haven, Florida, is an American bank based in Florida and a subsidiary of SouthState Corporation, a bank holding company. As of December 31, 2018, the company had 168 branches in South Carolina, North Carolina, Georgia, Florida, Alabama and Virginia.

References

- 1 2 3 Robertson, Rob (2004-04-23). "National Bank of Commerce to make debut in the Sunshine State". Memphis Business Journal . Retrieved 2010-09-30.

- ↑ "Bank of Commerce & Trust Company Building (National Bank of Commerce". Archived from the original on 2011-07-25. Retrieved 2010-09-30.

- ↑ "Bank of Commerce and Trust Company Building - Archiplanet" . Retrieved 2010-09-30.

- ↑ "One Commerce Square - Tallest Buildings in Memphis - Memphis Skyscrapers" . Retrieved 2010-09-30.

- 1 2 3 4 5 6 "NCF Chairman Tom Garrott Announces Retirement". PRNewsire. 2002-04-24. Retrieved 2010-09-16.

- ↑ Carron, Linda (1998-04-24). "NBC bank checks out first non-Kroger site". Triangle Business Journal . Retrieved 2010-09-16.

- 1 2 3 Jerome Obermark, "Memphis, Tenn.-Based Bank's Shares Drop on Merger News," The Commercial Appeal , March 21, 2000.

- 1 2 "CCB, National Commerce to merge". Triangle Business Journal . 2000-03-22. Retrieved 2010-09-16.

- 1 2 "National Bank of Commerce expands Georgia presence with deals in Atlanta and Savannah". Memphis Business Journal . 2001-12-10. Retrieved 2010-09-30.

- ↑ "National Bank of Commerce (Memphis, TN): Private Company Information". Business Week. Archived from the original on October 6, 2012. Retrieved 2010-09-16.

- ↑ "National Commerce approved for NYSE listing". Triangle Business Journal . 2001-07-11. Retrieved 2010-09-16.

- ↑ "National Commerce Financial Corporation to Acquire SouthBanc Shares, Inc". PRNewswire. 2001-07-16. Archived from the original on 2012-03-29. Retrieved 2010-09-16.

- ↑ Jane Secombe, "Central Carolina Bank to Take Control of 25 First Union, Wachovia Branches," Winston-Salem Journal , February 13, 2002.

- ↑ "NCF completes acquisitions". Memphis Business Journal . 2002-02-19. Retrieved 2010-09-16.

- ↑ "Name of Central Carolina Bank to change after SunTrust merger," The Herald-Sun , July 20, 2004.