Warren Edward Buffett is an American businessman, investor, and philanthropist who currently serves as the co-founder, chairman and CEO of Berkshire Hathaway. As a result of his immense investment success, Buffett is one of the best-known investors in the world. As of April 2024, he had a net worth of $139 billion, making him the ninth-richest person in the world.

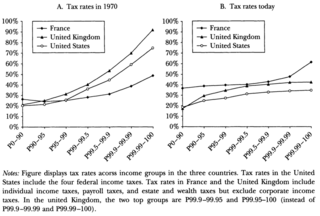

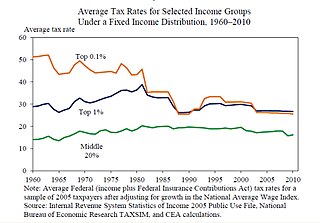

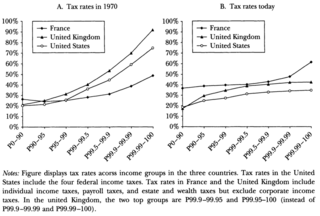

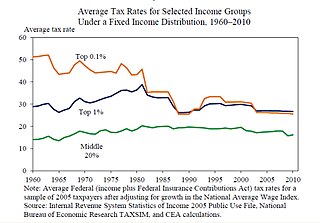

A progressive tax is a tax in which the tax rate increases as the taxable amount increases. The term progressive refers to the way the tax rate progresses from low to high, with the result that a taxpayer's average tax rate is less than the person's marginal tax rate. The term can be applied to individual taxes or to a tax system as a whole. Progressive taxes are imposed in an attempt to reduce the tax incidence of people with a lower ability to pay, as such taxes shift the incidence increasingly to those with a higher ability-to-pay. The opposite of a progressive tax is a regressive tax, such as a sales tax, where the poor pay a larger proportion of their income compared to the rich

The Log Cabin Republicans (LCR) is an organization affiliated with the Republican Party which advocates for equal rights for LGBT+ Americans, by educating the LGBT+ community and Republicans about each other.

Trickle-down economics is a generally critical term for supply-side economics, criticizing such policies as favoring wealthy individuals and large corporations. In the "trickle down" description, wealthy individuals directly benefit from supply-side style tax cuts, leaving only the leftover wealth to "trickle down" to those less fortunate. The term has been used broadly by critics of supply-side economics to refer to taxing and spending policies by governments that, intentionally or not, result in widening income inequality; it has also been used in critical references to neoliberalism. However, the term does not represent any cohesive economic theory. While economists who favor supply-side economics generally avoid the "trickle down" analogy and dispute the focus on tax cuts to the rich, the phrase "trickle down" has also been occasionally used by proponents of such policies.

Stephen Allen Schwarzman, is an American billionaire businessman. He is the chairman and CEO of the Blackstone Group, a global private equity firm he established in 1985 with Peter G. Peterson. Schwarzman was briefly chairman of President Donald Trump's Strategic and Policy Forum.

Cindy Lee Sheehan is an American anti-war activist, whose son, U.S. Army Specialist Casey Sheehan, was killed by enemy action during the Iraq War. She attracted national and international media attention in August 2005 for her extended antiwar protest at a makeshift camp outside President George W. Bush's Texas ranch—a stand that drew both passionate support and criticism. Sheehan ran unsuccessfully for Congress in 2008. She was a vocal critic of President Barack Obama's foreign policy. Her memoir, Peace Mom: A Mother's Journey Through Heartache to Activism, was published in 2006. In an interview with The Daily Beast in 2017, Sheehan continued to hold her critical views towards George W. Bush, while also criticizing the militarism of Donald Trump.

Stephen Moore is an American conservative writer and television commentator on economic issues. He co-founded and served as president of the Club for Growth from 1999 to 2004. Moore is a former member of the Wall Street Journal editorial board. He worked at The Heritage Foundation from 1983 to 1987 and again since 2014. Moore advised Herman Cain's 2012 presidential campaign and Donald Trump's 2016 presidential campaign.

Citizens for Tax Justice (CTJ) is a Washington, D.C.-based think tank and advocacy group founded in 1979 focusing on tax policies and their impact. CTJ's work focuses primarily on federal tax policy, but also analyzes state and local tax policies.

In the United States, individuals and corporations pay a tax on the net total of all their capital gains. The tax rate depends on both the investor's tax bracket and the amount of time the investment was held. Short-term capital gains are taxed at the investor's ordinary income tax rate and are defined as investments held for a year or less before being sold. Long-term capital gains, on dispositions of assets held for more than one year, are taxed at a lower rate.

The phrase Bush tax cuts refers to changes to the United States tax code passed originally during the presidency of George W. Bush and extended during the presidency of Barack Obama, through:

Carried interest, or carry, in finance, is a share of the profits of an investment paid to the investment manager specifically in alternative investments. It is a performance fee, rewarding the manager for enhancing performance. Since these fees are generally not taxed as normal income, some believe that the structure unfairly takes advantage of favorable tax treatment, e.g. in the United States.

The economic policy of the Barack Obama administration, or in its colloquial portmanteau form "Obamanomics", was characterized by moderate tax increases on higher income Americans designed to fund health care reform, reduce the federal budget deficit, and decrease income inequality. President Obama's first term (2009–2013) included measures designed to address the Great Recession and subprime mortgage crisis, which began in 2007. These included a major stimulus package, banking regulation, and comprehensive healthcare reform. As the economy improved and job creation continued during his second term (2013–2017), the Bush tax cuts were allowed to expire for the highest income taxpayers and a spending sequester (cap) was implemented, to further reduce the deficit back to typical historical levels. The number of persons without health insurance was reduced by 20 million, reaching a record low level as a percent of the population. By the end of his second term, the number of persons with jobs, real median household income, stock market, and real household net worth were all at record levels, while the unemployment rate was well below historical average.

Erica C. Payne is an American public policy commentator, author and progressive strategist.

The Buffett Rule is part of a tax plan which would require millionaires and billionaires to pay the same tax rate as middle-class families and working people. It was proposed by President Barack Obama in 2011. The tax plan proposed would apply a minimum tax rate of 30 percent on individuals making more than one million dollars a year. According to a White House official, the new tax rate would directly affect 0.3 percent of taxpayers.

We are the 99% is a political slogan widely used and coined during the 2011 Occupy movement. The phrase directly refers to the income and wealth inequality in the United States, with a concentration of wealth among the top-earning 1%. It reflects the understanding that "the 99%" are paying the price for the mistakes of a tiny minority within the upper class.

Political debates about the United States federal budget discusses some of the more significant U.S. budgetary debates of the 21st century. These include the causes of debt increases, the impact of tax cuts, specific events such as the United States fiscal cliff, the effectiveness of stimulus, and the impact of the Great Recession, among others. The article explains how to analyze the U.S. budget as well as the competing economic schools of thought that support the budgetary positions of the major parties.

The Government Accountability Institute (GAI) is a conservative think tank located in Tallahassee, Florida. GAI was founded in 2012 by Peter Schweizer and Steve Bannon with funding from Robert Mercer and family. Schweizer serves as the group's president.

The economic policy of the Donald Trump administration was characterized by the individual and corporate tax cuts, attempts to repeal the Affordable Care Act ("Obamacare"), trade protectionism, immigration restriction, deregulation focused on the energy and financial sectors, and responses to the COVID-19 pandemic.

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, Pub. L.Tooltip Public Law 115–97 (text)(PDF), is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs Act (TCJA), that amended the Internal Revenue Code of 1986. Major elements of the changes include reducing tax rates for businesses and individuals, increasing the standard deduction and family tax credits, eliminating personal exemptions and making it less beneficial to itemize deductions, limiting deductions for state and local income taxes and property taxes, further limiting the mortgage interest deduction, reducing the alternative minimum tax for individuals and eliminating it for corporations, doubling the estate tax exemption, and reducing the penalty for violating the individual mandate of the Affordable Care Act (ACA) to $0.