Related Research Articles

Daniel Milton Rooney was an American executive and diplomat best known for his association with the Pittsburgh Steelers, an American football team in the National Football League (NFL), and son of the Steelers' founder, Art Rooney. He held various roles within the organization, most notably as president, owner and chairman.

Soros Fund Management, LLC is a privately held American investment management firm. It is currently structured as a family office, but formerly as a hedge fund. The firm was founded in 1970 by George Soros and, in 2010, was reported to be one of the most profitable firms in the hedge fund industry, averaging a 20% annual rate of return over four decades. It is headquartered at 250 West 55th Street in New York. As of 2023, Soros Fund Management, LLC had $25 billion in AUM.

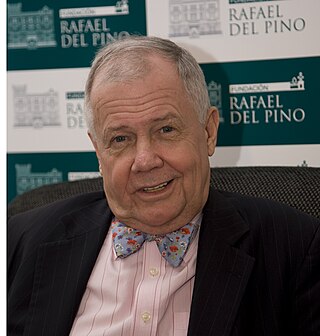

James Beeland Rogers Jr. is an American investor and financial commentator based in Singapore. Rogers is the chairman of Beeland Interests, Inc. He was the co-founder of the Quantum Fund and Soros Fund Management. He was also the creator of the Rogers International Commodities Index (RICI).

Steven A. Cohen is an American hedge-fund manager and owner of the New York Mets of Major League Baseball since September 14, 2020, owning just over 97% of the team. He is the founder of hedge fund Point72 Asset Management and S.A.C. Capital Advisors, which closed after pleading guilty to insider trading and other financial crimes.

Victor Niederhoffer is an American hedge fund manager, champion squash player, bestselling author and statistician.

Paul Tudor Jones II is an American billionaire hedge fund manager, conservationist and philanthropist. In 1980, he founded his hedge fund, Tudor Investment Corporation, an asset management firm headquartered in Stamford, Connecticut. Eight years later, he founded the Robin Hood Foundation, which focuses on poverty reduction. As of April 2022, his net worth was estimated at US$7.3 billion.

Bruce Stanley Kovner is an American billionaire hedge fund manager and philanthropist. He is chairman of CAM Capital, which he established in January 2012 to manage his investment, trading and business activities. From 1983 through 2011, Kovner was founder and chairman of Caxton Associates, a diversified trading company. As of April 2024, his net worth was estimated at US$7.7 billion.

Anne Dias-Griffin is a French-American investor. She is the founder and chief executive officer of Aragon, an investment firm active in global equities, with a focus on the internet, technology, and consumer sectors, as well as alternative assets.

Arthur J. Rooney Athletic Field, commonly known as simply Rooney Field, is a 2,200-seat multi-purpose facility in Pittsburgh, Pennsylvania. Situated on the campus of Duquesne University, Rooney Field is the home field of the Duquesne Dukes football, soccer and lacrosse teams.

Barton Michael Biggs was a money manager whose attention to emerging markets marked him as one of the world's first and foremost global investment strategists, a position he held—after inventing it in 1985—at Morgan Stanley, where he worked as a partner for over 30 years. Following his retirement in 2003, he founded Traxis Partners, a multibillion-dollar hedge fund, based in Greenwich, Connecticut. He is best known for accurately predicting the dot-com bubble in the late 1990s.

George Soros is a Hungarian-American billionaire hedge fund manager and philanthropist. As of October 2023, he had a net worth of US$6.7 billion, having donated more than $32 billion to the Open Society Foundations, of which $15 billion has already been distributed, representing 64% of his original fortune. Forbes called Soros the "most generous giver". He is a resident of New York.

Raymond Thomas Dalio is an American investor and hedge fund manager, who has served as co-chief investment officer of the world's largest hedge fund, Bridgewater Associates, since 1985. He founded Bridgewater in 1975 in New York.

The Rooney family is an Irish-American family known for its connections to the sports, acting, and political fields. After emigrating from Ireland in the 1840s, it established its American roots in Pittsburgh, Pennsylvania in the 1880s.

Farallon Capital Management, L.L.C. is an American multi-strategy hedge fund headquartered in San Francisco, California. Founded by Tom Steyer in 1986, the firm employs approximately 230 professionals in eight countries around the world.

Jacob Ezra Merkin is an American investor, hedge fund manager and philanthropist. He had been a fund manager and capital raiser until 2008 when one of the funds in Gabriel Capital LP, his $5 billion group of hedge funds became insolvent because a large portion of its assets was invested with the convicted Ponzi scheme operator Bernard Madoff. The fallout from his investment with Madoff has been extensive. He navigated a series of lawsuits without a finding of fraud or knowledge of the scheme, but agreed to repay any fees earned from the investment in Madoff historically. He had to resign a series of positions including his role as non-executive chairman of GMAC.

More Money Than God: Hedge Funds and the Making of a New Elite (2010) is a financial book by Sebastian Mallaby published by Penguin Press. Mallaby's work has been published in the Financial Times, The Washington Post, The New York Times, The Wall Street Journal, and the Atlantic Monthly as columnist, editor and editorial board member. He is a senior fellow for international economics at the Council on Foreign Relations (CFR). The book is a history of the hedge fund industry in the United States looking at the people, institutions, investment tools and concepts of hedge funds. It claims to be the "first authoritative history of the hedge fund industry." It is written for a general audience and originally published by Penguin Press. It was nominated for the 2010 Financial Times and Goldman Sachs Business Book of the Year Award and was one of The Wall Street Journal's 10-Best Books of 2010. The Journal said it was "The fullest account we have so far of a too-little-understood business that changed the shape of finance and no doubt will continue to do so."

Scott Bessent is an American investor, philanthropist, and educator. He is the founder of Key Square Group, a global macro investment firm.

James B. Rosenwald III is an American fund manager and academic who was the co-founder and managing partner of Dalton Investments LLC, an asset management company headquartered in Santa Monica, California, and adjunct professor at Stern School of Business at New York University. He invests in the Pacific Rim area. In 2020, Rosenwald co-founded Activist Japan investment trust Nippon Active Value Fund (NAVF) and launched its IPO.

Michael Edward Platt is a British billionaire hedge fund manager. He is the co-founder and managing director of BlueCrest Capital Management, Europe's third-largest hedge-fund firm which he co-founded in 2000. He is Britain's wealthiest hedge fund manager according to the Forbes Real Time Billionaires List, with an estimated wealth of US$15.2 billion.

Jonathan Tivadar Soros is the founder and chief executive officer of JS Capital Management LLC, a private investment firm. Prior to that, Soros worked at Soros Fund Management in daily operations and was co-deputy chairman of the organization.

References

- 1 2 3 4 5 6 Pittsburgh Post-Gazette: "Steelers' suitor Stanley Druckenmiller has always been good at making money" By Bill Toland August 17, 2008]

- ↑ Forbes: The World's Billionaires - Stanley Druckenmiller March 2013

- ↑ Lawrence Delevingne (July 16, 2014). "Druckenmiller: Fed policy 'fraught with unappreciated risk'". CNBC.

- ↑ Maine 04011 © 2021; Orient, The Bowdoin (27 March 2009). "Bowdoin Brief: Druckenmiller '75 earns $260 million in 2008". The Bowdoin Orient. Retrieved 2021-09-09.

{{cite web}}: CS1 maint: numeric names: authors list (link) - ↑ "The Top 5 Forex Traders of All Time". Topforexbrokers.org. 2011-02-16. Retrieved 2012-07-17.

- ↑ Finanzaonline, Redazione (2022-08-17). "Il miliardario Druckenmiller si disfa di altre azioni big tech in attesa recessione, ecco le due big di Wall Street scaricate lo scorso trimestre". FinanzaOnline (in Italian). Retrieved 2022-08-18.

- 1 2 Burton, Katherine (August 18, 2010). "Druckenmiller Calls It Quits After 30 Years as Job Gets Tougher". Bloomberg.

- ↑ Martin, Mitchell (April 29, 2000). "Soros Shuffles Management as Big Funds Struggle". The New York Times.

- ↑ Burton, Katherine; Kishan, Saijel (November 6, 2010). "Duquesne Alumni Said to Start New Hedge Fund With $5 Billion". Bloomberg.

- ↑ "Druckenmiller to Shutter His Hedge Fund". Dealbook. The New York Times . August 18, 2010.

- ↑ "Stanley Druckenmiller Portfolio / Duquesne Family Office LLC Holdings". cheaperthanguru.com. Retrieved 2020-10-12.

- ↑ "Duquesne Family Office LLC - Latest 13F Holdings". Fintel.io. Retrieved March 22, 2019.

- ↑ "Fiona K. Biggs Wed in Nevada". The New York Times , September 4, 1988

- ↑ "Wall Street Titans & Their Warbling Daughters". Billboard. 2014-03-26. Retrieved 2020-07-26.

- ↑ "Sarah Druckenmiller, Maximilian Cascante". The New York Times. 2018-06-24. ISSN 0362-4331 . Retrieved 2020-07-26.

- ↑ "The Fabulous Lives Of Wall Street's Kids". Business Insider. Retrieved 2020-07-26.

- 1 2 Lichtblau, Eric (10 October 2015). "From Fracking to Finance, a Torrent of Campaign Cash". The New York Times . Retrieved 15 October 2015.

- ↑ Barbaro, Michael (2 May 2015). "Christie's Camp Mobilizes to Salvage White House Hopes". The New York Times . Retrieved 15 October 2015.

- ↑ "Druckenmiller Says Inflation Could Reach as High as 10%". www.bloomberg.com. 2020-09-09. Retrieved 2020-09-24.

- ↑ LaRoche, Julia (20 September 2013). "Hedge Funder Stan Druckenmiller Wants Every Young Person In America To See These Charts About How They're Getting Screwed". Business Insider. Retrieved 11 May 2021.

- ↑ Krugman, Paul (24 October 2013). "Addicted to the Apocalypse". NY Times.

- ↑ Di Mento, Maria; Preston, Caroline (February 11, 2010). "A Slow Year for Big Gifts Spurs Wealthy Donors to Creativity". The Chronicle of Philanthropy . XXII (6): 25–26.

- ↑ "Druckenmiller Sends Millions to Children, Robin Hood". Bloomberg.com. 2010-08-30. Retrieved 2023-04-16.

- ↑ "News | Bowdoin College". www.bowdoin.edu. Retrieved 2023-04-16.

- ↑ Friedman, Thomas L (2013-10-15). "Sorry, Kids. We Ate It All". The New York Times . Retrieved 2013-10-16.

- ↑ "45,000 Walkers Raising $6 Million Prove AIDS Walk New York Steps Still Lead the Way" (Press release). AIDS Walk New York. May 20, 2012. Archived from the original on July 2, 2012. Retrieved July 27, 2012.

- ↑ "Stanley F. Druckenmiller Hall". Bowdoin College. Archived from the original on 2012-06-27. Retrieved 2012-07-17.

- ↑ Dulac, Gerry (2008-09-18). "Druckenmiller withdraws name from Steelers sale". Pittsburgh Post-Gazette . Retrieved 2008-09-19.

- ↑ "NFL owners approve altered Steelers ownership". ESPN.com. Dec 17, 2008. Retrieved May 3, 2023.