Antigua and Barbuda is a sovereign island country in the Caribbean. It lies at the conjuncture of the Caribbean Sea and the Atlantic Ocean in the Leeward Islands part of the Lesser Antilles.

The Eastern Caribbean dollar is the currency of all seven full members and one associate member of the Organisation of Eastern Caribbean States (OECS). The successor to the British West Indies dollar, it has existed since 1965, and it is normally abbreviated with the dollar sign $ or, alternatively, EC$ to distinguish it from other dollar-denominated currencies. The EC$ is subdivided into 100 cents. It has been pegged to the United States dollar since 7 July 1976, at the exchange rate of US$1 = EC$2.70.

The Eastern Caribbean Central Bank (ECCB) is a supranational central bank that serves Anguilla, Antigua and Barbuda, Dominica, Grenada, Montserrat, Saint Kitts and Nevis, Saint Lucia, and Saint Vincent and the Grenadines, all members of the Organisation of Eastern Caribbean States (OECS) that use the ECCB-issued Eastern Caribbean Dollar as their currency. The ECCB was established in 1983, succeeding the British Caribbean Currency Board (1950–1965) and the Eastern Caribbean Currency Authority (1965–1983). It is also in charge of bank supervision within its geographical remit.

The Organisation of Eastern Caribbean States is an inter-governmental organisation dedicated to economic harmonisation and integration, protection of human and legal rights, and the encouragement of good governance between countries and territories in the Eastern Caribbean. It also performs the role of spreading responsibility and liability in the event of natural disaster.

Antigua, also known as Waladli or Wadadli by the local population, is an island in the Lesser Antilles. It is one of the Leeward Islands in the Caribbean region and the most populous island of the country of Antigua and Barbuda. Antigua and Barbuda became an independent state within the Commonwealth of Nations on 1 November 1981.

The Eastern Caribbean Securities Exchange (ECSE) is the first regional securities market in the Western Hemisphere and a regional stock exchange, established by the Eastern Caribbean Central Bank (ECCB) to serve the eight member territories of Anguilla, Antigua and Barbuda, Dominica, Grenada, Montserrat, Saint Kitts and Nevis, Saint Lucia, and Saint Vincent and the Grenadines. Its headquarters are located in the city of Basseterre, on the island of St. Kitts.

Robert Allen Stanford is a convicted financial fraudster, former financier, and sponsor of professional sports. He was convicted of fraud in 2012, having operated an eight billion dollar Ponzi scheme, and is now serving a 110-year federal prison sentence.

The National Bank of Dominica Ltd. is a financial services firm in headquartered in Roseau, Dominica. It is the largest financial institution in the Commonwealth of Dominica. The bank was set up in 1978 as a state owned bank and was privatized in 2003. It was named 2022 Bank of the Year by the Eastern Caribbean Central Bank (ECCB).

Pelican Island is a small private island located off the northeast coast of Antigua, at the eastern end of Mercers Creek Bay and immediately to the east of Crump Island.

The economy of Antigua and Barbuda is service-based, with tourism and government services representing the key sources of employment and income. Tourism accounts directly or indirectly for more than half of GDP and is also the principal earner of foreign exchange in Antigua and Barbuda. However, a series of violent hurricanes since 1995 resulted in serious damage to tourist infrastructure and periods of sharp reductions in visitor numbers. In 1999 the budding offshore financial sector was seriously hurt by financial sanctions imposed by the United States and United Kingdom as a result of the loosening of its money-laundering controls. The government has made efforts to comply with international demands in order to get the sanctions lifted. The dual island nation's agricultural production is mainly directed to the domestic market; the sector is constrained by the limited water supply and labor shortages that reflect the pull of higher wages in tourism and construction. Manufacturing comprises enclave-type assembly for export with major products being bedding, handicrafts, and electronic components. Prospects for economic growth in the medium term will continue to depend on income growth in the industrialized world, especially in the US, which accounts for about one-third of all tourist arrivals. Estimated overall economic growth for 2000 was 2.5%. Inflation has trended down going from above 2 percent in the 1995-99 period and estimated at 0 percent in 2000.

The Stanford Financial Group was a privately held international group of financial services companies controlled by Allen Stanford, until it was seized by American authorities in early 2009. Headquartered at 5050 Westheimer in Uptown Houston, Texas, it had 50 offices in several countries, mainly in the Americas, included the Stanford International Bank, and was said to have managed US$8.5 billion of assets for more than 30,000 clients in 136 countries on six continents. On February 17, 2009, U.S. Federal agents placed the company into receivership due to charges of fraud. Ten days later, the U.S. Securities and Exchange Commission amended its complaint to accuse Stanford of turning the company into a "massive Ponzi scheme".

Stanford International Bank was a bank based in the Caribbean, which operated from 1986 to 2009 when it went into receivership. It was an affiliate of the Stanford Financial Group and failed when its parent was seized by United States authorities in early 2009 as part of the investigation into Allen Stanford.

Laura Pendergest-Holt is a convicted Ponzi scheme perpetrator, financier, and former chief investment officer of Stanford Financial Group, who was charged with a civil charge of fraud on February 17, 2009. On May 12, 2009, Pendergest-Holt was indicted by a federal grand jury on two counts of a criminal complaint of obstructing a fraud investigation and conspiracy to obstruct justice. In early 2009, Stanford Financial became the subject of several fraud investigations, and on February 17, 2009, Pendergest-Holt was charged by the U.S. Securities and Exchange Commission with fraud and multiple violations of U.S. securities laws for alleged "massive ongoing fraud" involving $8 billion in certificates of deposit. The FBI raided three of Stanford's offices in Houston, Memphis, and Tupelo, Mississippi. On February 27, 2009, the SEC amended its complaint to describe the alleged fraud as a "massive Ponzi scheme". On June 21, 2012, she pleaded guilty to obstructing a U.S. Securities and Exchange Commission investigation into Stanford International Bank (SIB), the Antiguan offshore bank owned by Robert Allen Stanford. On September 13, 2012, Holt was sentenced to three years in prison, followed by three years of supervised probation. She was released on April 23, 2015.

James M. Davis is the former chief financial officer of Stanford Financial Group. On 27 August 2009 he pleaded guilty to charges of fraud and obstruction of Justice in relation to a $7 billion investment fraud Ponzi scheme allegedly run by the company. On January 22, 2013, Davis was sentenced to five years in jail for his part in the Stanford Financial fraud. He admitted that he was aware of Allen Stanford's misuse of funds and he assisted in keeping the misuse of funds quiet. Davis was also sentenced to three years of supervised release and had a judgment of $1 billion placed against him. He finished serving his sentence at Memphis FCI and was released on July 24, 2017.

David Courtenay Harris was a High Court Judge on the Eastern Caribbean Supreme Court. A native of Dominica, he was assigned to reside in and hear cases from Antigua and Barbuda beginning in 2007. One of the cases he heard involved the Stanford International Bank of R. Allen Stanford. He is a graduate of the University of Windsor in Ontario.

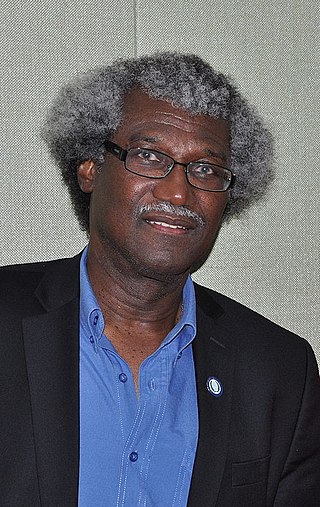

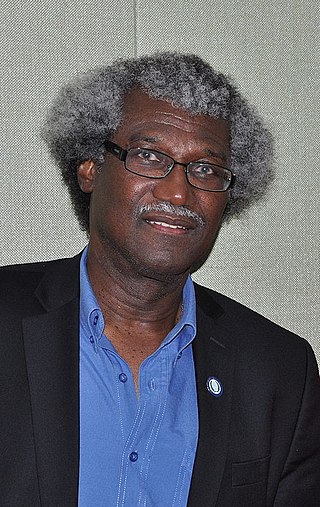

Errol Cort, is a Antigua and Barbuda politician, lawyer and economist. He was Minister of Justice and Legal Affairs and Attorney General of Antigua and Barbuda from 1999 to 2001 and has been involved with successful electoral reforms in the country. He served as Minister of Finance between 2004 and 2009 and is a member of the United Progressive Party (UPP), representing St. John's Rural East. Other ministerial positions held include Industry, Commerce, Customs, Investment, Economic Planning and Development, and Financial Services Regulation, Property Valuation and Tax Compliance.

Sir Kenneth Dwight Vincent Venner, KBE, SLC was the Governor of the Eastern Caribbean Central Bank, a position he held from December 1989 to November 2015. Prior to that, he served as the Director of Finance and Planning in the St Lucian Government between November 1981 and November 1989.

The governor of the Eastern Caribbean Central Bank is the head of the central banking system of the Eastern Caribbean region. To date there have been three governors, with the incumbent Timothy Antoine in office since February 2016.

In June 2009 Antigua and Barbuda became a formal member of the Bolivarian Alliance for the Americas (ALBA) international cooperation organization and the Caribbean oil alliance Petrocaribe. In 2009 Antigua and Barbuda received US$50 million from Venezuela. After American billionaire Allen Stanford's banks failed, Chávez sent financial assistance to Antigua and Barbuda, which was dependent on Stanford's investment when his business empire collapsed.