In economics, utility is a measure of the satisfaction that a certain person has from a certain state of the world. Over time, the term has been used in at least two different meanings.

In mathematics, a quadric or quadric surface (quadric hypersurface in higher dimensions), is a generalization of conic sections (ellipses, parabolas, and hyperbolas). It is a hypersurface (of dimension D) in a (D + 1)-dimensional space, and it is defined as the zero set of an irreducible polynomial of degree two in D + 1 variables; for example, D = 1 in the case of conic sections. When the defining polynomial is not absolutely irreducible, the zero set is generally not considered a quadric, although it is often called a degenerate quadric or a reducible quadric.

In geometry, a normal is an object that is perpendicular to a given object. For example, the normal line to a plane curve at a given point is the line perpendicular to the tangent line to the curve at the point.

In mathematics, a linear form is a linear map from a vector space to its field of scalars.

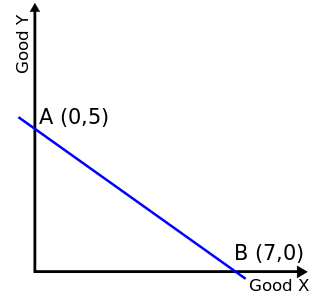

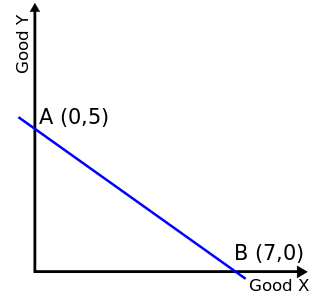

In economics, a budget constraint represents all the combinations of goods and services that a consumer may purchase given current prices within his or her given income. Consumer theory uses the concepts of a budget constraint and a preference map as tools to examine the parameters of consumer choices. Both concepts have a ready graphical representation in the two-good case. The consumer can only purchase as much as their income will allow, hence they are constrained by their budget. The equation of a budget constraint is where is the price of good X, and is the price of good Y, and m is income.

In economics, the marginal rate of substitution (MRS) is the rate at which a consumer can give up some amount of one good in exchange for another good while maintaining the same level of utility. At equilibrium consumption levels, marginal rates of substitution are identical. The marginal rate of substitution is one of the three factors from marginal productivity, the others being marginal rates of transformation and marginal productivity of a factor.

Utility maximization was first developed by utilitarian philosophers Jeremy Bentham and John Stuart Mill. In microeconomics, the utility maximization problem is the problem consumers face: "How should I spend my money in order to maximize my utility?" It is a type of optimal decision problem. It consists of choosing how much of each available good or service to consume, taking into account a constraint on total spending (income), the prices of the goods and their preferences.

In microeconomics, a consumer's Marshallian demand function is the quantity they demand of a particular good as a function of its price, their income, and the prices of other goods, a more technical exposition of the standard demand function. It is a solution to the utility maximization problem of how the consumer can maximize their utility for given income and prices. A synonymous term is uncompensated demand function, because when the price rises the consumer is not compensated with higher nominal income for the fall in their real income, unlike in the Hicksian demand function. Thus the change in quantity demanded is a combination of a substitution effect and a wealth effect. Although Marshallian demand is in the context of partial equilibrium theory, it is sometimes called Walrasian demand as used in general equilibrium theory.

In mathematics, a distinctive feature of algebraic geometry is that some line bundles on a projective variety can be considered "positive", while others are "negative". The most important notion of positivity is that of an ample line bundle, although there are several related classes of line bundles. Roughly speaking, positivity properties of a line bundle are related to having many global sections. Understanding the ample line bundles on a given variety X amounts to understanding the different ways of mapping X into projective space. In view of the correspondence between line bundles and divisors, there is an equivalent notion of an ample divisor.

In mathematical economics, the Arrow–Debreu model is a theoretical general equilibrium model. It posits that under certain economic assumptions there must be a set of prices such that aggregate supplies will equal aggregate demands for every commodity in the economy.

There are two fundamental theorems of welfare economics. The first states that in economic equilibrium, a set of complete markets, with complete information, and in perfect competition, will be Pareto optimal. The requirements for perfect competition are these:

- There are no externalities and each actor has perfect information.

- Firms and consumers take prices as given.

Convex optimization is a subfield of mathematical optimization that studies the problem of minimizing convex functions over convex sets. Many classes of convex optimization problems admit polynomial-time algorithms, whereas mathematical optimization is in general NP-hard.

In microeconomics, a consumer's Hicksian demand function or compensated demand function for a good is their quantity demanded as part of the solution to minimizing their expenditure on all goods while delivering a fixed level of utility. Essentially, a Hicksian demand function shows how an economic agent would react to the change in the price of a good, if the agent's income was compensated to guarantee the agent the same utility previous to the change in the price of the good—the agent will remain on the same indifference curve before and after the change in the price of the good. The function is named after John Hicks.

In mathematics, Farkas' lemma is a solvability theorem for a finite system of linear inequalities. It was originally proven by the Hungarian mathematician Gyula Farkas. Farkas' lemma is the key result underpinning the linear programming duality and has played a central role in the development of mathematical optimization. It is used amongst other things in the proof of the Karush–Kuhn–Tucker theorem in nonlinear programming. Remarkably, in the area of the foundations of quantum theory, the lemma also underlies the complete set of Bell inequalities in the form of necessary and sufficient conditions for the existence of a local hidden-variable theory, given data from any specific set of measurements.

In mathematics, the tautological bundle is a vector bundle occurring over a Grassmannian in a natural tautological way: for a Grassmannian of -dimensional subspaces of , given a point in the Grassmannian corresponding to a -dimensional vector subspace , the fiber over is the subspace itself. In the case of projective space the tautological bundle is known as the tautological line bundle.

Competitive equilibrium is a concept of economic equilibrium, introduced by Kenneth Arrow and Gérard Debreu in 1951, appropriate for the analysis of commodity markets with flexible prices and many traders, and serving as the benchmark of efficiency in economic analysis. It relies crucially on the assumption of a competitive environment where each trader decides upon a quantity that is so small compared to the total quantity traded in the market that their individual transactions have no influence on the prices. Competitive markets are an ideal standard by which other market structures are evaluated.

In economics and consumer theory, quasilinear utility functions are linear in one argument, generally the numeraire. Quasilinear preferences can be represented by the utility function where is strictly concave. A useful property of the quasilinear utility function is that the Marshallian/Walrasian demand for does not depend on wealth and is thus not subject to a wealth effect; The absence of a wealth effect simplifies analysis and makes quasilinear utility functions a common choice for modelling. Furthermore, when utility is quasilinear, compensating variation (CV), equivalent variation (EV), and consumer surplus are algebraically equivalent. In mechanism design, quasilinear utility ensures that agents can compensate each other with side payments.

The concept of a Projective space plays a central role in algebraic geometry. This article aims to define the notion in terms of abstract algebraic geometry and to describe some basic uses of projective spaces.

In theoretical economics, an abstract economy is a model that generalizes both the standard model of an exchange economy in microeconomics, and the standard model of a game in game theory. An equilibrium in an abstract economy generalizes both a Walrasian equilibrium in microeconomics, and a Nash equilibrium in game-theory.

In mathematics, a quadric or quadric hypersurface is the subspace of N-dimensional space defined by a polynomial equation of degree 2 over a field. Quadrics are fundamental examples in algebraic geometry. The theory is simplified by working in projective space rather than affine space. An example is the quadric surface