Related Research Articles

The United States secretary of the treasury is the head of the United States Department of the Treasury, and is the chief financial officer of the federal government of the United States. The secretary of the treasury serves as the principal advisor to the president of the United States on all matters pertaining to economic and fiscal policy. The secretary is, by custom, a member of the president's cabinet and, by law, a member of the National Security Council.

A government bond or sovereign bond is a form of bond issued by a government to support public spending. It generally includes a commitment to pay periodic interest, called coupon payments, and to repay the face value on the maturity date.

A reserve currency is a foreign currency that is held in significant quantities by central banks or other monetary authorities as part of their foreign exchange reserves. The reserve currency can be used in international transactions, international investments and all aspects of the global economy. It is often considered a hard currency or safe-haven currency.

The money market is a component of the economy that provides short-term funds. The money market deals in short-term loans, generally for a period of a year or less.

The Bretton Woods system of monetary management established the rules for commercial relations among the United States, Canada, Western European countries, and Australia as well as 44 other countries after the 1944 Bretton Woods Agreement. The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent states. The Bretton Woods system required countries to guarantee convertibility of their currencies into U.S. dollars to within 1% of fixed parity rates, with the dollar convertible to gold bullion for foreign governments and central banks at US$35 per troy ounce of fine gold. It also envisioned greater cooperation among countries in order to prevent future competitive devaluations, and thus established the International Monetary Fund (IMF) to monitor exchange rates and lend reserve currencies to nations with balance of payments deficits.

The Singapore dollar is the official currency of the Republic of Singapore. It is divided into 100 cents. It is normally abbreviated with the dollar sign $, or S$ to distinguish it from other dollar-denominated currencies. The Monetary Authority of Singapore (MAS) issues the banknotes and coins of the Singapore dollar.

John Harold Williamson was a British-born economist who coined the term Washington Consensus. He served as a senior fellow at the Peterson Institute for International Economics from 1981 until his retirement in 2012. During that time, he was the project director for the United Nations High-Level Panel on Financing for Development in 2001. He was also on leave as chief economist for South Asia at the World Bank during 1996–99, adviser to the International Monetary Fund from 1972 to 1974, and an economic consultant to the UK Treasury from 1968 to 1970. He was also an economics professor at Pontifícia Universidade Católica do Rio de Janeiro (1978–81), University of Warwick (1970–77), Massachusetts Institute of Technology, University of York (1963–68) and Princeton University (1962–63).

The Mexican peso crisis was a currency crisis sparked by the Mexican government's sudden devaluation of the peso against the U.S. dollar in December 1994, which became one of the first international financial crises ignited by capital flight.

Foreign exchange reserves are cash and other reserve assets such as gold and silver held by a central bank or other monetary authority that are primarily available to balance payments of the country, influence the foreign exchange rate of its currency, and to maintain confidence in financial markets. Reserves are held in one or more reserve currencies, nowadays mostly the United States dollar and to a lesser extent the euro.

The Louvre Accord was an agreement, signed on February 22, 1987, in Paris, that aimed to stabilize international currency markets and halt the continued decline of the US dollar after 1985 following the Plaza Accord. It was considered, from a relational international contract viewpoint, as a rational compromise solution between two ideal-type extremes of international monetary regimes: the perfectly flexible and the perfectly fixed exchange rates.

The United States Gold Reserve Act of January 30, 1934 required that all gold and gold certificates held by the Federal Reserve be surrendered and vested in the sole title of the United States Department of the Treasury. It also prohibited the Treasury and financial institutions from redeeming dollar bills for gold, established the Exchange Stabilization Fund under control of the Treasury to control the dollar's value without the assistance of the Federal Reserve, and authorized the president to establish the gold value of the dollar by proclamation.

The Exchange Stabilization Fund (ESF) is an emergency reserve fund of the United States Treasury Department, normally used for foreign exchange intervention. This arrangement allows the US government to influence currency exchange rates without directly affecting domestic money supply.

The history of the United States dollar began with moves by the Founding Fathers of the United States of America to establish a national currency based on the Spanish silver dollar, which had been in use in the North American colonies of the Kingdom of Great Britain for over 100 years prior to the United States Declaration of Independence. The new Congress's Coinage Act of 1792 established the United States dollar as the country's standard unit of money, creating the United States Mint tasked with producing and circulating coinage. Initially defined under a bimetallic standard in terms of a fixed quantity of silver or gold, it formally adopted the gold standard in 1900, and finally eliminated all links to gold in 1971.

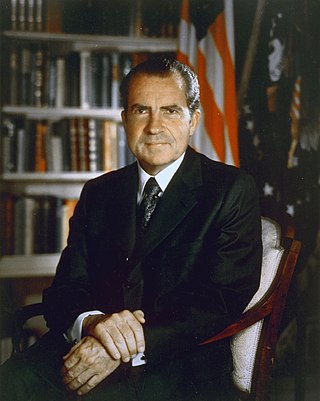

The Nixon shock refers to the effect of a series of economic measures, including wage and price freezes, surcharges on imports, and the unilateral cancellation of the direct international convertibility of the United States dollar to gold, taken by United States President Richard Nixon in 1971 in response to increasing inflation.

Fractional currency, also referred to as shinplasters, was introduced by the United States federal government following the outbreak of the Civil War. These low-denomination banknotes of the United States dollar were in use between 21 August 1862 and 15 February 1876, and issued in denominations of 3, 5, 10, 15, 25, and 50 cents across five issuing periods. The complete type set below is part of the National Numismatic Collection, housed at the National Museum of American History, part of the Smithsonian Institution.

The Stabilization fund of the Russian Federation was a sovereign wealth fund established based on a resolution of the Government of Russia on 1 January 2004, as a part of the federal budget to balance the federal budget at the time of when oil price falls below a cut-off price, currently set at US$27 per barrel.

The United States dollar is the official currency of the United States and several other countries. The Coinage Act of 1792 introduced the U.S. dollar at par with the Spanish silver dollar, divided it into 100 cents, and authorized the minting of coins denominated in dollars and cents. U.S. banknotes are issued in the form of Federal Reserve Notes, popularly called greenbacks due to their predominantly green color.

The subprime mortgage crisis reached a critical stage during the first week of September 2008, characterized by severely contracted liquidity in the global credit markets and insolvency threats to investment banks and other institutions.

The Mexican Debt Disclosure Act is a law of the United States formulating congressional oversight and monetary policy, through reports of the US president and the US treasury, to support the strength of the 1995 peso currency of Mexico; all resulting from speculative capital flight and the Mexican peso crisis of 1994. The Act required the submission of monthly reports by the United States Secretary of the Treasury concerning all international guarantees, long-term, and short-term currency swaps with the federal government of Mexico. The U.S. Congressional bill required the submission of semi-annual reports by the President of the United States concerning presidential certifications of all international credits, currency swaps, guarantees, and loans through the exchange stabilization fund to the government of Mexico.

Archie Lochhead was the first Director of the Exchange Stabilization Fund, Technical Assistant to Secretary of the Treasury Henry Morgenthau Jr. under the Franklin D. Roosevelt administration, and President of the Universal Trading Corporation. He also served as monetary advisor to the Chinese Ministry of Finance, and was awarded the Grand Cordon of the Order of Brilliant Star by the Chinese Nationalist government "in recognition of his meritorious services."

References

- ↑ "Exchange Stabilization Fund History". U.S. Department of Treasury. 25 January 2024.