Related Research Articles

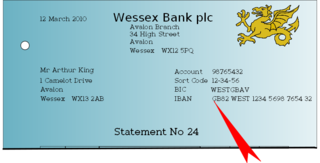

The International Bank Account Number (IBAN) is an internationally agreed upon system of identifying bank accounts across national borders to facilitate the communication and processing of cross border transactions with a reduced risk of transcription errors. An IBAN uniquely identifies the account of a customer at a financial institution. It was originally adopted by the European Committee for Banking Standards (ECBS) and since 1997 as the international standard ISO 13616 under the International Organization for Standardization (ISO). The current version is ISO 13616:2020, which indicates the Society for Worldwide Interbank Financial Telecommunication (SWIFT) as the formal registrar. Initially developed to facilitate payments within the European Union, it has been implemented by most European countries and numerous countries in other parts of the world, mainly in the Middle East and the Caribbean. As of July 2023, 86 countries were using the IBAN numbering system.

The Society for Worldwide Interbank Financial Telecommunication (Swift), legally S.W.I.F.T. SC, is a Belgian banking cooperative providing services related to the execution of financial transactions and payments between certain banks worldwide. Its principal function is to serve as the main messaging network through which international payments are initiated. It also sells software and services to financial institutions, mostly for use on its proprietary "SWIFTNet", and assigns ISO 9362 Business Identifier Codes (BICs), popularly known as "Swift codes".

ISO 9362 is an international standard for Business Identifier Codes (BIC), a unique identifier for business institutions, approved by the International Organization for Standardization (ISO). BIC is also known as SWIFT-BIC, SWIFT ID, or SWIFT code, after the Society for Worldwide Interbank Financial Telecommunication (SWIFT), which is designated by ISO as the BIC registration authority. BIC was defined originally as Bank Identifier Code and is most often assigned to financial organizations; when it is assigned to non-financial organization, the code may also be known as Business Entity Identifier (BEI). These codes are used when transferring money between banks, particularly for international wire transfers, and also for the exchange of other messages between banks. The codes can sometimes be found on account statements.

In the United States, an ABA routing transit number is a nine-digit code printed on the bottom of checks to identify the financial institution on which it was drawn. The American Bankers Association (ABA) developed the system in 1910 to facilitate the sorting, bundling, and delivering of paper checks to the drawer's bank for debit to the drawer's account.

The Financial Information eXchange (FIX) protocol is an electronic communications protocol initiated in 1992 for international real-time exchange of information related to securities transactions and markets. With trillions of dollars traded annually on the NASDAQ alone, financial service entities are employing direct market access (DMA) to increase their speed to financial markets. Managing the delivery of trading applications and keeping latency low increasingly requires an understanding of the FIX protocol.

An invoice, bill or tab is a commercial document issued by a seller to a buyer relating to a sale transaction and indicating the products, quantities, and agreed-upon prices for products or services the seller had provided the buyer.

Wire transfer, bank transfer, or credit transfer, is a method of electronic funds transfer from one person or entity to another. A wire transfer can be made from one bank account to another bank account, or through a transfer of cash at a cash office.

ISO 15022 is an ISO standard for securities messaging used in transactions between financial institutions. Participants in the financial industry need a common representation of the financial transactions they perform and this standard defines general message schema, which in turn are used by organizations to define messages in a complete and unambiguous way. This results in efficiency, lower costs, and the avoidance of errors. Prior to standardization in this area, there were overlapping standards, or ad hoc approaches where there was a functional gap and no standard.

The Australian financial system consists of the arrangements covering the borrowing and lending of funds and the transfer of ownership of financial claims in Australia, comprising:

A Bank State Branch is the name used in Australia for a bank code, which is a branch identifier. The BSB is normally used in association with the account number system used by each financial institution. The structure of the BSB + account number does not permit for account numbers to be transferable between financial institutions. While similar in structure, the New Zealand and Australian systems are only used in domestic transactions and are incompatible with each other. For international transfers, a SWIFT code is used in addition to the BSB and account number.

ISO 8583 is an international standard for financial transaction card originated interchange messaging. It is the International Organization for Standardization standard for systems that exchange electronic transactions initiated by cardholders using payment cards.

A bank code is a code assigned by a central bank, a bank supervisory body or a Bankers Association in a country to all its licensed member banks or financial institutions. The rules vary to a great extent between the countries. Also the name of bank codes varies. In some countries the bank codes can be viewed over the internet, but mostly in the local language.

Sort codes are the domestic bank codes used to route money transfers between financial institutions in the United Kingdom, and in the Republic of Ireland. They are six-digit hierarchical numerical addresses that specify clearing banks, clearing systems, regions, large financial institutions, groups of financial institutions and ultimately resolve to individual branches. In the UK they continue to be used to route transactions domestically within clearance organizations and to identify accounts, while in the Republic of Ireland they have been deprecated and replaced by the SEPA systems and infrastructure.

In Germany and Austria, the Bankleitzahl (BLZ) is a code that uniquely identifies a bank. The bank code always consists of eight digits in Germany and five digits in Austria. In Switzerland and Liechtenstein, the bank clearing number has the same meaning. The bank sort code must be specified for many business transactions in payment transactions.

The Industry Sorting Code Directory (ISCD) is the definitive list of bank branches and sub branches in the United Kingdom. The directory is maintained by VocaLink on behalf of UK Payments Administration.

A payment card number, primary account number (PAN), or simply a card number, is the card identifier found on payment cards, such as credit cards and debit cards, as well as stored-value cards, gift cards and other similar cards. In some situations the card number is referred to as a bank card number. The card number is primarily a card identifier and may not directly identify the bank account number/s to which the card is/are linked by the issuing entity. The card number prefix identifies the issuer of the card, and the digits that follow are used by the issuing entity to identify the cardholder as a customer and which is then associated by the issuing entity with the customer's designated bank accounts. In the case of stored-value type cards, the association with a particular customer is only made if the prepaid card is reloadable. Card numbers are allocated in accordance with ISO/IEC 7812. The card number is typically embossed on the front of a payment card, and is encoded on the magnetic stripe and chip, but may also be imprinted on the back of the card.

SWIFT message types are the format or schema used to send messages to financial institutions on the SWIFT network. The original message types were developed by SWIFT and a subset was retrospectively made into an ISO standard, ISO 15022. In many instances, SWIFT message types between custodians follow the ISO standard. This was later supplemented by a XML based version under ISO 20022.

The International Bank of Azerbaijan-Georgia is a subsidiary bank of the International Bank of Azerbaijan located in Tbilisi, Georgia, founded in 2007. It is one of three Azerbaijani banks operating in Georgia. The bank is a member of the Association of Banks of Georgia.

The Cross-Border Interbank Payment System (CIPS) is a Chinese payment system that offers clearing and settlement services for its participants in cross-border renminbi (RMB) payments and trade. Backed by the People's Bank of China (PBOC), China launched the CIPS in 2015 to internationalize RMB use. CIPS also counts several foreign banks as shareholders, including HSBC, Standard Chartered, the Bank of East Asia, DBS Bank, Citi, Australia and New Zealand Banking Group, and BNP Paribas.

MT202 COV is a specific SWIFT message type used on the SWIFT network for financial institution (FI) funds transfer between financial institutions.

References

- ↑ "SWIFT Message Type Reference". SWIFT Integration Projects. Oracle. Retrieved 2016-04-29.