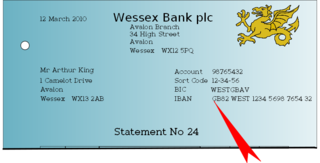

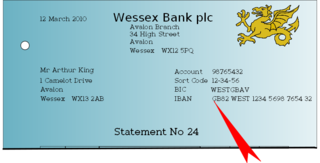

The International Bank Account Number (IBAN) is an internationally agreed upon system of identifying bank accounts across national borders to facilitate the communication and processing of cross border transactions with a reduced risk of transcription errors. An IBAN uniquely identifies the account of a customer at a financial institution. It was originally adopted by the European Committee for Banking Standards (ECBS) and since 1997 as the international standard ISO 13616 under the International Organization for Standardization (ISO). The current version is ISO 13616:2020, which indicates the Society for Worldwide Interbank Financial Telecommunication (SWIFT) as the formal registrar. Initially developed to facilitate payments within the European Union, it has been implemented by most European countries and numerous countries in other parts of the world, mainly in the Middle East and the Caribbean. As of July 2023, 86 countries were using the IBAN numbering system.

ISO 4217 is a standard published by the International Organization for Standardization (ISO) that defines alpha codes and numeric codes for the representation of currencies and provides information about the relationships between individual currencies and their minor units. This data is published in three tables:

The Society for Worldwide Interbank Financial Telecommunication (Swift), legally S.W.I.F.T. SC, is a Belgian banking cooperative providing services related to the execution of financial transactions and payments between certain banks worldwide. Its principal function is to serve as the main messaging network through which international payments are initiated. It also sells software and services to financial institutions, mostly for use on its proprietary "SWIFTNet", and assigns ISO 9362 Business Identifier Codes (BICs), popularly known as "Swift codes".

A bank account is a financial account maintained by a bank or other financial institution in which the financial transactions between the bank and a customer are recorded. Each financial institution sets the terms and conditions for each type of account it offers, which are classified in commonly understood types, such as deposit accounts, credit card accounts, current accounts, loan accounts or many other types of account. A customer may have more than one account. Once an account is opened, funds entrusted by the customer to the financial institution on deposit are recorded in the account designated by the customer. Funds can be withdrawn from loan loaders.

In the United States, an ABA routing transit number is a nine-digit code printed on the bottom of checks to identify the financial institution on which it was drawn. The American Bankers Association (ABA) developed the system in 1910 to facilitate the sorting, bundling, and delivering of paper checks to the drawer's bank for debit to the drawer's account.

Wire transfer, bank transfer, or credit transfer, is a method of electronic funds transfer from one person or entity to another. A wire transfer can be made from one bank account to another bank account, or through a transfer of cash at a cash office.

A Bank State Branch is the name used in Australia for a bank code, which is a branch identifier. The BSB is normally used in association with the account number system used by each financial institution. The structure of the BSB + account number does not permit for account numbers to be transferable between financial institutions. While similar in structure, the New Zealand and Australian systems are only used in domestic transactions and are incompatible with each other. For international transfers, a SWIFT code is used in addition to the BSB and account number.

A bank code is a code assigned by a central bank, a bank supervisory body or a Bankers Association in a country to all its licensed member banks or financial institutions. The rules vary to a great extent between the countries. Also the name of bank codes varies. In some countries the bank codes can be viewed over the internet, but mostly in the local language.

Sort codes are the domestic bank codes used to route money transfers between financial institutions in the United Kingdom, and in the Republic of Ireland. They are six-digit hierarchical numerical addresses that specify clearing banks, clearing systems, regions, large financial institutions, groups of financial institutions and ultimately resolve to individual branches. In the UK they continue to be used to route transactions domestically within clearance organizations and to identify accounts, while in the Republic of Ireland they have been deprecated and replaced by the SEPA systems and infrastructure.

Electronic funds transfer (EFT) is the electronic transfer of money from one bank account to another, either within a single financial institution or across multiple institutions, via computer-based systems, without the direct intervention of bank staff.

The Clearing House Interbank Payments System (CHIPS) is a United States private clearing house for large-value transactions. As of 2023, it settles approximately 500,000 payments totaling US$1.7 trillion per day. Together with the Federal Reserve Banks' Fedwire Funds Service, CHIPS forms the primary U.S. network for large-value domestic and international USD payments where it has a market share of around 96%. CHIPS transfers are governed by Article 4A of Uniform Commercial Code.

In Germany and Austria, the Bankleitzahl (BLZ) is a code that uniquely identifies a bank. The bank code always consists of eight digits in Germany and five digits in Austria. In Switzerland and Liechtenstein, the bank clearing number has the same meaning. The bank sort code must be specified for many business transactions in payment transactions.

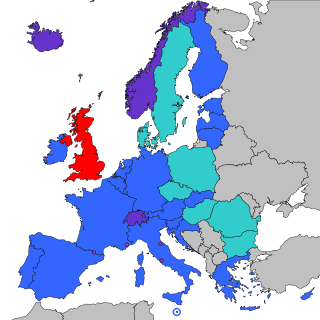

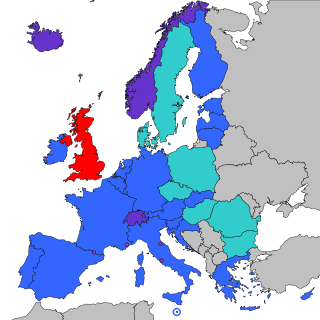

The Single Euro Payments Area (SEPA) is a payment integration initiative of the European Union for simplification of bank transfers denominated in euro. As of 2020, there were 36 members in SEPA, consisting of the 27 member states of the European Union, the four member states of the European Free Trade Association, and the United Kingdom. Some microstates participate in the technical schemes: Andorra, Monaco, San Marino, and Vatican City.

A payment card number, primary account number (PAN), or simply a card number, is the card identifier found on payment cards, such as credit cards and debit cards, as well as stored-value cards, gift cards and other similar cards. In some situations the card number is referred to as a bank card number. The card number is primarily a card identifier and may not directly identify the bank account number/s to which the card is/are linked by the issuing entity. The card number prefix identifies the issuer of the card, and the digits that follow are used by the issuing entity to identify the cardholder as a customer and which is then associated by the issuing entity with the customer's designated bank accounts. In the case of stored-value type cards, the association with a particular customer is only made if the prepaid card is reloadable. Card numbers are allocated in accordance with ISO/IEC 7812. The card number is typically embossed on the front of a payment card, and is encoded on the magnetic stripe and chip, but may also be imprinted on the back of the card.

SWIFT message types are the format or schema used to send messages to financial institutions on the SWIFT network. The original message types were developed by SWIFT and a subset was retrospectively made into an ISO standard, ISO 15022. In many instances, SWIFT message types between custodians follow the ISO standard. This was later supplemented by a XML based version under ISO 20022.

New Zealand bank account numbers in NZD follow a standardised format of 16 digits:

MT103 is a specific SWIFT message type/format used on the Society for Worldwide Interbank Financial Telecommunication (SWIFT) payment system to send for cross border/international wire transfer messages between financial institutions for customer cash transfers.

Payments as a service (PaaS) is a marketing phrase used to describe a software as a service to connect a group of international payment systems. The architecture is represented by a layer – or overlay – that resides on top of these disparate systems and provides for two-way communications between the payment system and the PaaS. Communication is governed by standard APIs created by the PaaS provider.

The International Bank of Azerbaijan-Georgia is a subsidiary bank of the International Bank of Azerbaijan located in Tbilisi, Georgia, founded in 2007. It is one of three Azerbaijani banks operating in Georgia. The bank is a member of the Association of Banks of Georgia.

The Cross-Border Interbank Payment System (CIPS) is a Chinese payment system that offers clearing and settlement services for its participants in cross-border renminbi (RMB) payments and trade. Backed by the People's Bank of China (PBOC), China launched the CIPS in 2015 to internationalize RMB use. CIPS also counts several foreign banks as shareholders, including HSBC, Standard Chartered, the Bank of East Asia, DBS Bank, Citi, Australia and New Zealand Banking Group, and BNP Paribas.