Ballot Measure 5 was a landmark piece of direct legislation in the U.S. state of Oregon in 1990. Measure 5, an amendment to the Oregon Constitution, established limits on Oregon's property taxes on real estate. Its primary champion and spokesman was Don McIntire, a politically-active Gresham health club owner who would go on to lead the Taxpayers Association of Oregon.

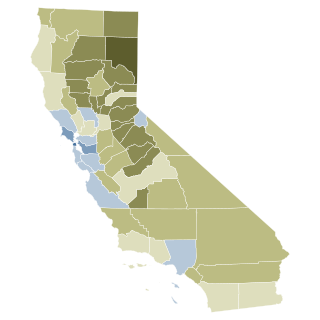

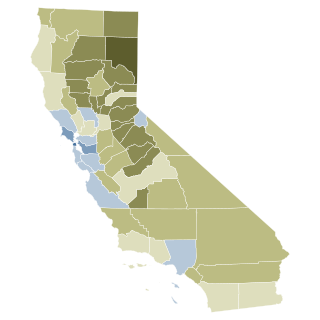

Proposition 13 is an amendment of the Constitution of California enacted during 1978, by means of the initiative process. The initiative was approved by California voters on June 6, 1978 by a nearly two to one margin. It was upheld as constitutional by the United States Supreme Court in the case of Nordlinger v. Hahn, 505 U.S. 1 (1992). Proposition 13 is embodied in Article XIII A of the Constitution of the State of California.

Ballot Measure 47 was an initiative in the U.S. state of Oregon that passed in 1996, affecting the assessment of property taxes and instituting a double majority provision for tax legislation. Measure 50 was a revised version of the law, which also passed, after being referred to the voters by the 1997 state legislature.

Bill Sizemore is an American political activist and writer in Redmond, Oregon, United States. Sizemore has never held elected office, but has nonetheless been a major political figure in Oregon since the 1990s. He is considered one of the main proponents of the Oregon tax revolt, a movement that seeks to reduce taxes in the state. Oregon Taxpayers United, a political action committee he founded in 1993, has advanced numerous ballot initiatives limiting taxation, and has opposed spending initiatives. Sizemore made an unsuccessful run for Governor of Oregon in 1998. He also announced his intention to run for governor in 2010, but was indicted by the state on charges of tax evasion. The charges were later amended to failure to file tax returns.

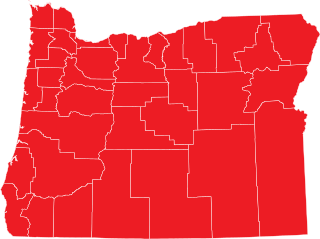

Oregon ballot measure 48 was one of two unsuccessful ballot measures sponsored by the Taxpayers Association of Oregon (TAO) on the November 7, 2006 general election ballot. Measure 48 was an initiated constitutional amendment ballot measure. Oregon statute currently limits state appropriations to 8% of projected personal income in Oregon. If Governor declares emergency, legislature may exceed current statutory appropriations limit by 60% vote of each house. This measure would have added a constitutional provision limiting any increase in state spending from one biennium to next biennium to the percentage increase in state population, plus inflation, over previous two years. Certain exceptions to limit, including spending of: federal, donated funds; proceeds from selling certain bonds, real property; money to fund emergency funds; money to fund tax, "kicker," other refunds were included in the provisions of the measure. It also would have provided that spending limit may be exceeded by amount approved by two-thirds of each house of legislature and approved by majority of voters voting in general election.

The Oregon tax rebate, commonly referred to as the kicker, is a rebate calculated for both individual and corporate taxpayers in the U.S. state of Oregon when a revenue surplus exists. The Oregon Constitution mandates that the rebate be issued when the calculated revenue for a given biennium exceeds the forecast revenue by at least two percent. The law was first enacted by ballot measure in 1980, and was entered into the Oregon Constitution with the enactment of Ballot Measure 86 in 2000.

The State Income Tax Repeal, also known as Massachusetts Question 1, was one of the 2008 ballot measures that appeared on the November 4, 2008 ballot in the U.S. state of Massachusetts. Voters were asked whether or not they approved of the proposed measure which, if it had passed, would have ended the 5.3% income tax in Massachusetts on wages, interest, dividends and capital gains. Ultimately, Massachusetts voters defeated Question 1 by a wide margin, with approximately 70% opposed versus 30% in favor.

The 75th Oregon Legislative Assembly convened beginning on January 12, 2009, for its biennial regular session. All of the 60 seats in the House of Representatives and half of the 30 seats in the State Senate were up for election in 2008; the general election for those seats took place on November 4.

Oregon Ballot Measure 64 was an initiated state statute ballot measure on the November 4, 2008 general election ballot in Oregon.

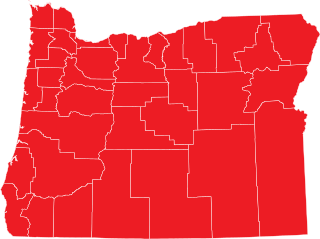

Oregon Ballot Measure 58 was an initiated state statute ballot measure sponsored by Bill Sizemore that appeared on the November 4, 2008 general election ballot in Oregon. It was rejected by voters.

Oregon Ballot Measure 59 was an initiated state statute ballot measure sponsored by Bill Sizemore that appeared on the November 4, 2008 general election ballot in Oregon, United States. If it had passed, Oregon would have join Alabama, Iowa, and Louisiana as the only states to allow federal income taxes to be fully deducted on state income tax returns.

Oregon Ballot Measure 60 was an initiated state statute ballot measure filed by Bill Sizemore and R. Russell Walker. Sizemore referred to it the "Kids First Act." The measure appeared on the November 4, 2008 general election ballot in Oregon.

Loren Ernest Parks was an American businessman from the state of Nevada. He previously lived in Oregon, from 1957 to 2002, and was the biggest political contributor in the history of that state. He financed numerous ballot measure initiative petitions and campaigns from the mid-1990s. He also contributed heavily to races for prominent offices by his attorney, Kevin Mannix, a frequent chief petitioner of ballot campaigns.

Oregon ballot measure 41 was one of two unsuccessful ballot measures sponsored by the Taxpayers Association of Oregon (TAO) on the November 7, 2006 general election ballot. If passed it would have allowed a state income tax deduction equal to Federal exemptions deduction to substitute for state exemption credit on a person's state income tax filing.

Oregon Ballot Measure 56 or House Joint Resolution 15 is a legislatively referred constitutional amendment that enacted law which provides that property tax elections decided at May and November elections will be decided by a majority of voters who are voting in the relevant election. It repealed the double majority requirement passed by the voters in the 1990s via Measures 47 and 50, which requires that, for non-general elections, all bond measures can pass only when a majority of registered voters turn out.

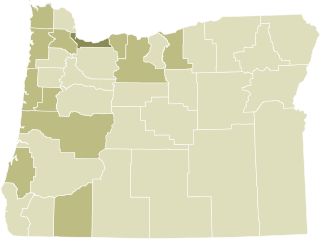

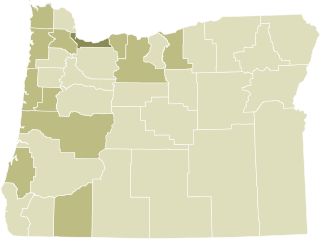

Measures 66 and 67 are two ballot referendums that were on the January 26, 2010 special election ballot in the US state of Oregon, which proposed tax increases on corporations and on households making US$250,000 and individuals making $125,000 to help balance the state's budget. The measures referred two bills passed by the Oregon state legislature on June 11, 2009, and signed by Governor Ted Kulongoski on July 20, 2009, to the voters for approval. They were approved and became effective February 25, 2010.

Massachusetts Question 3, filed under the name, the 3 percent Sales Tax Relief Act, appears on the November 2, 2010 ballot in the state of Massachusetts as an initiative. The measure, if enacted by voters, would reduce the state sales tax rate from 6.25 to 3 percent. The measure is being sponsored by the Alliance to Roll Back Taxes headed by Carla Howell. The measure would be enacted into a law 30 days after the election if approved by voters.

Proposition 13 was a failed California ballot proposition on the March 3, 2020, ballot that would have authorized the issuance of $15 billion in bonds to finance capital improvements for public and charter schools statewide. The proposition would have also raised the borrowing limit for some school districts and eliminated school impact fees for multifamily housing near transit stations.

California Proposition 19 (2020), also referred to as Assembly Constitutional Amendment No. 11, is an amendment of the Constitution of California that was narrowly approved by voters in the general election on November 3, 2020, with just over 51% of the vote. The legislation increases the property tax burden on owners of inherited property to provide expanded property tax benefits to homeowners ages 55 years and older, disabled homeowners, and victims of natural disasters, and fund wildfire response. According to the California Legislative Analyst, Proposition 19 is a large net tax increase "of hundreds of millions of dollars per year."