The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agencies. The terms "national deficit" and "national surplus" usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:

The military budget of the United States is the largest portion of the discretionary federal budget allocated to the Department of Defense (DoD), or more broadly, the portion of the budget that goes to any military-related expenditures. The military budget pays the salaries, training, and health care of uniformed and civilian personnel, maintains arms, equipment and facilities, funds operations, and develops and buys new items. The budget funds six branches of the US military: the Army, Navy, Marine Corps, Coast Guard, Air Force, and Space Force.

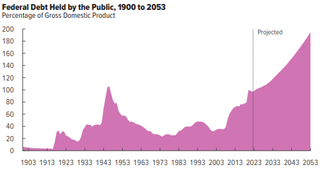

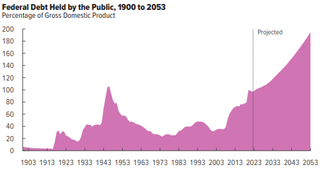

The United States budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. CBO estimated in February 2024 that Federal debt held by the public is projected to rise from 99 percent of GDP in 2024 to 116 percent in 2034 and would continue to grow if current laws generally remained unchanged. Over that period, the growth of interest costs and mandatory spending outpaces the growth of revenues and the economy, driving up debt. Those factors persist beyond 2034, pushing federal debt higher still, to 172 percent of GDP in 2054.

The New Zealand budget for fiscal year 2006–2007 was presented to the New Zealand House of Representatives by Finance Minister Dr Michael Cullen on 18 May 2006.

The history of the United States public debt began with federal government debt incurred during the American Revolutionary War by the first U.S treasurer, Michael Hillegas, after the country's formation in 1776. The United States has continuously experienced fluctuating public debt, except for about a year during 1835–1836. To facilitate comparisons over time, public debt is often expressed as a ratio to gross domestic product (GDP). Historically, the United States public debt as a share of GDP has increased during wars and recessions, and subsequently declined.

Canadian public debt, or general government debt, is the liabilities of the government sector. Government gross debt consists of liabilities that are a financial claim that requires payment of interest and/or principal in future. They consist mainly of Treasury bonds, but also include public service employee pension liabilities. Changes in debt arise primarily from new borrowing, due to government expenditures exceeding revenues.

The 2011 United States federal budget was the budget to fund government operations for the fiscal year 2011. The budget was the subject of a spending request by President Barack Obama. The actual appropriations for Fiscal Year 2011 had to be authorized by the Congress before they could take effect, according to the U.S. budget process.

The 2012 United States federal budget was the budget to fund government operations for the fiscal year 2012, which lasted from October 1, 2011, through September 30, 2012. The original spending request was issued by President Barack Obama in February 2011. That April, the Republican-held House of Representatives announced a competing plan, The Path to Prosperity, emboldened by a major victory in the 2010 Congressional elections associated with the Tea Party movement. The budget plans were both intended to focus on deficit reduction, but differed in their changes to taxation, entitlement programs, defense spending, and research funding.

The New Zealand budget for fiscal year 2012–2013 was presented to the New Zealand House of Representatives by Finance Minister Bill English on 24 May 2012.

The New Zealand budget for fiscal year 2013/14 was presented to the New Zealand House of Representatives by Finance Minister Bill English on 16 May 2013. This was the fifth budget English has presented as Minister of Finance.

This article details the fourteen austerity packages passed by the Government of Greece between 2010 and 2017. These austerity measures were a result of the Greek government-debt crisis and other economic factors. All of the legislation listed remains in force.

The New Zealand budget for fiscal year 2010-2011 was presented to the New Zealand House of Representatives by Finance Minister Bill English on 20 May 2010.

The New Zealand budget for fiscal year 2009-2010 was presented to the New Zealand House of Representatives by Finance Minister Bill English on 28 May 2009.

The New Zealand Budget is an annual statement by the New Zealand Government that outlines of the nation's revenues and expenditures for the preceding fiscal year and expectations for the next one. It is prepared by the New Zealand Treasury for the Minister of Finance. The Budget is usually presented to the House of Representatives in May.

The New Zealand budget for fiscal year 2016/17 was presented to the New Zealand House of Representatives by Finance Minister Bill English on 26 May 2016. It was the eighth budget English has presented as Minister of Finance, and the eighth budget of the Fifth National Government.

The Canadian federal budget for fiscal year 2019–20 was presented to the House of Commons by Finance Minister Bill Morneau on March 19, 2019. This was the last budget before the 2019 federal election. The deficit is projected to rise to $19.8 billion, after including a $3 billion adjustment for risk. The budget introduced $22.8 billion of new spending over six years. The budget will not make any changes to the income tax brackets for individuals or corporations. This was later refined to $39.4 billion when the Annual Financial Report of the Government of Canada for Fiscal Year 2019–2020 was released.

The 2019 Alberta budget, known as the A plan for jobs and the economy, is the budget for the province of Alberta for fiscal year 2019 - 2020. It was presented to the Legislative Assembly of Alberta on October 24, 2019 by Travis Toews, the Minister of Finance of Alberta of the Government of Alberta.

The Canadian federal budget for the fiscal years of 2020–21 and 2021–22 was presented to the House of Commons by finance minister Chrystia Freeland on 19 April 2021. The Canadian government did not produce a budget in 2020 due to the COVID-19 pandemic. Instead, the government produced a series of economic updates and stimulus plans throughout the year.

Budget 2022, dubbed the Wellbeing Budget 2022, is the New Zealand budget for fiscal year 2022/23, presented to the House of Representatives by Finance Minister, Grant Robertson, on 19 May 2022 as the fifth budget presented by the Sixth Labour Government. This budget was released in the midst of socio-economic impacts of the widespread community transmission of the SARS-CoV-2 Omicron variant, rising living costs, and the 2022 Russian invasion of Ukraine.

The 2023 New Zealand mini-budget, also known as Mini Budget 2023, was released by Minister of Finance Nicola Willis on 20 December 2023 as part of the Sixth National Government's plan to address the cost of living, deliver income tax relief, and reduce the tax burden. The Government's mini-budget delivered NZ$7.47 billion in operational savings by repealing or stopping 15 programmes launched by the previous Labour Government including 20 hours of free child care for two-year olds, eliminating depreciation for commercial buildings and dissolving the Climate Emergency Response Fund.