The economy of New Zealand is a highly developed free-market economy. It is the 52nd-largest national economy in the world when measured by nominal gross domestic product (GDP) and the 63rd-largest in the world when measured by purchasing power parity (PPP). New Zealand has one of the most globalised economies and depends greatly on international trade, mainly with China, Australia, the European Union, the United States, Japan and Korea. New Zealand's 1983 Closer Economic Relations agreement with Australia means that the economy aligns closely with that of Australia. Among OECD nations, New Zealand has a highly efficient and strong social security system; social expenditure stood at roughly 19.4% of GDP.

Australia is a highly developed country with a mixed economy. As of 2023, Australia was the 14th-largest national economy by nominal GDP, the 19th-largest by PPP-adjusted GDP, and was the 21st-largest goods exporter and 24th-largest goods importer. Australia took the record for the longest run of uninterrupted GDP growth in the developed world with the March 2017 financial quarter. It was the 103rd quarter and the 26th year since the country had a technical recession. As of June 2021, the country's GDP was estimated at $1.98 trillion.

The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agencies. The terms "national deficit" and "national surplus" usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:

The minister of Finance, originally known as colonial treasurer, is a minister and the head of the New Zealand Treasury, responsible for producing an annual New Zealand budget outlining the government's proposed expenditure. The position is often considered to be the most important cabinet post after that of the prime minister.

Sir Roger Owen Douglas is a retired New Zealand politician, economist and accountant who served as a minister in two Labour governments. He is most recognised for his key involvement in New Zealand's radical economic restructuring in the 1980s, when the Fourth Labour Government's economic policy became known as "Rogernomics", which implemented neoliberal economic policies.

Sir Michael John Cullen was a New Zealand politician. He was a Member of the New Zealand House of Representatives from 1981 to 2009, the Deputy Leader of the New Zealand Labour Party from 1996 to 2008 and a senior minister in the Fifth Labour Government from 1999 to 2008, serving as Deputy Prime Minister, Minister of Finance, and Attorney-General.

David Francis Caygill is a former New Zealand politician. He was born and raised in Christchurch. He entered politics in 1971 as Christchurch's youngest city councillor at the age of 22. He served as a Member of Parliament (MP) from 1978 to 1996, representing the Labour Party. A supporter of Rogernomics, he served as Minister of Finance between 1988 and 1990. From 2010 to 2019, he was one of the government-appointed commissioners at Environment Canterbury.

The New Zealand Treasury is the central public service department of New Zealand charged with advising the Government on economic policy, assisting with improving the performance of New Zealand's economy, and managing financial resources. The Minister responsible for the Treasury is the Minister of Finance of New Zealand; however, from 1996 to 2002, there existed a more specific position of Treasurer of New Zealand. The role was created for Winston Peters by the Fourth National Government under Jim Bolger after the 1996 election, and abolished by Helen Clark’s government in 2002.

The New Zealand budget for fiscal year 2006–2007 was presented to the New Zealand House of Representatives by Finance Minister Dr Michael Cullen on 18 May 2006.

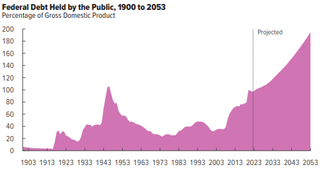

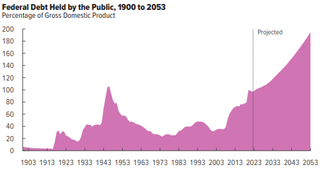

The history of the United States public debt began with federal government debt incurred during the American Revolutionary War by the first U.S treasurer, Michael Hillegas, after the country's formation in 1776. The United States has continuously experienced fluctuating public debt, except for about a year during 1835–1836. To facilitate comparisons over time, public debt is often expressed as a ratio to gross domestic product (GDP). Historically, the United States public debt as a share of GDP has increased during wars and recessions, and subsequently declined.

The 2008 New Zealand general election was held on 8 November 2008 to determine the composition of the 49th New Zealand Parliament. The liberal-conservative National Party, headed by its parliamentary leader John Key, won the largest share of votes and seats, ending nine years of government by the social-democratic Labour Party, led by Helen Clark. Key announced a week later that he would lead a National minority government with confidence-and-supply support from the ACT, United Future and Māori parties. The Governor-General swore Key in as New Zealand's 38th Prime Minister on 19 November 2008. This marked the beginning of the Fifth National Government which governed for the next nine years, until the 2017 general election, when a government was formed between the Labour and New Zealand First parties, with support on confidence and supply by the Green Party.

The Fifth Labour Government of New Zealand was the government of New Zealand from 10 December 1999 to 19 November 2008. Labour Party leader Helen Clark negotiated a coalition with Jim Anderton, leader of the Alliance Party. While undertaking a number of substantial reforms, it was not particularly radical compared to previous Labour governments.

The post-2008 Irish economic downturn in the Republic of Ireland, coincided with a series of banking scandals, followed the 1990s and 2000s Celtic Tiger period of rapid real economic growth fuelled by foreign direct investment, a subsequent property bubble which rendered the real economy uncompetitive, and an expansion in bank lending in the early 2000s. An initial slowdown in economic growth amid the international 2007–2008 financial crisis greatly intensified in late 2008 and the country fell into recession for the first time since the 1980s. Emigration, as well as unemployment, escalated to levels not seen since that decade.

Greece faced a sovereign debt crisis in the aftermath of the 2007–2008 financial crisis. Widely known in the country as The Crisis, it reached the populace as a series of sudden reforms and austerity measures that led to impoverishment and loss of income and property, as well as a humanitarian crisis. In all, the Greek economy suffered the longest recession of any advanced mixed economy to date and became the first developed country whose stock market was downgraded to that of an emerging market in 2013. As a result, the Greek political system was upended, social exclusion increased, and hundreds of thousands of well-educated Greeks left the country.

The history of the United States debt ceiling deals with movements in the United States debt ceiling since it was created in 1917. Management of the United States public debt is an important part of the macroeconomics of the United States economy and finance system, and the debt ceiling is a limitation on the federal government's ability to manage the economy and finance system. The debt ceiling is also a limitation on the federal government's ability to finance government operations, and the failure of Congress to authorize an increase in the debt ceiling has resulted in crises, especially in recent years.

The early 1990s recession saw a period of economic downturn affect much of the world in the late 1980s and early 1990s. The economy of Australia suffered its worst recession since the Great Depression.

The New Zealand budget for fiscal year 2014/15 was presented to the New Zealand House of Representatives by Finance Minister Bill English on 15 May 2014. This was the sixth budget English has presented as Minister of Finance.

The New Zealand budget for fiscal year 2009-2010 was presented to the New Zealand House of Representatives by Finance Minister Bill English on 28 May 2009.

The New Zealand budget for fiscal year 2007-2008 was presented to the New Zealand House of Representatives by Finance Minister Dr Michael Cullen on 17 May 2007.

The Crown Retail Deposit Guarantee Scheme was an opt-in deposit insurance scheme, established under the Public Finance Act 1989 in New Zealand during the Great Recession, 2008 to 2011. Dr Michael Cullen, Finance Minister at the time of the scheme's introduction said, "The deposit guarantee is designed to give assurance to New Zealand depositors. The New Zealand banking system remains sound. We want to ensure that ordinary New Zealanders feel that their deposits are safe in the current uncertain international financial market conditions."