The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agencies. The terms "national deficit" and "national surplus" usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:

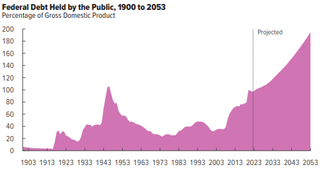

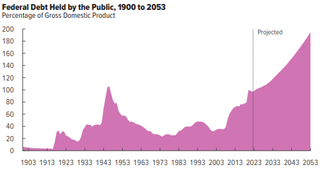

The United States budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. CBO estimated in February 2024 that Federal debt held by the public is projected to rise from 99 percent of GDP in 2024 to 116 percent in 2034 and would continue to grow if current laws generally remained unchanged. Over that period, the growth of interest costs and mandatory spending outpaces the growth of revenues and the economy, driving up debt. Those factors persist beyond 2034, pushing federal debt higher still, to 172 percent of GDP in 2054.

The New Zealand budget for fiscal year 2006–2007 was presented to the New Zealand House of Representatives by Finance Minister Dr Michael Cullen on 18 May 2006.

The history of the United States public debt began with federal government debt incurred during the American Revolutionary War by the first U.S treasurer, Michael Hillegas, after the country's formation in 1776. The United States has continuously experienced fluctuating public debt, except for about a year during 1835–1836. To facilitate comparisons over time, public debt is often expressed as a ratio to gross domestic product (GDP). Historically, the United States public debt as a share of GDP has increased during wars and recessions, and subsequently declined.

The economic policy and legacy of the George W. Bush administration was characterized by significant income tax cuts in 2001 and 2003, the implementation of Medicare Part D in 2003, increased military spending for two wars, a housing bubble that contributed to the subprime mortgage crisis of 2007–2008, and the Great Recession that followed. Economic performance during the period was adversely affected by two recessions, in 2001 and 2007–2009.

Beginning in 2008, many nations of the world enacted fiscal stimulus plans in response to the Great Recession. These nations used different combinations of government spending and tax cuts to boost their sagging economies. Most of these plans were based on the Keynesian theory that deficit spending by governments can replace some of the demand lost during a recession and prevent the waste of economic resources idled by a lack of demand. The International Monetary Fund recommended that countries implement fiscal stimulus measures equal to 2% of their GDP to help offset the global contraction. In subsequent years, fiscal consolidation measures were implemented by some countries in an effort to reduce debt and deficit levels while at the same time stimulating economic recovery.

The June 2010 United Kingdom Budget, officially also known as Responsibility, freedom, fairness: a five-year plan to re-build the economy, was delivered by George Osborne, Chancellor of the Exchequer, to the House of Commons in his budget speech that commenced at 12.33pm on Tuesday, 22 June 2010. It was the first budget of the Conservative-Liberal Democrat coalition formed after the general election of May 2010. The government dubbed it an "emergency budget", and stated that its purpose was to reduce the national debt accumulated under the Labour government.

The 2011 United Kingdom budget, officially called 2011 Budget – A strong and stable economy, growth and fairness, was delivered by George Osborne, the Chancellor of the Exchequer, to the House of Commons on 23 March 2011.

The 2012 United States federal budget was the budget to fund government operations for the fiscal year 2012, which lasted from October 1, 2011, through September 30, 2012. The original spending request was issued by President Barack Obama in February 2011. That April, the Republican-held House of Representatives announced a competing plan, The Path to Prosperity, emboldened by a major victory in the 2010 Congressional elections associated with the Tea Party movement. The budget plans were both intended to focus on deficit reduction, but differed in their changes to taxation, entitlement programs, defense spending, and research funding.

In 2011, ongoing political debate in the United States Congress about the appropriate level of government spending and its effect on the national debt and deficit reached a crisis centered on raising the debt ceiling, leading to the passage of the Budget Control Act of 2011.

Political debates about the United States federal budget discusses some of the more significant U.S. budgetary debates of the 21st century. These include the causes of debt increases, the impact of tax cuts, specific events such as the United States fiscal cliff, the effectiveness of stimulus, and the impact of the Great Recession, among others. The article explains how to analyze the U.S. budget as well as the competing economic schools of thought that support the budgetary positions of the major parties.

Deficit reduction in the United States refers to taxation, spending, and economic policy debates and proposals designed to reduce the federal government budget deficit. Government agencies including the Government Accountability Office (GAO), Congressional Budget Office (CBO), the Office of Management and Budget (OMB), and the U.S. Treasury Department have reported that the federal government is facing a series of important long-run financing challenges, mainly driven by an aging population, rising healthcare costs per person, and rising interest payments on the national debt.

The New Zealand budget for fiscal year 2012–2013 was presented to the New Zealand House of Representatives by Finance Minister Bill English on 24 May 2012.

The Ontario government debt consists of the liabilities of the Government of Ontario. Approximately 82% of Ontario's debt is in the form of debt securities, while other liabilities include government employee pension plan obligations, loans, and accounts payable. The Ontario Financing Authority, which manages the provinces' debt, says that as of March 31, 2020, the Ontario government's net debt is CDN $353.3 billion. Net debt is projected to rise to $398 billion in 2020-21. The Debt-to-GDP ratio for 2019-2020 was 39.7%, and is projected to rise to 47.1% in 2020-21. Interest on the debt in 2019-20 was CDN$12.5 billion, representing 8.0% of Ontario's revenue and its fourth-largest spending area.

This article details the fourteen austerity packages passed by the Government of Greece between 2010 and 2017. These austerity measures were a result of the Greek government-debt crisis and other economic factors. All of the legislation listed remains in force.

The New Zealand budget for fiscal year 2010-2011 was presented to the New Zealand House of Representatives by Finance Minister Bill English on 20 May 2010.

The New Zealand budget for fiscal year 2011-2012 was presented to the New Zealand House of Representatives by Finance Minister Bill English on 19 May 2011.

The New Zealand budget for fiscal year 2008-2009 was presented to the New Zealand House of Representatives by Finance Minister Dr Michael Cullen on 22 May 2008.

The 2019 Alberta budget, known as the A plan for jobs and the economy, is the budget for the province of Alberta for fiscal year 2019 - 2020. It was presented to the Legislative Assembly of Alberta on October 24, 2019 by Travis Toews, the Minister of Finance of Alberta of the Government of Alberta.

The Canadian federal budget for fiscal year 1997–98 was presented by Minister of Finance Paul Martin in the House of Commons of Canada on 18 February 1997. It is the last budget of the 35th Canadian Parliament and the last budget before the 1997 Canadian federal election. The budget's unofficial subtitle is Building the Future for Canadians.