Related Research Articles

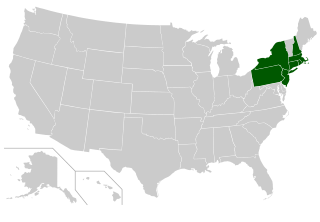

The Ivy League is an American collegiate athletic conference of eight private research universities in the Northeastern United States. It participates in the National Collegiate Athletic Association (NCAA) Division I, and in football, in the Football Championship Subdivision (FCS). The term Ivy League is used more broadly to refer to the eight schools that belong to the league, which are globally renowned as elite colleges associated with academic excellence, highly selective admissions, and social elitism. The term was used as early as 1933, and it became official in 1954 following the formation of the Ivy League athletic conference. At times, they have also been referred to as the "Ancient Eight".

The Massachusetts Institute of Technology (MIT) is a private research university in Cambridge, Massachusetts, United States. Established in 1861, MIT has played a significant role in the development of many areas of modern technology and science.

In the United States, antitrust law is a collection of mostly federal laws that govern the conduct and organization of businesses in order to promote economic competition and prevent unjustified monopolies. The three main U.S. antitrust statutes are the Sherman Act of 1890, the Clayton Act of 1914, and the Federal Trade Commission Act of 1914. These acts serve three major functions. First, Section 1 of the Sherman Act prohibits price fixing and the operation of cartels, and prohibits other collusive practices that unreasonably restrain trade. Second, Section 7 of the Clayton Act restricts the mergers and acquisitions of organizations that may substantially lessen competition or tend to create a monopoly. Third, Section 2 of the Sherman Act prohibits monopolization.

Price fixing is an anticompetitive agreement between participants on the same side in a market to buy or sell a product, service, or commodity only at a fixed price, or maintain the market conditions such that the price is maintained at a given level by controlling supply and demand.

Robert Cox Merton is an American economist, Nobel Memorial Prize in Economic Sciences laureate, and professor at the MIT Sloan School of Management, known for his pioneering contributions to continuous-time finance, especially the first continuous-time option pricing model, the Black–Scholes–Merton model. In 1997 Merton together with Myron Scholes were awarded the Bank of Sweden Prize in Economic Sciences in Memory of Alfred Nobel for the method to determine the value of derivatives.

The National Association of Realtors (NAR) is an American trade association for those who work in the real estate industry. As of December 2023, it had over 1.5 million members, making it the largest trade association in the United States including NAR's institutes, societies, and councils, involved in all aspects of the residential and commercial real estate industries. The organization holds a U.S. trademark over the term "Realtor". NAR also functions as a self-regulatory organization for real estate brokerage. The organization is headquartered in Chicago.

University of Phoenix (UoPX) is a private for-profit university headquartered in Phoenix, Arizona. Founded in 1976, the university confers certificates and degrees at the certificate, associate, bachelor's, master's, and doctoral degree levels. It is institutionally accredited by the Higher Learning Commission and has an open enrollment admissions policy for many undergraduate programs. The school is owned by Apollo Global Management and Vistria Group.

Student financial aid in the United States is funding that is available exclusively to students attending a post-secondary educational institution in the United States. This funding is used to assist in covering the many costs incurred in pursuing post-secondary education. Financial aid is available from federal and state governments, educational institutions, and private organizations. It can be awarded through grants, loans, work-study, and scholarships. To apply for federal financial aid, students must first complete the Free Application for Federal Student Aid (FAFSA).

Need-blind admission in the United States refers to a college admission policy that does not take into account an applicant's financial status when deciding whether to accept them. This approach typically results in a higher percentage of accepted students who require financial assistance and requires the institution to have a substantial endowment or other funding sources to support the policy. Institutions that participated in an antitrust exemption granted by Congress were required by law to be need-blind until September 30, 2022.

The Higher Education Act of 1965 (HEA) was legislation signed into United States law on November 8, 1965, as part of President Lyndon Johnson's Great Society domestic agenda. Johnson chose Texas State University, his alma mater, as the signing site. The law was intended "to strengthen the educational resources of our colleges and universities and to provide financial assistance for students in postsecondary and higher education". It increased federal money given to universities, created scholarships, gave low-interest loans for students, and established a National Teachers Corps. The "financial assistance for students" is covered in Title IV of the HEA.

An interchange fee is a fee paid between banks for the acceptance of card-based transactions. Usually for sales/services transactions it is a fee that a merchant's bank pays a customer's bank.

Christine A. Varney is an American antitrust attorney who served as the U.S. assistant attorney general of the Antitrust Division for the Obama administration and as a Federal Trade commissioner in the Clinton administration. Since August 2011, Varney has been a partner of the New York law firm Cravath, Swaine & Moore, where she chairs the antitrust department.

The lysine price-fixing conspiracy was an organized effort during the mid-1990s to raise the price of the animal feed additive lysine. It involved five companies that had commercialized high-tech fermentation technologies, including Archer Daniels Midland (ADM), Ajinomoto, Kyowa Hakko Kogyo, Sewon America Inc. and Cheil Jedang Ltd. A criminal investigation resulted in fines and three-year prison sentences for three executives of ADM who colluded with the other companies to fix prices. The other four companies settled with the United States Department of Justice Antitrust Division in September through December 1996. Each firm and four executives from the Asian firms pleaded guilty as part of a plea bargain to aid in further investigation against ADM. The cartel had been able to raise lysine prices 70% within their first nine months of cooperation.

Hagens Berman is a law firm headquartered in Seattle, Washington. As of 2022, it had about 80 lawyers. Hagens Berman is a plaintiff's law firm, especially known for large class-action lawsuits. The firm was founded in 1993 by Steve Berman and Carl Hagens in order to pursue a case against Jack in the Box that was turned down by the law firm at which they worked. A few years later the firm represented 13 out of 46 U.S. states involved in litigation against tobacco companies. Subsequently, Hagens Berman took on a number of class-action cases against large car manufacturers, oil businesses, and others. Hagens Berman has been involved in municipal climate change litigation, suing oil companies on behalf of cities. The firm has been subject to an ethics investigation and sanction over its handling of thalidomide litigation involving alleged birth defects.

David Sparks Evans is an American economist specializing in antitrust and two-sided markets. He is the chairman of Global Economics, Inc., and founding editor of Competition Policy International. He teaches at the University College London, where he is the co-executive director of the Jevons Institute for Competition Law and Economics, and at the University of Chicago Law School.

Denise Louise Cote is a senior United States district judge of the United States District Court for the Southern District of New York.

Broadcast Music Inc. v. Columbia Broadcasting System Inc., 441 U.S. 1 (1979), was an important antitrust case decided by the Supreme Court of the United States. It examined a complaint brought by CBS affiliates that the method in which broadcast companies determine fees for the issuance of blanket licenses was a violation of the Sherman Antitrust Act. The Supreme Court ruled that the issuance of blanket licenses was not a violation of the act, holding that the nature of blanket licenses did not arise to price fixing.

Larry Eugene Fondren is an American entrepreneur, inventor and credit markets expert noted for his efforts to bring transparency and higher yields to the bond market and for improving access within financial markets.

Chicago Clearing Corporation (CCC) is a securities class action settlement claim filing service based in Chicago, Illinois. Started in 1993 to buy and sell coupons issued at the end of class action settlements, the company now employs more than 20 staff members. CCC has over 1000 clients that include bank trust departments, hedge funds, mutual funds, registered investment advisers, professional traders, and insurance companies. This client base has approximately $2 trillion in AUM and more than 2,000,000 individual accounts.

RealPage, Inc. is an American property management software company, owned by the private equity firm Thoma Bravo, and known for its algorithmic rent setting, which has been accused of antitrust violations and price fixing. Its services are used to manage more than 24 million housing units worldwide in multifamily, commercial, single-family, and vacation rentals.

References

- ↑ "History of the 568 Presidents' Group". 568 Group. Archived from the original on 21 November 2008. Retrieved 16 December 2008.

- ↑ "Website". 568 Group. Archived from the original on 7 January 2023. Retrieved 24 March 2023.

- ↑ Li, Joanna (September 19, 2022). "Class (action) not dismissed: Fight to dissolve 568 Presidents Group continues". The Georgetown Voice. Archived from the original on 24 March 2023. Retrieved March 24, 2022.

- ↑ Johnston, David (August 10, 1989). "Price-Fixing Inquiry at 20 Elite Colleges". The New York Times. Archived from the original on 2012-11-09. Retrieved 2008-12-16.

- ↑ Chira, Susan (March 13, 1991). "23 College Won't Pool Discal Data". The New York Times. Archived from the original on 2012-11-09. Retrieved 2008-12-16.

- ↑ DePalma, Anthony (May 23, 1991). "Ivy Universities Deny Price-Fixing But Agree to Avoid It in the Future". The New York Times. Archived from the original on 2010-09-06. Retrieved 2008-12-16.

- ↑ DePalma, Anthony (September 2, 1992). "MIT Ruled Guilty in Anti-Trust Case". The New York Times. Archived from the original on 2012-11-07. Retrieved 2008-07-16.

- ↑ DePalma, Anthony (June 26, 1992). "Price-Fixing or Charity? Trial of M.I.T. Begins". The New York Times. Archived from the original on 2012-11-09. Retrieved 2008-08-13.

- ↑ "Settlement allows cooperation on awarding financial-aid". MIT Tech Talk. 1994. Archived from the original on 2008-06-30. Retrieved 2007-03-03.

- ↑ Honan, William (December 21, 1993). "MIT Suit Over Aid May Be Settled". The New York Times. Archived from the original on 2011-02-09. Retrieved 2008-07-16.

- ↑ "568 Group Member Institutions". 568 Presidents' Group. 2022. Archived from the original on 2 June 2022. Retrieved 2 August 2022.

- ↑ "568 Group Member Institutions". 568 Presidents' Group. 2015. Archived from the original on 30 October 2014. Retrieved 24 June 2015.

- ↑ "568 Cartel Lawsuit". Freedman, Normand and Friedland; Gilbert Litigators & Counselors; Berger Montague. Retrieved March 3, 2023.

- ↑ Williams, Stephen. "Judge approves $284M settlement with plaintiffs for 10 of 17 universities sued for alleged price fixing". WHYY. WHYY. Retrieved 30 July 2024.

- 1 2 Moody, Josh. "Johns Hopkins, Caltech Settle in Antitrust Lawsuit". Inside Higher Ed. Retrieved 2025-01-21.

- ↑ Levine, Jesse. "Court approves Columbia settlement for $24 million in class action financial aid lawsuit". Columbia Spectator. Retrieved 6 August 2024.