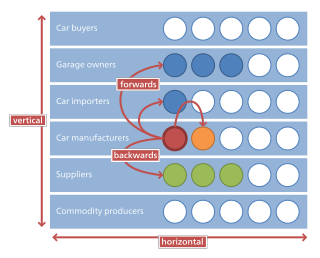

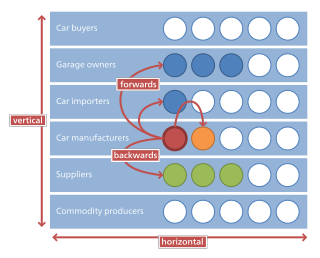

Horizontal integration is the process of a company increasing production of goods or services at the same level of the value chain, in the same industry. A company may do this via internal expansion or through mergers and acquisitions.

In the field of management, strategic management involves the formulation and implementation of the major goals and initiatives taken by an organization's managers on behalf of stakeholders, based on consideration of resources and an assessment of the internal and external environments in which the organization operates. Strategic management provides overall direction to an enterprise and involves specifying the organization's objectives, developing policies and plans to achieve those objectives, and then allocating resources to implement the plans. Academics and practicing managers have developed numerous models and frameworks to assist in strategic decision-making in the context of complex environments and competitive dynamics. Strategic management is not static in nature; the models can include a feedback loop to monitor execution and to inform the next round of planning.

Marketing management is the strategic organizational discipline that focuses on the practical application of marketing orientation, techniques and methods inside enterprises and organizations and on the management of marketing resources and activities. Compare marketology, which Aghazadeh defines in terms of "recognizing, generating and disseminating market insight to ensure better market-related decisions".

In business, a competitive advantage is an attribute that allows an organization to outperform its competitors.

Competitive analysis in marketing and strategic management is an assessment of the strengths and weaknesses of current and potential competitors. This analysis provides both an offensive and defensive strategic context to identify opportunities and threats. Profiling combines all of the relevant sources of competitor analysis into one framework in the support of efficient and effective strategy formulation, implementation, monitoring and adjustment.

Porter's Five Forces Framework is a method of analysing the competitive environment of a business. It draws from industrial organization (IO) economics to derive five forces that determine the competitive intensity and, therefore, the attractiveness of an industry in terms of its profitability. An "unattractive" industry is one in which the effect of these five forces reduces overall profitability. The most unattractive industry would be one approaching "pure competition", in which available profits for all firms are driven to normal profit levels. The five-forces perspective is associated with its originator, Michael E. Porter of Harvard University. This framework was first published in Harvard Business Review in 1979.

SWOT analysis is a strategic planning and strategic management technique used to help a person or organization identify Strengths, Weaknesses, Opportunities, and Threats related to business competition or project planning. It is sometimes called situational assessment or situational analysis. Additional acronyms using the same components include TOWS and WOTS-UP.

Marketing strategy refers to efforts undertaken by an organization to increase its sales and achieve competitive advantage.

Business strategies can be categorized in many ways. One popular method uses the typology put forward by American academics Raymond E. Miles and Charles C. Snow in their 1978 book, Organizational Strategy, Structure, and Process.

Market penetration refers to the successful selling of a good or service in a specific market. It involves using tactics that increase the growth of an existing product in an existing market. It is measured by the amount of sales volume of an existing good or service compared to the total target market for that product or service. Market penetration is the key for a business growth strategy stemming from the Ansoff Matrix (Richardson, M., & Evans, C.. H. Igor Ansoff first devised and published the Ansoff Matrix in the Harvard Business Review in 1957, within an article titled "Strategies for Diversification". The grid/matrix is utilized across businesses to help evaluate and determine the next stages the company must take in order to grow and the risks associated with the chosen strategy. With numerous options available, this matrix helps narrow down the best fit for an organization.

The growth–share matrix is a chart created in a collaborative effort by BCG employees: Alan Zakon first sketched it and then, together with his colleagues, refined it. BCG's founder Bruce D. Henderson popularized the concept in an essay titled "The Product Portfolio" in BCG's publication Perspectives in 1970. The purpose of this matrix is to help corporations to analyze their business units, that is, their product lines. This helps the company allocate resources and is used as an analytical tool in brand marketing, product management, strategic management, and portfolio analysis.

An advertising campaign is a series of advertisement messages that share a single idea and theme which make up an integrated marketing communication (IMC). An IMC is a platform in which a group of people can group their ideas, beliefs, and concepts into one large media base. Advertising campaigns utilize diverse media channels over a particular time frame and target identified audiences.

Organic business growth is related to the growth of natural systems and organisms, societies and economies, as a dynamic organizational process, that for business expansion is marked by increased output, customer base expansion, or new product development, as opposed to mergers and acquisitions, which is inorganic growth.

A strategic business unit (SBU) in business strategic management, is a profit center which focuses on product offering and market segment. SBUs typically have a discrete marketing plan, analysis of competition, and marketing campaign, even though they may be part of a larger business entity.

Marketing intelligence (MI) is the everyday information relevant to a company's markets, gathered and analyzed specifically for the purpose of accurate and confident decision-making in determining market opportunity, market penetration strategy, and market development metrics. Marketing intelligence is necessary when entering a foreign market.

Market development is a growth strategy that identifies and develops new market segments for current products. It involves marketing existing products in new markets. A development strategy targets non-buying customers in currently targeted segments. It also targets new customers in new segments. A market development strategy entails expanding the potential market through new users or new uses. New users can be defined as new geographic segments, new demographic segments, new institutional segments or new psychographic segments. Another way is to expand sales through new uses for the product.

Diversification is a corporate strategy to enter into or start new products or product lines, new services or new markets, involving substantially different skills, technology and knowledge.

The following outline is provided as an overview of and topical guide to marketing:

Product strategy defines the high-level plan for developing and marketing a product, how the product supports the business strategy and goals, and is brought to life through product roadmaps. A product strategy describes a vision of the future with this product, the ideal customer profile and market to serve, go-to-market and positioning (marketing), thematic areas of investment, and measures of success. A product strategy sets the direction for new product development. Companies utilize the product strategy in strategic planning and marketing to set the direction of the company's activities. The product strategy is composed of a variety of sequential processes in order for the vision to be effectively achieved. The strategy must be clear in terms of the target customer and market of the product in order to plan the roadmap needed to achieve strategic goals and give customers better value.

Top-line growth is the increase in revenue or gross sales by a company over a defined period and is used to indicate the financial strength of a business and its potential for growth in the future. It is usually measured over periods of one-half or full years and is often reported as a percentage growth compared to the previous year or period. Top-line growth does not accrue across periods, instead it is recalculated based on the performance of the business in a specified reporting period. It is a gross figure that represents economic inflows to the company, prior to the deduction of expenses or changes in equity contributed by the business owners or the investors. Top-line growth is often used as a metric for business growth potential and overall operating performance. In most businesses, it forms an integral part of their strategic planning and a means of assessments for such strategies.