A capital market is a financial market in which long-term debt or equity-backed securities are bought and sold. Capital markets channel the wealth of savers to those who can put it to long-term productive use, such as companies or governments making long-term investments. Financial regulators like the Bank of England (BoE) and the U.S. Securities and Exchange Commission (SEC) oversee capital markets to protect investors against fraud, among other duties.

A government bond or sovereign bond is a bond issued by a national government, generally with a promise to pay periodic interest payments and to repay the face value on the maturity date. Government bonds are usually denominated in the country's own currency, in which case the government cannot be forced to default, although it may choose to do so. If a government is close to default on its debt the media often refer to this as a sovereign debt crisis.

A municipal bond, commonly known as a Muni Bond, is a bond issued by a local government or territory, or one of their agencies. It is generally used to finance public projects such as roads, schools, airports and seaports, and infrastructure-related repairs. The term municipal bond is commonly used in the United States, which has the largest market of such trade-able securities in the world. As of 2011, the municipal bond market was valued at $3.7 trillion. Potential issuers of municipal bonds include states, cities, counties, redevelopment agencies, special-purpose districts, school districts, public utility districts, publicly owned airports and seaports, and other governmental entities at or below the state level having more than a de minimis amount of one of the three sovereign powers: the power of taxation, the power of eminent domain or the police power.

A United States Treasury security is a government debt instrument issued by the United States Department of the Treasury to finance government spending as an alternative to taxation. Treasury securities are often referred to simply as Treasuries. Since 2012 the management of government debt has been arranged by the Bureau of the Fiscal Service, succeeding the Bureau of the Public Debt.

Fixed income refers to any type of investment under which the borrower or issuer is obliged to make payments of a fixed amount on a fixed schedule. For example, the borrower may have to pay interest at a fixed rate once a year, and to repay the principal amount on maturity. Fixed-income securities can be contrasted with equity securities – often referred to as stocks and shares – that create no obligation to pay dividends or any other form of income.

Daily inflation-indexed bonds are bonds where the principal is indexed to inflation or deflation on a daily basis in terms of the official Daily CPI or monetized daily indexed unit of account like the Unidad de Fomento in Chile and the Real Value unit of Colombia. They are thus designed to hedge the inflation risk of a bond. The first known inflation-indexed bond was issued by the Massachusetts Bay Company in 1780. The market has grown dramatically since the British government began issuing inflation-linked Gilts in 1981. As of 2008, government-issued inflation-linked bonds comprise over $1.5 trillion of the international debt market. The inflation-linked market primarily consists of sovereign bonds, with privately issued inflation-linked bonds constituting a small portion of the market.

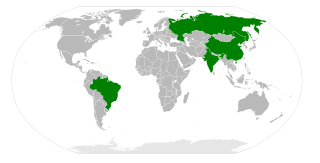

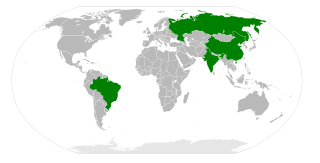

In economics, BRIC is a grouping acronym that refers to the countries of Brazil, Russia, India and China, which are all deemed to be at a similar stage of newly advanced economic development. It is typically rendered as "the BRICs" or "the BRIC countries" or "the BRIC economies" or alternatively as the "Big Four". A related acronym, BRICS, adds South Africa. There are arguments that Indonesia should be included into grouping, effectively turning it into BRIIC or BRIICS.

The bond market is a financial market where participants can issue new debt, known as the primary market, or buy and sell debt securities, known as the secondary market. This is usually in the form of bonds, but it may include notes, bills, and so on.

ArirangTV is a global, English-language television network based in Seoul, South Korea.The service is aimed at the overseas market, similar to DD India, WION, BBC World News, DW, France 24 and RT.It is operated by the Korea International Broadcasting Foundation and is financially supported by the Ministry of Culture, Sports and Tourism. The channel, which airs in 105 countries, is considered a public relations arm of the South Korean government.

Korea Exchange (KRX) is the sole securities exchange operator in South Korea. It is headquartered in Busan, and has an office for cash markets and market oversight in Seoul.

In investment, the bond credit rating represents the credit worthiness of corporate or government bonds. It is not the same as individual's credit score. The ratings are published by credit rating agencies and used by investment professionals to assess the likelihood the debt will be repaid.

Arirang-1 or Arirang I is an unmanned artificial satellite created by the Korea Aerospace Research Institute and launched by a US rocket on December 21, 1999. This was the first satellite built primarily by South Korean engineers, although previous foreign-built satellites had been launched by Korean companies. It carries a surveillance camera able to distinguish objects with a diameter of 6.6 meters. It takes its name from the popular Korean folk song Arirang.

A Formosa bond is a bond issued in Taiwan but denominated in a currency other than the New Taiwan Dollar. They are issued by the Taiwan branches of publicly traded overseas financial institutions and to be traded must have a credit rating of BBB or higher.

A Panda bond is a Chinese renminbi-denominated bond from a non-Chinese issuer, sold in the People's Republic of China. The first two Panda bonds were issued in October 2005 on the same day by the International Finance Corporation and the Asian Development Bank. Their terms were 1.13 billion yuan of 10-year bonds at a 3.4% yield and 1 billion yuan of 10-year bonds at a 3.34% yield. The Chinese government had been negotiating for several years about implementation details before permitting the sale of such bonds; they had been concerned about the possible effects on their currency peg. Eventually, it was agreed that funds raised from sales of Panda bonds would have to remain in China; issuers would not be permitted to repatriate such funds.

A Kimchi bond is a non-won-denominated bond issued in the South Korean market. The name refers to kimchi, a Korean side dish. Woori Bank, which is credited with coining the term, defines it as solely referring to bonds from foreign issuers, a definition echoed by the Ministry of Finance and Economy. However, in practise, the term is also used to refer to non-won-denominated bond issuance by domestic entities. Deutsche Bank credits itself as having executed the first kimchi bond transaction, a US$100 million two-year floating rate note sold by South Korean company SK Global, but the first foreign company to sell non-won-denominated bonds in the South Korean market was Bear Stearns. Although foreign firms had long been permitted to issue won-denominated bonds, typically referred to as Arirang bonds, permission for them to issue foreign currency-denominated bonds was slower in coming. Permission was finally granted due to the strength of the won in 2005.

The Luxembourg Stock Exchange, LuxSE is based in Luxembourg City at 35A boulevard Joseph II.

Dim sum bonds are bonds issued outside of China but denominated in Chinese renminbi, rather than the local currency. They are named after dim sum, a popular style of cuisine in southern China.

Chinese-issued U.S. dollars bonds are dollar-denominated bond issued by Chinese financial institutions and corporations.