Related Research Articles

The United States Code is the official codification of the general and permanent federal statutes of the United States. It contains 53 titles, which are organized into numbered sections.

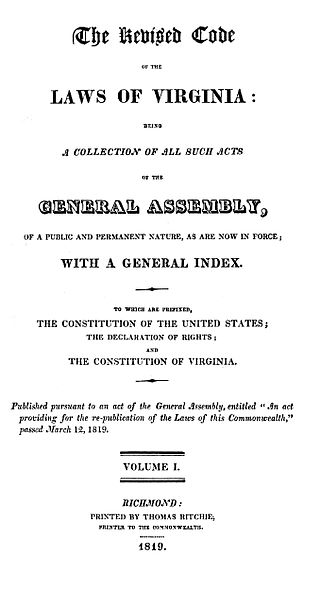

The Code of Virginia is the statutory law of the U.S. state of Virginia and consists of the codified legislation of the Virginia General Assembly. The 1950 Code of Virginia is the revision currently in force. The previous official versions were the Codes of 1819, 1849, 1887, and 1919, though other compilations had been printed privately as early as 1733, and other editions have been issued that were not designated full revisions of the code.

The Arizona attorney general is the chief legal officer of the State of Arizona, in the United States. This state officer is the head of the Arizona Department of Law, more commonly known as the Arizona Attorney General's Office. The state attorney general is a constitutionally-established officer, elected by the people of the state to a four-year term. The state attorney general is second in the line of succession to the office of Governor of Arizona.

The Ohio Revised Code (ORC) contains all current statutes of the Ohio General Assembly of a permanent and general nature, consolidated into provisions, titles, chapters and sections. However, the only official publication of the enactments of the General Assembly is the Laws of Ohio; the Ohio Revised Code is only a reference.

Proposition 204 of 2006, or the Humane Treatment of Farm Animals Act, was a law enacted by the voters of Arizona by means of the initiative process. It requires that pigs and calves used for veal on factory farms be given enough room to turn around and fully extend their limbs. The Act was approved in a vote held as part of the 2006 Arizona state elections, held on November 7. It passed with over 62% support.

Transaction privilege tax (TPT) refers to a gross receipts tax levied by the state of Arizona on certain persons for the privilege of conducting business in the state. TPT differs from the "true" sales tax imposed by many other U.S. states as it is imposed upon the seller or lessor rather than the purchaser or lessee. The seller/lessor may pass the burden of the tax on to the purchaser/lessee, but the seller or lessor is the party that remains ultimately liable to Arizona for the tax. TPT is imposed under 16 separate business classifications: amusement, commercial lease, job printing, membership camping, mining, owner builder sales, personal property rental, pipeline, prime contracting, private car line, publication, restaurant, retail, telecommunications, transient lodging, transporting, and utilities. State tax rates for the various classifications are as follows: 5.5% for the transient lodging classification, 3.125% for the mining classification, 0% for the commercial lease classification, and 5.6% for all other tax classifications. Taxes are imposed on the total gross receipts of taxable businesses, with the exception of prime contractors, who are taxed on 65% of their gross receipts. All gross receipts for a person subject to tax under a particular tax classification are subject to tax unless otherwise specifically exempted or excluded by statute. Exemptions and deductions of one tax classification may not be used under another classification unless specifically delineated.

The Oregon Revised Statutes (ORS) is the codified body of statutory law governing the U.S. state of Oregon, as enacted by the Oregon Legislative Assembly, and occasionally by citizen initiative. The statutes are subordinate to the Oregon Constitution.

The California Codes are 29 legal codes enacted by the California State Legislature, which, alongside uncodified acts, form the general statutory law of California. The official codes are maintained by the California Office of Legislative Counsel for the legislature. The Legislative Counsel also publishes the official text of the Codes publicly at leginfo.legislature.ca.gov.

In the United States, the law for murder varies by jurisdiction. In many US jurisdictions there is a hierarchy of acts, known collectively as homicide, of which first-degree murder and felony murder are the most serious, followed by second-degree murder and, in a few states, third-degree murder, which in other states is divided into voluntary manslaughter, and involuntary manslaughter such as reckless homicide and negligent homicide, which are the least serious, and ending finally in justifiable homicide, which is not a crime. However, because there are at least 52 relevant jurisdictions, each with its own criminal code, this is a considerable simplification.

Firearm laws in Arizona regulate the sale, possession, and use of firearms and ammunition in the state of Arizona in the United States.

The copyright status of works produced by the governments of states, territories, and municipalities in the United States varies. Copyright law is federal in the United States. Federal law expressly denies U.S. copyright protection to two types of government works: works of the U.S. federal government itself, and all edicts of any government regardless of level or whether or not foreign. Other than addressing these "edicts of government", U.S. federal law does not address copyrights of U.S. state and local government.

The law of the U.S. state of Georgia consists of several levels, including constitutional, statutory, and regulatory law, as well as case law and local law. The Official Code of Georgia Annotated forms the general statutory law.

The law of New Jersey consists of several levels, including constitutional, statutory, regulatory, case law, and local law.

The Illinois Compiled Statutes (ILCS) are the codified statutes of a general and permanent nature of Illinois. The compilation organizes the general Acts of Illinois into 67 chapters arranged within 9 major topic areas. The ILCS took effect in 1993, replacing the previous numbering scheme generally known as the Illinois Revised Statutes, the latest of which had been adopted in 1874 but appended by private publishers since.

The Colorado Revised Statutes (C.R.S.) are a legal code of Colorado, the codified general and permanent statutes of the Colorado General Assembly.

The law of New Hampshire is the state law of the U.S. state of New Hampshire. It consists of the Constitution of the State of New Hampshire, as well as the New Hampshire Revised Statutes Annotated, the New Hampshire Code of Administrative Rules, and precedents of the state courts.