Related Research Articles

In economics, a recession is a business cycle contraction that occurs when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending. This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale anthropogenic or natural disaster.

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of inflation is deflation, a decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices faced by households do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose. The employment cost index is also used for wages in the United States.

In economics and political science, fiscal policy is the use of government revenue collection and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variables developed in reaction to the Great Depression of the 1930s, when the previous laissez-faire approach to economic management became unworkable. Fiscal policy is based on the theories of the British economist John Maynard Keynes, whose Keynesian economics theorised that government changes in the levels of taxation and government spending influence aggregate demand and the level of economic activity. Fiscal and monetary policy are the key strategies used by a country's government and central bank to advance its economic objectives. The combination of these policies enables these authorities to target inflation and to increase employment. Additionally, it is designed to try to keep GDP growth at 2%–3% and the unemployment rate near the natural unemployment rate of 4%–5%. This implies that fiscal policy is used to stabilise the economy over the course of the business cycle.

An economic bubble is a period when current asset prices greatly exceed their intrinsic valuation, being the valuation that the underlying long-term fundamentals justify. Bubbles can be caused by overly optimistic projections about the scale and sustainability of growth, and/or by the belief that intrinsic valuation is no longer relevant when making an investment. They have appeared in most asset classes, including equities, commodities, real estate, and even esoteric assets. Bubbles usually form as a result of either excess liquidity in markets, and/or changed investor psychology. Large multi-asset bubbles, are attributed to central banking liquidity.

The monetary policy of The United States is the set of policies which the Federal Reserve follows to achieve its twin objectives of high employment and stable inflation.

Monetary policy is the policy adopted by the monetary authority of a nation to affect monetary and other financial conditions to accomplish broader objectives like high employment and price stability. Further purposes of a monetary policy may be to contribute to economic stability or to maintain predictable exchange rates with other currencies. Today most central banks in developed countries conduct their monetary policy within an inflation targeting framework, whereas the monetary policies of most developing countries' central banks target some kind of a fixed exchange rate system. A third monetary policy strategy, targeting the money supply, was widely followed during the 1980s, but has diminished in popularity since that, though it is still the official strategy in a number of emerging economies.

Foreign exchange reserves are cash and other reserve assets such as gold held by a central bank or other monetary authority that are primarily available to balance payments of the country, influence the foreign exchange rate of its currency, and to maintain confidence in financial markets. Reserves are held in one or more reserve currencies, nowadays mostly the United States dollar and to a lesser extent the euro.

The Bank of Korea is the central bank of the Republic of Korea and issuer of Korean Republic won. It was established on 12 June 1950 in Seoul, South Korea.

The wealth elasticity of demand, in microeconomics and macroeconomics, is the proportional change in the consumption of a good relative to a change in consumers' wealth. Measuring and accounting for the variability in this elasticity is a continuing problem in behavioral finance and consumer theory.

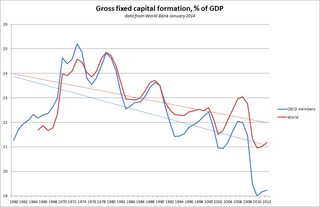

Capital formation is a concept used in macroeconomics, national accounts and financial economics. Occasionally it is also used in corporate accounts. It can be defined in three ways:

The real economy concerns the production, purchase and flow of goods and services within an economy. It is contrasted with the financial economy, which concerns the aspects of the economy that deal purely in transactions of money and other financial assets, which represent ownership or claims to ownership of real sector goods and services.

In finance, risk factors are the building blocks of investing, that help explain the systematic returns in equity market, and the possibility of losing money in investments or business adventures. A risk factor is a concept in finance theory such as the capital asset pricing model, arbitrage pricing theory and other theories that use pricing kernels. In these models, the rate of return of an asset is a random variable whose realization in any time period is a linear combination of other random variables plus a disturbance term or white noise. In practice, a linear combination of observed factors included in a linear asset pricing model proxy for a linear combination of unobserved risk factors if financial market efficiency is assumed. In the Intertemporal CAPM, non-market factors proxy for changes in the investment opportunity set.

Currency depreciation is the loss of value of a country's currency with respect to one or more foreign reference currencies, typically in a floating exchange rate system in which no official currency value is maintained. Currency appreciation in the same context is an increase in the value of the currency. Short-term changes in the value of a currency are reflected in changes in the exchange rate.

A sudden stop in capital flows is defined as a sudden slowdown in private capital inflows into emerging market economies, and a corresponding sharp reversal from large current account deficits into smaller deficits or small surpluses. Sudden stops are usually followed by a sharp decrease in output, private spending and credit to the private sector, and real exchange rate depreciation. The term “sudden stop” was inspired by a banker’s comment on a paper by Rüdiger Dornbusch and Alejandro Werner about Mexico, that “it is not speed that kills, it is the sudden stop”.

The Bernanke doctrine refers to measures, identified by Ben Bernanke while Chairman of the Board of Governors of the United States Federal Reserve, that the Federal Reserve can use in conducting monetary policy to combat deflation.

The credit channel mechanism of monetary policy describes the theory that a central bank's policy changes affect the amount of credit that banks issue to firms and consumers for purchases, which in turn affects the real economy.

The interest rate channel is a mechanism of monetary policy, whereby a policy-induced change in the short-term nominal interest rate by the central bank affects the price level, and subsequently output and employment.

A balance sheet recession is a type of economic recession that occurs when high levels of private sector debt cause individuals or companies to collectively focus on saving by paying down debt rather than spending or investing, causing economic growth to slow or decline. The term is attributed to economist Richard Koo and is related to the debt deflation concept described by economist Irving Fisher. Recent examples include Japan's recession that began in 1990 and the U.S. recession of 2007-2009.

The monetary transmission mechanism is the process by which asset prices and general economic conditions are affected as a result of monetary policy decisions. Such decisions are intended to influence the aggregate demand, interest rates, and amounts of money and credit in order to affect overall economic performance. The traditional monetary transmission mechanism occurs through interest rate channels, which affect interest rates, costs of borrowing, levels of physical investment, and aggregate demand. Additionally, aggregate demand can be affected through friction in the credit markets, known as the credit view. In short, the monetary transmission mechanism can be defined as the link between monetary policy and aggregate demand.

A distributional effect is the effect of the redistribution of the final gains and costs derived from the direct gains and cost allocations of a project. A project has a direct-profit redistribution effect and a direct-cost redistribution effect. But whether it is profit or cost, the redistribution effect can be expressed as a benefit to a group of people or department or region, and the loss to another party. In theory, the indirect profit and indirect costs can also be derived from the redistribution effect, and valued.

References

- 1 2 3 4 5 6 Mishkin, F. S. (2001). "The transmission mechanism and the role of asset prices in monetary policy (No. w8617)". National bureau of economic research. CiteSeerX 10.1.1.159.7073 .

- ↑ ECB (2010) Monetary Policy transmission in the Euro area, a decade after the introduction of the Euro

- ↑ "Égert, B., & MacDonald, R. (2006). Transmission mechanism in transition economies: surveying the surveyable (No. 1739). CESifo working paper" (PDF). Archived from the original (PDF) on 2014-12-31. Retrieved 2014-03-06.

- ↑ Mihaljek, D., & Klau, M. (2008). Exchange rate pass-through in emerging market economies: what has changed and why?. BIS Papers, 35, 103-130