The economy of Alberta is the sum of all economic activity in Alberta, Canada's fourth largest province by population. Alberta's GDP in 2018 was CDN$338.2 billion.

The Harken Energy scandal refers to a series of transactions entered into during 1990 involving Harken Energy. These transactions are alleged to involve either issues relating to insider trading, or influence peddling. No wrongdoings were found by any investigating authorities although the matter generated political controversy.

The National Energy Program (NEP) was an energy policy of the Canadian federal government from 1980 to 1985. Created under the Liberal government of Prime Minister Pierre Trudeau by Energy Minister Marc Lalonde in 1980, the program was administered by the Department of Energy, Mines and Resources. Introduced following the oil crises and stagflation of the 1970s, the NEP proved to be a highly controversial policy initiative that pitted centralized economic nationalism and federal aspirations of energy self-sufficiency against provincial jurisdiction with hundreds of billions of dollars in oil revenue at stake. The result was a dispute that sparked intense opposition and anger in Canada's West, particularly in Alberta, and the rise of the Reform Party, a development that would shape Canadian politics for years to come.

Ovintiv Inc., formerly Encana Corporation, is a hydrocarbon exploration and production company organized in Delaware and headquartered in Denver, United States. It was founded and headquartered in Calgary, Alberta, and was the largest energy company and largest natural gas producer in Canada. The company was rebranded as Ovintiv and relocated to Denver in 2019–20.

Brookfield Asset Management Inc. is a Canadian based company and is one of the world’s largest alternative investment management companies with US$626 billion of assets under management in 2021. It focuses on direct control investments in real estate, renewable power, infrastructure, credit and private equity. The Company invests in distressed securities through Oaktree Capital, which it bought in 2019. Brookfield’s headquarters is located in Toronto, and it also has corporate offices in New York City, London, São Paulo, Mumbai, Shanghai, Dubai, and Sydney.

Bausch Health Companies Inc. is a Canadian multinational specialty pharmaceutical company based in Laval, Quebec, Canada. It develops, manufactures and markets pharmaceutical products and branded generic drugs, primarily for skin diseases, gastrointestinal disorders, eye health and neurology. Bausch Health owns Bausch & Lomb, a supplier of eye health products.

Talisman Energy Inc. was a Canadian multinational oil and gas exploration and production company headquartered in Calgary, Alberta. It was one of Canada's largest independent oil and gas companies. Originally formed from the Canadian assets of BP Canada Ltd. it grew and operated globally, with operations in Canada and the United States of America in North America; Colombia, South America; Algeria in North Africa; United Kingdom and Norway in Europe; Indonesia, Malaysia, Vietnam, Papua New Guinea, East Timor and Australia in the Far East; and Kurdistan in the Middle East. Talisman Energy has also built the offshore Beatrice Wind Farm in the North Sea off the coast of Scotland.

Ecojustice Canada, is a Canadian non-profit environmental law organization that provides funding to lawyers to use litigation to defend and protect the environment. Ecojustice is Canada's largest environmental law charity.

Pengrowth Energy Corporation was a Canadian oil and natural gas company based in Calgary, Alberta. Established in 1988 by Calgary entrepreneur James S Kinnear, it was one of the largest of the Canadian royalty trusts ("Canroys"), with a market capitalization of US$4.12 billion at the end of 2007. Its assets were approximately evenly distributed between oil and natural gas.

Obsidian Energy Ltd. is a mid-sized Canadian oil and natural gas production company based in Calgary, Alberta.

Rachel Anne Notley is a Canadian politician who served as the 17th premier of Alberta from 2015 to 2019, and has been the leader of the Opposition since 2019. She sits as the member of the Legislative Assembly (MLA) for Edmonton-Strathcona, and is the leader of the Alberta New Democratic Party (NDP). The daughter of former Alberta NDP leader Grant Notley, she was a lawyer before entering politics; she focused on labour law, with a specialty in workers' compensation advocacy and workplace health and safety issues.

Although there are numerous oil companies operating in Canada, as of 2009, the majority of production, refining and marketing was done by fewer than 20 of them. According to the 2013 edition of Forbes Global 2000, canoils.com and any other list that emphasizes market capitalization and revenue when sizing up companies, as of March 31, 2014 these are the largest Canada-based oil and gas companies.

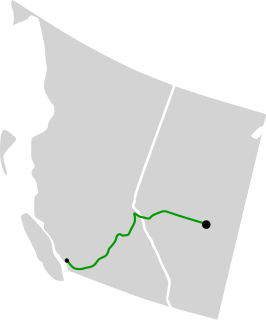

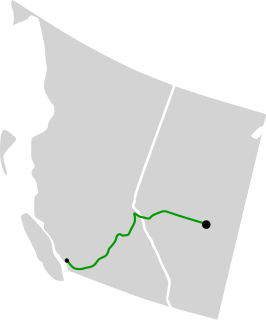

The Enbridge Northern Gateway Pipelines were a project to build a twin pipeline from Bruderheim, Alberta to Kitimat, British Columbia. The eastbound pipeline would have imported natural gas condensate and the westbound pipeline would have exported diluted bitumen from the Athabasca oil sands to a marine terminal in Kitimat for transportation to Asian markets via oil tankers. The project would have also included terminal facilities with "integrated marine infrastructure at tidewater to accommodate loading and unloading of oil and condensate tankers, and marine transportation of oil and condensate." The CA$7.9 billion project was proposed in mid-2000s and has been postponed several times. The proposed project would have been developed by Enbridge Inc., a Canadian crude oil and liquids pipeline and storage company.

Canadian Natural Resources Limited, or CNRL or Canadian Natural is a senior Canadian oil and natural gas company that operates primarily in the Western Canadian provinces of British Columbia, Alberta, Saskatchewan, and Manitoba, with offshore operations in the United Kingdom sector of the North Sea, and offshore Côte d'Ivoire and Gabon. The company, which is headquartered in Calgary, Alberta, has the largest undeveloped base in the Western Canadian Sedimentary Basin. It is the largest independent producer of natural gas in Western Canada and the largest producer of heavy crude oil in Canada.

The Irving Oil Refinery is a Canadian oil refinery located in Saint John, New Brunswick. It is currently the largest oil refinery in Canada, capable of producing more than 320,000 barrels (51,000 m3) of refined products per day. Over 80 per cent of the production is exported to the United States, accounting for 19 per cent of the country's gasoline imports and 75 per cent of Canada's gasoline exports to the US.

Andrew Edward Left is an activist, short seller, author and editor of the online investment newsletter Citron Research, formerly StockLemon.com. Under the name Citron Research, Left publishes reports on firms that he claims are overvalued or are engaged in fraud. Left is known for advising investors on short selling and has often appeared on various media outlets such as CNBC and Bloomberg to talk about his opinions on stocks. In 2017, Left was called 'The Bounty Hunter of Wall Street' by The New York Times. Left gained further notoriety following his announced short of GameStop, precipitating a short squeeze that has hurt him and other short sellers in the short term.

Western Canadian Select (WCS) is a heavy sour blend of crude oil that is one of North America's largest heavy crude oil streams. It was established in December 2004 as a new heavy oil stream by EnCana, Canadian Natural Resources Limited, Petro-Canada and Talisman Energy Inc.. It is a heavy blended crude oil, composed mostly of bitumen blended with sweet synthetic and condensate diluents and 21 existing streams of both conventional and unconventional Alberta heavy crude oils at the large Husky Midstream General Partnership terminal in Hardisty, Alberta. Western Canadian Select—the benchmark for heavy, acidic crudes—is one of many petroleum products from the Western Canadian Sedimentary Basin oil sands. Calgary-based Husky Energy, now a subsidiary of Cenovus, had joined the initial four founders in 2015;

The Trans Mountain Pipeline System, or simply the Trans Mountain Pipeline, is a pipeline that carries crude and refined oil from Alberta to the coast of British Columbia, Canada. The pipeline is currently owned by the Government of Canada through Trans Mountain Corporation, a subsidiary of the federal Crown corporation Canada Development Investment Corporation (CDEV). Until the August 31, 2018 purchase by CDEV, the Trans Mountain Pipeline was owned by the Canadian division of Houston, Texas-based pipeline operator Kinder Morgan. The pipeline has been in use since 1953. It is the only pipeline to run between these two areas.

MiMedx Group is a biomedical company based in Marietta, Georgia, founded in 2008. It is traded on the NASDAQ as MDXG. The CEO is Tim Wright. Using tissues from birth such as the placenta, amniotic sac, and umbilical cord, MiMedx creates skin for skin grafts. With the arrival of Wright in May 2019, the company accelerated the process of working with auditors and regulators to resolve legal and financial issues created by the previous management. Wright also began a cultural and financial turnaround, assembling a new senior management team by August 2019 to instill “transparency, truthfulness, and timeliness” in communications and business dealings. As of December 2020, the company had approximately 735 employees.

Navigator Ltd. is a Canadian public relations, crisis management, lobbying and polling company based in Toronto, with offices in Ottawa, Calgary, Edmonton, and Moncton. They have represented a number of high-profile Canadian clients including Brian Mulroney, Michael Bryant, and Magna International. The company was founded in 2000 by Jaime Watt, a communications strategist tied to the Progressive Conservative Party of Ontario. Watt remains the Executive Chairman of the company.