Related Research Articles

In finance, a derivative is a contract that derives its value from the performance of an underlying entity. This underlying entity can be an asset, index, or interest rate, and is often simply called the underlying. Derivatives can be used for a number of purposes, including insuring against price movements (hedging), increasing exposure to price movements for speculation, or getting access to otherwise hard-to-trade assets or markets.

A stock exchange, securities exchange, or bourse is an exchange where stockbrokers and traders can buy and sell securities, such as shares of stock, bonds and other financial instruments. Stock exchanges may also provide facilities for the issue and redemption of such securities and instruments and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as "continuous auction" markets with buyers and sellers consummating transactions via open outcry at a central location such as the floor of the exchange or by using an electronic trading platform.

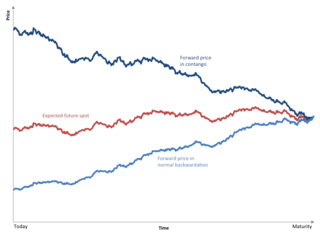

Contango is a situation where the futures price of a commodity is higher than the expected spot price of the contract at maturity. In a contango situation, arbitrageurs or speculators are "willing to pay more [now] for a commodity [to be received] at some point in the future than the actual expected price of the commodity [at that future point]. This may be due to people's desire to pay a premium to have the commodity in the future rather than paying the costs of storage and carry costs of buying the commodity today." On the other side of the trade, hedgers are happy to sell futures contracts and accept the higher-than-expected returns. A contango market is also known as a normal market, or carrying-cost market.

In finance, being short in an asset means investing in such a way that the investor will profit if the value of the asset falls. This is the opposite of a more conventional "long" position, where the investor will profit if the value of the asset rises.

In finance, a put or put option is a derivative instrument in financial markets that gives the holder the right to sell an asset, at a specified price, by a specified date to the writer of the put. The purchase of a put option is interpreted as a negative sentiment about the future value of the underlying stock. The term "put" comes from the fact that the owner has the right to "put up for sale" the stock or index.

In financial mathematics, the put–call parity defines a relationship between the price of a European call option and European put option, both with the identical strike price and expiry, namely that a portfolio of a long call option and a short put option is equivalent to a single forward contract at this strike price and expiry. This is because if the price at expiry is above the strike price, the call will be exercised, while if it is below, the put will be exercised, and thus in either case one unit of the asset will be purchased for the strike price, exactly as in a forward contract.

In finance, a futures contract is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the forward price. The specified time in the future when delivery and payment occur is known as the delivery date. Because it derives its value from the value of the underlying asset, a futures contract is a derivative.

In finance, a forward contract or simply a forward is a non-standardized contract between two parties to buy or sell an asset at a specified future time at a price agreed on at the time of conclusion of the contract, making it a type of derivative instrument. The party agreeing to buy the underlying asset in the future assumes a long position, and the party agreeing to sell the asset in the future assumes a short position. The price agreed upon is called the delivery price, which is equal to the forward price at the time the contract is entered into.

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. Futures exchanges provide physical or electronic trading venues, details of standardized contracts, market and price data, clearing houses, exchange self-regulations, margin mechanisms, settlement procedures, delivery times, delivery procedures and other services to foster trading in futures contracts. Futures exchanges can be organized as non-profit member-owned organizations or as for-profit organizations. Futures exchanges can be integrated under the same brand name or organization with other types of exchanges, such as stock markets, options markets, and bond markets. Non-profit member-owned futures exchanges benefit their members, who earn commissions and revenue acting as brokers or market makers. For-profit futures exchanges earn most of their revenue from trading and clearing fees.

A hedge is an investment position intended to offset potential losses or gains that may be incurred by a companion investment. A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance, forward contracts, swaps, options, gambles, many types of over-the-counter and derivative products, and futures contracts.

Fixed income refers to any type of investment under which the borrower or issuer is obliged to make payments of a fixed amount on a fixed schedule. For example, the borrower may have to pay interest at a fixed rate once a year and repay the principal amount on maturity. Fixed-income securities — more commonly known as bonds — can be contrasted with equity securities – often referred to as stocks and shares – that create no obligation to pay dividends or any other form of income. Bonds carry a level of legal protections for investors that equity securities do not — in the event of a bankruptcy, bond holders would be repaid after liquidation of assets, whereas shareholders with stock often receive nothing.

In finance, a foreign exchange option is a derivative financial instrument that gives the right but not the obligation to exchange money denominated in one currency into another currency at a pre-agreed exchange rate on a specified date. See Foreign exchange derivative.

In finance, a contract for difference (CFD) is a legally binding agreement that creates, defines, and governs mutual rights and obligations between two parties, typically described as "buyer" and "seller", stipulating that the buyer will pay to the seller the difference between the current value of an asset and its value at contract time. If the closing trade price is higher than the opening price, then the seller will pay the buyer the difference, and that will be the buyer’s profit. The opposite is also true. That is, if the current asset price is lower at the exit price than the value at the contract’s opening, then the seller, rather than the buyer, will benefit from the difference.

Harshad Shantilal Mehta was an Indian stockbroker and a convicted fraudster. Mehta's involvement in the 1992 Indian securities scam made him infamous as a market manipulator.

In finance, margin is the collateral that a holder of a financial instrument has to deposit with a counterparty to cover some or all of the credit risk the holder poses for the counterparty. This risk can arise if the holder has done any of the following:

In finance, an option is a contract which conveys to its owner, the holder, the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset and have a valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in over-the-counter (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts.

In finance, stock consist of all the shares by which ownership of a corporation or company is divided. A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets, or voting power, often dividing these up in proportion to the amount of money each stockholder has invested. Not all stock is necessarily equal, as certain classes of stock may be issued for example without voting rights, with enhanced voting rights, or with a certain priority to receive profits or liquidation proceeds before or after other classes of shareholders.

An exchange, bourse, trading exchange or trading venue is an organized market where (especially) tradable securities, commodities, foreign exchange, futures, and options contracts are bought and sold.

The Islamic banking and finance movement that developed in the late 20th century as part of the revival of Islamic identity sought to create an alternative to conventional banking that complied with sharia (Islamic) law. Following sharia it banned from its practices riba (usury) – which it defined as any interest paid on all loans of money – and involvement in haram (forbidden) goods or services such as pork or alcohol. It also forbids gambling (maisir) and excessive risk.

The 1992 Indian stock market scam was a market manipulation carried out by Harshad Shantilal Mehta with other bankers and politicians on the Bombay Stock Exchange. The scam caused significant disruption to the stock market of India, defrauding investors of over ten million USD.

References

- ↑ Alexander Balfour. February 1995. "Bogged-down in Bombay." Euromoney. Issue 310. p. 96.

- ↑ C. Raja Rajeshwari. 28 January 2004. "From badla to derivatives." The Hindu Business Line.

- ↑ Susan Thomas. 29 June 2001. "Ban on badla, take 2 Archived 25 November 2006 at the Wayback Machine ." Economic Times.

- ↑ B. Venkatesh. 2001. "Badla versus futures [Usurped!]." The Hindu Business Line.