Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debtor.

In finance, default is failure to meet the legal obligations of a loan, for example when a home buyer fails to make a mortgage payment, or when a corporation or government fails to pay a bond which has reached maturity. A national or sovereign default is the failure or refusal of a government to repay its national debt.

Debt is an obligation that requires one party, the debtor, to pay money borrowed or otherwise withheld from another party, the creditor. Debt may be owed by a sovereign state or country, local government, company, or an individual. Commercial debt is generally subject to contractual terms regarding the amount and timing of repayments of principal and interest. Loans, bonds, notes, and mortgages are all types of debt. In financial accounting, debt is a type of financial transaction, as distinct from equity.

Debt relief or debt cancellation is the partial or total forgiveness of debt, or the slowing or stopping of debt growth, owed by individuals, corporations, or nations.

Debt consolidation is a form of debt refinancing that entails taking out one loan to pay off many others. This commonly refers to a personal finance process of individuals addressing high consumer debt, but occasionally it can also refer to a country's fiscal approach to consolidate corporate debt or government debt. The process can secure a lower overall interest rate to the entire debt load and provide the convenience of servicing only one loan or debt. Debt consolidation is sometimes offered by loan sharks, charging clients exorbitant interest rates. Further regulation has been discussed as a result.

Title 11 of the United States Code sets forth the statutes governing the various types of relief for bankruptcy in the United States. Chapter 13 of the United States Bankruptcy Code provides an individual with the opportunity to propose a plan of reorganization to reorganize their financial affairs while under the bankruptcy court's protection. The purpose of chapter 13 is to enable an individual with a regular source of income to propose a chapter 13 plan that provides for their various classes of creditors. Under chapter 13, the Bankruptcy Court has the power to approve a chapter 13 plan without the approval of creditors as long as it meets the statutory requirements under chapter 13. Chapter 13 plans are usually three to five years in length and may not exceed five years. Chapter 13 is in contrast to the purpose of Chapter 7, which does not provide for a plan of reorganization, but provides for the discharge of certain debt and the liquidation of non-exempt property. A Chapter 13 plan may be looked at as a form of debt consolidation, but a Chapter 13 allows a person to achieve much more than simply consolidating his or her unsecured debt such as credit cards and personal loans. A chapter 13 plan may provide for the four general categories of debt: priority claims, secured claims, priority unsecured claims, and general unsecured claims. Chapter 13 plans are often used to cure arrearages on a mortgage, avoid "underwater" junior mortgages or other liens, pay back taxes over time, or partially repay general unsecured debt. In recent years, some bankruptcy courts have allowed Chapter 13 to be used as a platform to expedite a mortgage modification application.

The Dawes Plan temporarily resolved the issue of the reparations that Germany owed to the Allies of World War I. Enacted in 1924, it ended the crisis in European diplomacy that occurred after French and Belgian troops occupied the Ruhr in response to Germany's failure to meet its reparations obligations.

The Young Plan was a 1929 attempt to settle issues surrounding the World War I reparations obligations that Germany owed under the terms of Treaty of Versailles. Developed to replace the 1924 Dawes Plan, the Young Plan was negotiated in Paris from February to June 1929 by a committee of international financial experts under the leadership of American businessman and economist Owen D. Young. Representatives of the affected governments then finalised and approved the plan at The Hague conference of 1929/30. Reparations were set at 36 billion Reichsmarks payable through 1988. Including interest, the total came to 112 billion Reichsmarks. The average annual payment was approximately two billion Reichsmarks. The plan came into effect on 17 May 1930, retroactive to 1 September 1929.

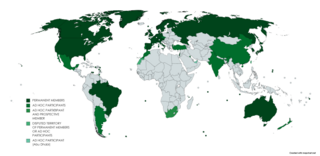

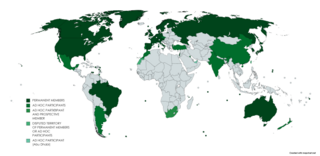

Paris Club is a group of major creditor countries aiming to provide a sustainable way to tackle debt problems in debtor countries. Its creation, which is the first informal meeting, dates back to 1956, when Argentina agreed to hold a meeting with its public creditors.

A debtor or debitor is a legal entity that owes a debt to another entity. The entity may be an individual, a firm, a government, a company or other legal person. The counterparty is called a creditor. When the counterpart of this debt arrangement is a bank, the debtor is more often referred to as a borrower.

In corporate finance, distressed securities are securities over companies or government entities that are experiencing financial or operational distress, default, or are under bankruptcy. As far as debt securities, this is called distressed debt. Purchasing or holding such distressed-debt creates significant risk due to the possibility that bankruptcy may render such securities worthless.

A vulture fund is a hedge fund or private-equity fund that invests in debt considered to be very weak or in default, known as distressed debt. Investors in the fund profit by buying debt at a discounted price on a secondary market and then using numerous methods to sell the debt for more than the purchasing price. Debtors include companies, countries, and individuals.

A bankruptcy discharge is a court order that releases an individual or business from specific debts and obligations they owe to creditors. In other words, it's a legal process that eliminates the debtor's liability to pay certain types of debts they owe before filing the bankruptcy case.

Credit counseling is commonly a process that is used to help individual debtors with debt settlement through education, budgeting and the use of a variety of tools with the goal to reduce and ultimately eliminate debt. Credit counseling is most often done by Credit counseling agencies that are empowered by contract to act on behalf of the debtor to negotiate with creditors to resolve debt that is beyond a debtor's ability to pay. Some of the agencies are non-profits that charge at no or non-fee rates, while others can be for-profit and include high fees. Regulations on credit counseling and Credit counseling agencies varies by country and sometimes within regions of the countries themselves. In the United States, individuals filing Chapter 13 bankruptcy are required to receive counseling.

The external debt of Haiti is a notable and controversial national debt which mostly stems from an outstanding 1825 compensation to former slavers of the French colonial empire and later 20th century corruptions.

Debtors Anonymous (DA) is a twelve-step program for people who want to stop incurring unsecured debt. Collectively they attend more than 500 weekly meetings in fifteen countries, according to data released in 2011. Those who compulsively incur unsecured debt are said to be engaged in compulsive borrowing and are known as compulsive debtors.

The London Agreement on German External Debts, also known as the London Debt Agreement, was a debt relief treaty between the Federal Republic of Germany and creditor nations. The Agreement was signed in London on 27 February 1953, and came into force on 16 September 1953.

A sovereign default is the failure or refusal of the government of a sovereign state to pay back its debt in full when due. Cessation of due payments may either be accompanied by that government's formal declaration that it will not pay its debts (repudiation), or it may be unannounced. A credit rating agency will take into account in its gradings capital, interest, extraneous and procedural defaults, and failures to abide by the terms of bonds or other debt instruments.

A tax refund interception, also referred to as a tax refund offset, is the act of an agency responsible for sending tax refunds using all or part of a refund to fulfill an obligation of the taxpayer rather than sending the money to the taxpayer him/herself.

World War Foreign Debts Commission Act is a United States statute authorized February 9, 1922 endorsing a commission, working under Secretary of the Treasury Andrew Mellon, to negotiate repayment agreements with Great Britain and France in the aftermath of World War I.