Related Research Articles

In finance, a high-yield bond is a bond that is rated below investment grade by credit rating agencies. These bonds have a higher risk of default or other adverse credit events but offer higher yields than investment-grade bonds in order to compensate for the increased risk.

Investment banking is an advisory-based financial service for institutional investors, corporations, governments, and similar clients. Traditionally associated with corporate finance, such a bank might assist in raising financial capital by underwriting or acting as the client's agent in the issuance of debt or equity securities. An investment bank may also assist companies involved in mergers and acquisitions (M&A) and provide ancillary services such as market making, trading of derivatives and equity securities, FICC services or research. Most investment banks maintain prime brokerage and asset management departments in conjunction with their investment research businesses. As an industry, it is broken up into the Bulge Bracket, Middle Market, and boutique market.

A chief operating officer (COO), also called chief operations officer, is an executive in charge of the daily operations of an organization. COOs are usually second-in-command immediately after the CEO, and report directly to them, acting on their behalf in their absence.

Neuberger Berman Group LLC is an American private, independent, employee-owned investment management firm. The firm manages equities, fixed income, private equity and hedge fund portfolios for global institutional investors, advisors and high-net-worth individuals.

Lehman Brothers Inc. was an American global financial services firm founded in 1850. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States, with about 25,000 employees worldwide. It was doing business in investment banking, equity, fixed-income and derivatives sales and trading, research, investment management, private equity, and private banking. Lehman was operational for 158 years from its founding in 1850 until 2008.

The Bear Stearns Companies, Inc. was an American investment bank, securities trading, and brokerage firm that failed in 2008 during the 2007–2008 financial crisis and the Great Recession. After its closure it was subsequently sold to JPMorgan Chase. The company's main business areas before its failure were capital markets, investment banking, wealth management, and global clearing services, and it was heavily involved in the subprime mortgage crisis.

Salomon Brothers, Inc., was an American multinational bulge bracket investment bank headquartered in New York City. It was one of the five largest investment banking enterprises in the United States and a very profitable firm on Wall Street during the 1980s and 1990s. Its CEO and chairman at that time, John Gutfreund, was nicknamed "the King of Wall Street".

Nomura Securities Co., Ltd. is a Japanese financial services company and a wholly owned subsidiary of Nomura Holdings, Inc. (NHI), which forms part of the Nomura Group. It plays a central role in the securities business, the group's core business. Nomura is a financial services group and global investment bank. Based in Tokyo, Japan, with regional headquarters in Hong Kong, London, and New York, Nomura employs about 26,000 staff worldwide; it is known as Nomura Securities International in the US, and Nomura International plc. in EMEA. It operates through five business divisions: retail, global markets, investment banking, merchant banking, and asset management.

The bond market is a financial market in which participants can issue new debt, known as the primary market, or buy and sell debt securities, known as the secondary market. This is usually in the form of bonds, but it may include notes, bills, and so on for public and private expenditures. The bond market has largely been dominated by the United States, which accounts for about 39% of the market. As of 2021, the size of the bond market is estimated to be at $119 trillion worldwide and $46 trillion for the US market, according to the Securities Industry and Financial Markets Association (SIFMA).

Robert Edward Diamond Jr. is an American banker and former chief executive officer of Barclays plc. In 2010, he became its president and deputy group chief executive; and in January 2011, succeeded John Varley as group chief executive of Barclays.

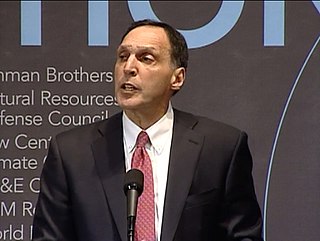

Richard Severin Fuld Jr. is an American banker best known as the final chairman and chief executive officer of investment bank Lehman Brothers. Fuld held this position from 1 April 1994 after the firm's spinoff from American Express until 15 September 2008. Lehman Brothers filed for bankruptcy protection under Chapter 11 on September 15, 2008, and subsequently announced the sale of major operations to parties including Barclays Bank and Nomura Securities.

The Bloomberg US Aggregate Bond Index, or the Agg, is a broad base, market capitalization-weighted bond market index representing intermediate term investment grade bonds traded in the United States. Investors frequently use the index as a stand-in for measuring the performance of the US bond market.

Stifel Financial Corp. is an American multinational independent investment bank and financial services company created under the Stifel name in July 1983 and listed on the New York Stock Exchange on November 24, 1986. Its predecessor company was founded in 1890 as the Altheimer and Rawlings Investment Company and is headquartered in downtown St. Louis, Missouri.

The bankruptcy of Lehman Brothers, also known as the Crash of '08 and the Lehman Shock on September 15, 2008, was the climax of the subprime mortgage crisis. After the financial services firm was notified of a pending credit downgrade due to its heavy position in subprime mortgages, the Federal Reserve summoned several banks to negotiate financing for its reorganization. These discussions failed, and Lehman filed a Chapter 11 petition that remains the largest bankruptcy filing in U.S. history, involving more than US$600 billion in assets.

The Last Days of Lehman Brothers is a British television film, first broadcast on BBC Two and BBC HD on Wednesday 9 September 2009. Filmed in London, it was written by Craig Warner and directed by Michael Samuels. It was shown as part of the BBC's "Aftershock" season, a selection of programmes marking the first anniversary of the collapse of the American investment bank Lehman Brothers. It featured James Cromwell, Ben Daniels, Corey Johnson, Michael Landes and James Bolam.

Hugh E. "Skip" McGee III is an American investment banker who was formerly a senior executive at Lehman Brothers and Barclays. He is presently co-founder and chief executive officer of Intrepid Financial Partners, a power and energy focused merchant bank.

Barclays plc is a British multinational universal bank, headquartered in London, England. Barclays operates as two divisions, Barclays UK and Barclays International, supported by a service company, Barclays Execution Services.

Alvarez & Marsal Holdings, LLC(A&M) is a global professional services firm notable for its work in turnaround management and performance improvement of a number of large, high-profile businesses both in the US and abroad such as Lehman Brothers, HealthSouth, Tribune Company, Warnaco, Interstate Bakeries, Target, Darden Restaurants and Arthur Andersen.

Mizuho Americas was established on July 1, 2016 as a US bank holding company, as the American corporate and investment banking arm of the Tokyo-based Mizuho Financial Group.

The corporate debt bubble is the large increase in corporate bonds, excluding that of financial institutions, following the financial crisis of 2007–08. Global corporate debt rose from 84% of gross world product in 2009 to 92% in 2019, or about $72 trillion. In the world's eight largest economies—the United States, China, Japan, the United Kingdom, France, Spain, Italy, and Germany—total corporate debt was about $51 trillion in 2019, compared to $34 trillion in 2009. Excluding debt held by financial institutions—which trade debt as mortgages, student loans, and other instruments—the debt owed by non-financial companies in early March 2020 was $13 trillion worldwide, of which about $9.6 trillion was in the U.S.

References

- ↑ "Management Biographies". Lehman Brothers. Archived from the original on May 29, 2001. Retrieved January 14, 2022.

- ↑ Ward, Vicky. "Lehman's Desperate Housewives". Vanity Fair . Retrieved January 8, 2021.

- ↑ Wilchins, Christian; Plumb, Dan (June 12, 2008). "Lehman demotes key executives after surprise loss". Reuters . Retrieved January 8, 2021.

- ↑ "Lehman demotes CFO Callan, names new COO". Reuters. June 12, 2008. Retrieved January 8, 2021.

- ↑ Mamudi, Sam. "Lehman folds with record $613 billion debt". MarketWatch . Retrieved January 8, 2021.

- ↑ "McDade to Leave Barclays Capital". The New York Times . October 31, 2008. Retrieved January 8, 2021.