Related Research Articles

A statute of frauds is a form of statute requiring that certain kinds of contracts be memorialized in writing, signed by the party against whom they are to be enforced, with sufficient content to evidence the contract.

The U.S. Securities and Exchange Commission (SEC) is an independent agency of the United States federal government, created in the aftermath of the Wall Street Crash of 1929. The primary purpose of the SEC is to enforce the law against market manipulation.

The Uniform Commercial Code (UCC), first published in 1952, is one of a number of uniform acts that have been established as law with the goal of harmonizing the laws of sales and other commercial transactions across the United States through UCC adoption by all 50 states, the District of Columbia, and the Territories of the United States.

The Securities Act of 1933, also known as the 1933 Act, the Securities Act, the Truth in Securities Act, the Federal Securities Act, and the '33 Act, was enacted by the United States Congress on May 27, 1933, during the Great Depression and after the stock market crash of 1929. It is an integral part of United States securities regulation. It is legislated pursuant to the Interstate Commerce Clause of the Constitution.

The Securities Exchange Act of 1934 is a law governing the secondary trading of securities in the United States of America. A landmark piece of wide-ranging legislation, the Act of '34 and related statutes form the basis of regulation of the financial markets and their participants in the United States. The 1934 Act also established the Securities and Exchange Commission (SEC), the agency primarily responsible for enforcement of United States federal securities law.

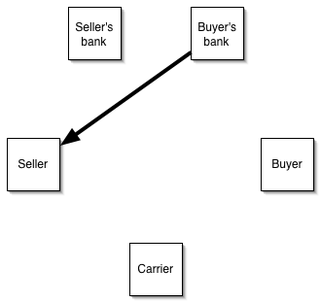

A letter of credit (LC), also known as a documentary credit or bankers commercial credit, or letter of undertaking (LoU), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Letters of credit are used extensively in the financing of international trade, when the reliability of contracting parties cannot be readily and easily determined. Its economic effect is to introduce a bank as an underwriter that assumes the counterparty risk of the buyer paying the seller for goods.

The Investment Company Act of 1940 is an act of Congress which regulates investment funds. It was passed as a United States Public Law on August 22, 1940, and is codified at 15 U.S.C. §§ 80a-1–80a-64. Along with the Securities Exchange Act of 1934, the Investment Advisers Act of 1940, and extensive rules issued by the U.S. Securities and Exchange Commission; it is central to financial regulation in the United States. It has been updated by the Dodd-Frank Act of 2010. It is the primary source of regulation for mutual funds and closed-end funds, now a multi-trillion dollar investment industry. The 1940 Act also impacts the operations of hedge funds, private equity funds and even holding companies.

The Foreign Corrupt Practices Act of 1977 (FCPA) is a United States federal law that prohibits U.S. citizens and entities from bribing foreign government officials to benefit their business interests.

SEC Rule 10b-5, codified at 17 CFR 240.10b-5, is one of the most important rules targeting securities fraud in the United States. It was promulgated by the U.S. Securities and Exchange Commission (SEC), pursuant to its authority granted under § 10(b) of the Securities Exchange Act of 1934. The rule prohibits any act or omission resulting in fraud or deceit in connection with the purchase or sale of any security. The issue of insider trading is given further definition in SEC Rule 10b5-1.

Securities regulation in the United States is the field of U.S. law that covers transactions and other dealings with securities. The term is usually understood to include both federal and state-level regulation by governmental regulatory agencies, but sometimes may also encompass listing requirements of exchanges like the New York Stock Exchange and rules of self-regulatory organizations like the Financial Industry Regulatory Authority (FINRA).

Business brokers, also called business transfer agents, or intermediaries, assist buyers and sellers of privately held businesses in the buying and selling process. They typically estimate the value of the business; advertise it for sale with or without disclosing its identity; handle the initial potential buyer interviews, discussions, and negotiations with prospective buyers; facilitate the progress of the due diligence investigation and generally assist with the business sale.

Commercial property, also called commercial real estate, investment property or income property, is real estate intended to generate a profit, either from capital gains or rental income. Commercial property includes office buildings, medical centers, hotels, malls, retail stores, multifamily housing buildings, farm land, warehouses, and garages. In many U.S. states, residential property containing more than a certain number of units qualifies as commercial property for borrowing and tax purposes.

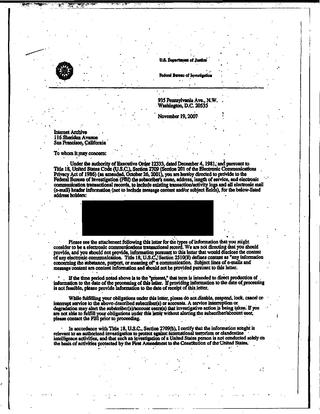

A national security letter (NSL) is an administrative subpoena issued by the United States government to gather information for national security purposes. NSLs do not require prior approval from a judge. The Stored Communications Act, Fair Credit Reporting Act, and Right to Financial Privacy Act authorize the United States government to seek such information that is "relevant" to an authorized national security investigation. By law, NSLs can request only non-content information, for example, transactional records and phone numbers dialed, but never the content of telephone calls or e-mails.

A debt buyer is a company, sometimes a collection agency, a private debt collection law firm, or a private investor, that purchases delinquent or charged-off debts from a creditor or lender for a percentage of the face value of the debt based on the potential collectibility of the accounts. The debt buyer can then collect on its own, utilize the services of a third-party collection agency, repackage and resell portions of the purchased portfolio, or use any combination of these options.

Securities and Exchange Commission v. Ralston Purina Co., 346 U.S. 119 (1953), was a case in which the United States Supreme Court held that a corporation offering "key employees" equity stock shares is eligible for a transaction-based exemption from securities registration under Section 4(1) [Now Section 4(a)(2)] of the Securities Act of 1933. This exemption would generally not apply when offered to all employees, including rank-and-file employees, as the investors should be "sophisticated investors."

A set of heads of agreement, heads of terms, or letter of intent is a non-binding document outlining the main issues relevant to a tentative sale, partnership, or other agreement.

Regulation S-K is a prescribed regulation under the US Securities Act of 1933 that lays out reporting requirements for various SEC filings used by public companies. Companies are also often called issuers, filers or registrants.

Wilko v. Swan, 346 U.S. 427 (1953), is a United States Supreme Court decision on the arbitration of securities fraud claims. It had originally been brought by an investor who claimed his broker at Hayden Stone had sold stock to him without disclosing that he and the firm were the primary sellers. By a 7–2 margin the Court held that the provisions of the Securities Act of 1933 barring any waiver of rights under that statute took precedence over the Federal Arbitration Act's (FAA) requirement that arbitration clauses in contracts be given full effect by federal courts. It reversed a decision to the contrary by a divided panel of the Second Circuit Court of Appeals.

The Philippine Competition Commission (PhCC) is an independent, quasi-judicial body formed to implement the Philippine Competition Act (Republic Act No. 10667). The PhCC aims to promote and maintain market competition within the Philippines by regulating anti-competition behavior. The main role of the PhCC is to promote economic efficiency within the Philippine economy, ensuring fair and healthy market competition.

References

- ↑ Susan DiCicco (December 16, 2014). "Exchange Act Does Not Prohibit Big Boy Letters". Portfolio Media.

- ↑ "Cleary Gottlieb Steen & Hamilton LLP | News | "Big Boy" Letters Revisited: The SEC's Division of Enforcement Weighs in". Archived from the original on 2011-07-19. Retrieved 2008-08-19.