Related Research Articles

The Commodity Futures Trading Commission (CFTC) is an independent agency of the US government created in 1974 that regulates the U.S. derivatives markets,which includes futures,swaps,and certain kinds of options.

The Commodity Futures Modernization Act of 2000 (CFMA) is United States federal legislation that ensured financial products known as over-the-counter (OTC) derivatives remained unregulated. It was signed into law on December 21,2000 by President Bill Clinton. It clarified the law so most OTC derivative transactions between "sophisticated parties" would not be regulated as "futures" under the Commodity Exchange Act of 1936 (CEA) or as "securities" under the federal securities laws. Instead,the major dealers of those products would continue to have their dealings in OTC derivatives supervised by their federal regulators under general "safety and soundness" standards. The Commodity Futures Trading Commission's (CFTC) desire to have "functional regulation" of the market was also rejected. Instead,the CFTC would continue to do "entity-based supervision of OTC derivatives dealers". The CFMA's treatment of OTC derivatives such as credit default swaps has become controversial,as those derivatives played a major role in the financial crisis of 2008 and the subsequent 2008–2012 global recession.

Commodity Exchange Act is a federal act enacted in 1936 by the U.S. Government,with some of its provisions amending the Grain Futures Act of 1922.

Commodity Futures Trading Commission (CFTC) Act of 1974 created the Commodity Futures Trading Commission,to replace the U.S. Department of Agriculture's Commodity Exchange Authority,as the independent federal agency responsible for regulating the futures trading industry. The Act made extensive changes in the basic authority of Commodity Exchange Act of 1936,which itself had made extensive changes in the original Grain Futures Act of 1922..

Jill E. Sommers was sworn in as a commissioner of the Commodity Futures Trading Commission on August 8,2007 to a term that expired April 13,2009. She was nominated on July 20,2009 by President Barack Obama to serve a five-year second term.,and confirmed by the United States Senate on October 8,2009.

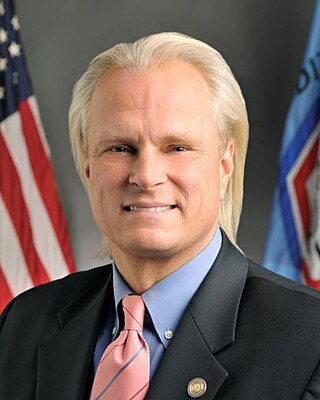

Bartholomew Hamilton Chilton was an American civil servant.

A Swap Execution Facility (SEF) is a platform for financial swap trading that provides pre-trade information and a mechanism for executing swap transactions among eligible participants.

A Commodity pool operator (CPO) is an individual or organization that solicits or receives funds to use in the operation of a commodity pool,syndicate,investment trust,or other similar fund,specifically for trading in commodity interests. Such interests include commodity futures,swaps,options and/or leverage transactions. A commodity pool may refer to funds that trade in commodities and can include hedge funds. A CPO may make trading decisions for a fund or the fund can be managed by one or more independent commodity trading advisors. The definition of CPO may apply to investment advisors for hedge funds and private funds including mutual funds and exchange-traded funds in certain cases. CPOs are generally regulated by the United States federal government through the Commodity Futures Trading Commission and National Futures Association.

A commodity trading advisor (CTA) is US financial regulatory term for an individual or organization who is retained by a fund or individual client to provide advice and services related to trading in futures contracts,commodity options and/or swaps. They are responsible for the trading within managed futures accounts. The definition of CTA may also apply to investment advisors for hedge funds and private funds including mutual funds and exchange-traded funds in certain cases. CTAs are generally regulated by the United States federal government through registration with the Commodity Futures Trading Commission (CFTC) and membership of the National Futures Association (NFA).

A managed futures account (MFA) or managed futures fund (MFF) is a type of alternative investment in the US in which trading in the futures markets is managed by another person or entity,rather than the fund's owner. Managed futures accounts include,but are not limited to,commodity pools. These funds are operated by commodity trading advisors (CTAs) or commodity pool operators (CPOs),who are generally regulated in the United States by the Commodity Futures Trading Commission and the National Futures Association. As of June 2016,the assets under management held by managed futures accounts totaled $340 billion.

H.R. 1003,long title "To improve consideration by the Commodity Futures Trading Commission of the costs and benefits of its regulations and orders" is a bill that was introduced into the United States House of Representatives during the 113th United States Congress. H.R. 1003 would broaden the items for the Commodity Futures Trading Commission (CFTC) to consider when assessing costs and benefits of a proposed regulation. Further,the bill would require the agency to adopt such a regulation only if it determines that the estimated benefits justify the estimated costs.

Brian Kim is an American former hedge fund manager. He founded the now-defunct Liquid Capital Management LLC,which focused on futures trading.

James M. Stone is an American business executive. Jim Stone is the founder of Boston-based Plymouth Rock Assurance Corporation and chief executive of its parent company,The Plymouth Rock Company. Stone was a Lecturer in Economics at Harvard University in the early 1970s and then was the Massachusetts Commissioner of Insurance from 1975 to 1979. He was appointed chairman of the Commodity Futures Trading Commission by President Jimmy Carter,and served on the Commission until 1983. He is a fellow of the American Academy of Arts and Sciences.

Heath Price Tarbert is an American lawyer and former government official who served as the 14th Chairman of the Commodity Futures Trading Commission (CFTC) from 2019 to 2021. He previously served as Assistant Secretary of the Treasury for International Markets and Development and as acting Under Secretary of the Treasury for International Affairs. As of 2023,he is Chief Legal Officer and Head of Corporate Affairs for Circle.

Gregory Doud is an American economist and government official who served as the Chief Agricultural Negotiator in the Office of the United States Trade Representative (USTR) during the Trump Administration. Doud previously served as the president of the Commodity Markets Council. He also served as a staff member for the United States Senate Committee on Agriculture,Nutrition and Forestry and as chief economist for the National Cattlemen's Beef Association.

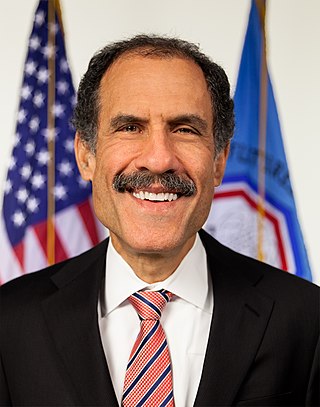

Rostin Behnam(born February 16,1978) is an American lawyer and government official who currently serves as the 15th chairman of the Commodity Futures Trading Commission (CFTC). Prior to leading the CFTC,he served as one of five-member CFTC commissioners,having been nominated on July 13,2017 by President Donald Trump to fulfill a term expiring June 19,2021. Behnam was unanimously confirmed by the Senate on August 3,2017,and sworn in as commissioner on September 6,2017. On January 21,2021,the commission members unanimously elected Behnam to be acting chairman following President Joe Biden' s inauguration and the resignation of Heath Tarbert,who served as chairman since July 15,2019. Behnam was re-nominated by President Biden as a commissioner,and simultaneously nominated to chair the agency for a new 5-year term through June 19,2026. Behnam was unanimously confirmed by the Senate on December 15,2021,and sworn in as CFTC's chairman and chief administrative officer on January 4,2022.

Dan Michael Berkovitz was nominated by President Donald Trump to serve as a commissioner of the Commodity Futures Trading Commission on April 24,2018. He was unanimously confirmed by the Senate on August 28,2018 and sworn into office on September 7,2018 for a five-year term expiring on April 13,2023.

Caroline D. Pham is an American attorney who serves as a commissioner of the Commodity Futures Trading Commission.

Summer Kristine Mersinger is an American attorney who serves as a commissioner of the Commodity Futures Trading Commission.

Robert R. Davis is an American economist and trade association executive. A longtime executive at the American Bankers Association and its predecessor,America's Community Bankers,Davis served for five and a half years as a member of the Commodity Futures Trading Commission.

References

- ↑ "JoinCalifornia - Bill Bagley". www.joincalifornia.com.

- ↑ Committee, United States Congress Senate Agriculture and Forestry (October 16, 1975). "Nominations to the Commodity Futures Trading Commission: Hearing Before ..., 94-1 ..., April 10, 1975" – via Google Books.

- ↑ "Alumnus/a of the Year Recipients". Cal Alumni Association. January 27, 2010.

- ↑ cahighways.org

- ↑ Bagley, William T. (2009-12-22). California's Golden Years: When Government Worked and Why: William T. Bagley: 9780877724346: Amazon.com: Books. ISBN 978-0877724346.

- ↑ "Bill Bagley CFTC Commissioner". cftc.gov.