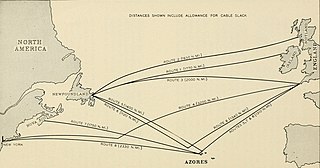

TAT-1 was the first submarine transatlantic telephone cable system. It was laid between Kerrera, Oban, Scotland and Clarenville, Newfoundland. Two cables were laid between 1955 and 1956 with one cable for each direction. It was inaugurated on September 25, 1956. The cable was able to carry 35 simultaneous telephone calls. A 36th channel was used to carry up to 22 telegraph lines.

A transatlantic telecommunications cable is a submarine communications cable connecting one side of the Atlantic Ocean to the other. In the 19th and early 20th centuries, each cable was a single wire. After mid-century, coaxial cable came into use, with amplifiers. Late in the 20th century, all cables installed used optical fiber as well as optical amplifiers, because distances range thousands of kilometers.

The Canadian dollar is the currency of Canada. It is abbreviated with the dollar sign $. There is no standard disambiguating form, but the abbreviations Can$, CA$ and C$ are frequently used for distinction from other dollar-denominated currencies. It is divided into 100 cents (¢).

Transatlantic telegraph cables were undersea cables running under the Atlantic Ocean for telegraph communications. Telegraphy is an obsolete form of communication, and the cables have long since been decommissioned, but telephone and data are still carried on other transatlantic telecommunications cables.

Sterling is the currency of the United Kingdom and nine of its associated territories. The pound is the main unit of sterling, and the word pound is also used to refer to the British currency generally, often qualified in international contexts as the British pound or the pound sterling.

The Hong Kong dollar is the official currency of the Hong Kong Special Administrative Region. It is subdivided into 100 cents or 1000 mils. The Hong Kong Monetary Authority is the monetary authority of Hong Kong and the Hong Kong dollar.

The Central Bank of Malaysia is the Malaysian central bank. Established on 26 January 1959 as the Central Bank of Malaya, its main purpose is to issue currency, act as banker and adviser to the government of Malaysia and regulate the country's financial institutions, credit system and monetary policy. Its headquarters is located in Kuala Lumpur, the federal capital of Malaysia.

The foreign exchange market is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the credit market.

A currency pair is the quotation of the relative value of a currency unit against the unit of another currency in the foreign exchange market. The currency that is used as the reference is called the counter currency, quote currency, or currency and the currency that is quoted in relation is called the base currency or transaction currency.

Foreign exchange fraud is any trading scheme used to defraud traders by convincing them that they can expect to gain a high profit by trading in the foreign exchange market. Currency trading became a common form of fraud in early 2008, according to Michael Dunn of the U.S. Commodity Futures Trading Commission.

The carry of an asset is the return obtained from holding it, or the cost of holding it. For instance, commodities are usually negative carry assets, as they incur storage costs or may suffer from depreciation. But in some circumstances, appropriately hedged commodities can be positive carry assets if the forward/futures market is willing to pay sufficient premium for future delivery. This can also refer to a trade with more than one leg, where you earn the spread between borrowing a low carry asset and lending a high carry one; such as gold during financial crisis, due to its safe haven quality.

In foreign exchange markets, a percentage in point (pip) is a unit of change in an exchange rate of a currency pair.A pip is the smallest whole unit price move that an exchange rate can make, based on forex market convention.

The interbank market is the top-level foreign exchange market where banks exchange different currencies. The banks can either deal with one another directly, or through electronic brokering platforms. The Electronic Broking Services (EBS) and Thomson Reuters Dealing are the two competitors in the electronic brokering platform business and together connect over 1000 banks. The currencies of most developed countries have floating exchange rates. These currencies do not have fixed values but, rather, values that fluctuate relative to other currencies.

Retail foreign exchange trading is a small segment of the larger foreign exchange market where individuals speculate on the exchange rate between different currencies. This segment has developed with the advent of dedicated electronic trading platforms and the internet, which allows individuals to access the global currency markets. As of 2016, it was reported that retail foreign exchange trading represented 5.5% of the whole foreign exchange market.

Currency strength expresses the value of currency. For economists, it is often calculated as purchasing power, while for financial traders, it can be described as an indicator, reflecting many factors related to the currency; for example, fundamental data, overall economic performance (stability) or interest rates. It can also be calculated from currency in relation to other currencies, usually using a pre-defined currency basket. A typical example of this method is the U.S. Dollar Index (USDX).

A currency basket is a portfolio of selected currencies with different weightings. A currency basket is commonly used by investors to minimize the risk of currency fluctuations and also governments when setting the market value of a country's currency.

The Wall Street Journal Dollar Index is an index of the value of the U.S. dollar relative to 16 foreign currencies.

The forex scandal is a 2013 financial scandal that involves the revelation, and subsequent investigation, that banks colluded for at least a decade to manipulate exchange rates on the forex market for their own financial gain. Market regulators in Asia, Switzerland, the United Kingdom, and the United States began to investigate the $4.7 trillion per day foreign exchange market (forex) after Bloomberg News reported in June 2013 that currency dealers said they had been front-running client orders and rigging the foreign exchange benchmark WM/Reuters rates by colluding with counterparts and pushing through trades before and during the 60-second windows when the benchmark rates are set. The behavior occurred daily in the spot foreign-exchange market and went on for at least a decade according to currency traders.

In foreign exchange market, synthetic currency pair or synthetic cross currency pair is an artificial currency pair which generally is not available in market but one needs to trade across those pairs. One highly traded currency, usually United States dollar, which trades with the target currencies, is taken as intermediary currency and offsetting positions are taken on target currencies. The use of synthetic cross currency pairs has become less common with wide availability of most common currency pairs in the market.