Related Research Articles

A nonprofit organization (NPO), also known as a nonbusiness entity, nonprofit institution, or simply a nonprofit, is a legal entity organized and operated for a collective, public or social benefit, as opposed to an entity that operates as a business aiming to generate a profit for its owners. A nonprofit organization is subject to the non-distribution constraint: any revenues that exceed expenses must be committed to the organization's purpose, not taken by private parties. Depending on the local laws, charities are regularly organized as non-profits. A host of organizations may be nonprofit, including some political organizations, schools, hospitals, business associations, churches, foundations, social clubs, and consumer cooperatives. Nonprofit entities may seek approval from governments to be tax-exempt, and some may also qualify to receive tax-deductible contributions, but an entity may incorporate as a nonprofit entity without having tax-exempt status.

Neal A Boortz Jr. is an American author, former attorney, and former libertarian radio host. His nationally syndicated talk show, The Neal Boortz Show, which ended in 2013, was carried throughout the United States. The content of the show included politics, current events, social issues, and topics of interest, which Boortz discussed with callers, correspondents, and guests. Boortz touched on many controversial topics.

James Arthur Gibbons is an American attorney, aviator, geologist, hydrologist and politician who was the 28th Governor of Nevada from 2007 to 2011. A member of the Republican Party, he previously served as the U.S. representative for Nevada's 2nd congressional district from 1997 to 2006.

FairTax is a single rate tax proposal which has been proposed as a bill in the United States Congress regularly since 2005 that includes complete dismantling of the Internal Revenue Service. The proposal would eliminate all federal income taxes, payroll taxes, gift taxes, and estate taxes, replacing them with a single consumption tax on retail sales.

Operation Snow White was a criminal conspiracy by the Church of Scientology during the 1970s to purge unfavorable records about Scientology and its founder, L. Ron Hubbard. This project included a series of infiltrations into and thefts from 136 government agencies, foreign embassies and consulates, as well as private organizations critical of Scientology, carried out by Church members in more than 30 countries. It was one of the largest infiltrations of the United States government in history, with up to 5,000 covert agents. This operation also exposed the Scientology plot "Operation Freakout", because Operation Snow White was the case that initiated the U.S. government's investigation of the Church.

Bruce Reeves Bartlett is an American historian and author. He served as a domestic policy adviser to Ronald Reagan and as a Treasury official under George H. W. Bush. Bartlett also writes for the New York Times Economix blog.

The Church of Scientology is a group of interconnected corporate entities and other organizations devoted to the practice, administration and dissemination of Scientology, which is variously defined as a cult, a business, or a new religious movement. The movement has been the subject of a number of controversies, and the Church of Scientology has been described by government inquiries, international parliamentary bodies, scholars, law lords, and numerous superior court judgements as both a dangerous cult and a manipulative profit-making business. In 1979, several executives of the organization were convicted and imprisoned for multiple offenses by a U.S. Federal Court. The Church of Scientology itself was convicted of fraud by a French court in 2009, a decision upheld by the supreme Court of Cassation in 2013. The German government classifies Scientology as an unconstitutional sect. In France, it has been classified as a dangerous cult. In some countries, it has attained legal recognition as a religion.

Mark C. "Marty" Rathbun is a former senior executive of the Church of Scientology who last held the post of Inspector General of the Religious Technology Center (RTC), the organization that is responsible for the protection and enforcement of all Dianetics and Scientology copyrights and trademarks.

The United States federal government and most state governments impose an income tax. They are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed, but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. Most business expenses are deductible. Individuals may deduct certain personal expenses, including home mortgage interest, state taxes, contributions to charity, and some other items. Some deductions are subject to limits, and an Alternative Minimum Tax (AMT) applies at the federal and some state levels.

Americans For Fair Taxation (AFFT), also known as FairTax.org, is a U.S. political advocacy group based in Clearwater, Florida that is dedicated to fundamental tax code replacement. It is made up of volunteers who are working to get the Fair Tax Act enacted in the United States – a plan to replace all federal payroll and income taxes with a national retail sales tax and monthly tax "prebate" to households of citizens and legal resident aliens.

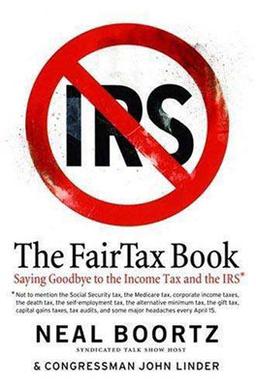

The FairTax Book is a non-fiction book by libertarian radio talk show host Neal Boortz and Congressman John Linder, published on August 2, 2005, as a tool to increase public support and understanding for the FairTax plan. Released by ReganBooks, the hardcover version held the #1 spot on the New York Times Best Seller list for the last two weeks of August 2005 and remained in the top ten for seven weeks. The paperback reprint of the book in May 2006 contains additional information and an afterword. It also spent several weeks on the New York Times Best Seller list. Boortz stated that he donates his share of the proceeds to charity to promote the book.

Hubbard College of Administration International (HCA) is a school that teaches the administration methods developed by L. Ron Hubbard for the Church of Scientology.

The Fair Tax Act is a bill in the United States Congress for changing tax laws to replace the Internal Revenue Service (IRS) and all federal income taxes, payroll taxes, corporate taxes, capital gains taxes, gift taxes, and estate taxes with a national retail sales tax, to be levied once at the point of purchase on all new goods and services. The proposal also calls for a monthly payment to households of citizens and legal resident aliens as an advance rebate of tax on purchases up to the poverty level. The impact of the FairTax on the distribution of the tax burden is a point of dispute. The plan's supporters argue that it would decrease tax burdens, broaden the tax base, be progressive, increase purchasing power, and tax wealth, while opponents argue that a national sales tax would be inherently regressive and would decrease tax burdens paid by high-income individuals.

Recognition of Scientology and the Church of Scientology varies from country to country with respect to state recognition for religious status, charitable status, or tax exempt status. Decisions are contingent upon the legal constructs of each individual country, and results are not uniform worldwide. For example, the absence of a clear definition for 'religion' or 'religious worship' has resulted in unresolved and uncertain status for Scientology in some countries.

Scientology is a set of beliefs and practices invented by the American author L. Ron Hubbard, and an associated movement. It is variously defined as a cult, a business, a religion, a scam, or a new religious movement. Hubbard initially developed a set of ideas that he called Dianetics, which he represented as a form of therapy. An organization that he established in 1950 to promote it went bankrupt, and Hubbard lost the rights to his book Dianetics in 1952. He then recharacterized his ideas as a religion, likely for tax purposes, and renamed them Scientology. By 1954, he had regained the rights to Dianetics and founded the Church of Scientology, which remains the largest organization promoting Scientology. There are practitioners independent of the Church, in what is referred to as the Free Zone. Estimates put the number of Scientologists at under 40,000 worldwide.

Tax protester arguments are arguments made by people, primarily in the United States, who contend that tax laws are unconstitutional or otherwise invalid.

Scientology was founded in the United States by science fiction author L. Ron Hubbard and is now practiced in many other countries.

The Church of Scientology International (CSI) is a California 501(c)(3) non-profit corporation. Within the worldwide network of Scientology corporations and entities, CSI is officially referred to as the "mother church" of the Church of Scientology.

The tax status of the Church of Scientology in the United States has been the subject of decades of controversy and litigation. Although the Church of Scientology was initially partially exempted by the Internal Revenue Service (IRS) from paying federal income tax, its two principal entities in the United States lost this exemption in 1957 and 1968. This action was taken because of concerns that church funds were being used for the private gain of its founder L. Ron Hubbard or due to an international psychiatric conspiracy against Scientology.

Scientology front groups are those groups named or operated in such a way as to disguise their association with the Church of Scientology (COS). COS uses front groups to promote its interests in politics, to make itself appear legitimate, and to recruit. The Times published, "[The church attracts] the unwary through a wide array of front groups in such businesses as publishing, consulting, health care and even remedial education." Many of the groups are founded on pseudoscience, named disingenuously, and underplay their links to Scientology.

References

- ↑ "CATS Las Vegas". Archived from the original on July 10, 2011. Retrieved July 12, 2011.

- ↑ "Declaration of Vic and Vicki Krohn". Moving On Up a Little Higher . October 31, 2012.

- ↑ Boortz, Neal (August 29, 2007). "On the Fairtax / Scientology Connection". boortz.com. Archived from the original on August 29, 2007.

- 1 2 Galloway, Jim; Kemper, Bob (August 28, 2007). "On John Linder and Scientology". The Atlanta Journal-Constitution. Archived from the original on September 30, 2007.

- ↑ Bartlett, Bruce (August 26, 2007). "Fair Tax, Flawed Tax". The Wall Street Journal. Archived from the original on August 30, 2007.

- 1 2 Bartlett, Bruce (September 7, 2007). "Scientology's Fair Tax Plot". CBS News . Archived from the original on November 4, 2012. Retrieved July 12, 2011.

- ↑

- "CATS History". Citizens for an Alternative Tax System. Archived from the original on December 6, 2006.

- "Chapters". CATS. Archived from the original on April 18, 2001.