The Federal Farm Loan Act of 1916 was a United States federal law aimed at increasing credit to rural family farmers. It did so by creating a federal farm loan board, twelve regional farm loan banks and tens of farm loan associations. The act was signed into law by President of the United States Woodrow Wilson.

The Farm Credit Administration is an independent agency of the federal government of the United States. Its function is to regulate the financial institutions that provide credit to farmers.

A cooperative is "an autonomous association of persons united voluntarily to meet their common economic, social and cultural needs and aspirations through a jointly owned and democratically-controlled enterprise". Cooperatives are democratically controlled by their members, with each member having one vote in electing the board of directors. Cooperatives may include:

Crédit Agricole Group, sometimes called La banque verte, is a French international banking group and the world's largest cooperative financial institution. It is second largest bank in France, after BNP Paribas, as well as the third largest in Europe and tenth largest in the world. It consists of a network of Crédit Agricole local banks, 390 millionédit Agricole regional banks and a central institute, the Crédit Agricole S.A.. It is listed through Crédit Agricole S.A., as an intermediate holding company, on Euronext Paris' first market and is part of the CAC 40 stock market index. Local banks of the group owned the regional banks, in turn the regional banks majority owned the S.A. via a holding company, in turn the S.A. owned part of the subsidiaries of the group, such as LCL, the Italian network and the CIB unit. It is considered to be a systemically important bank by the Financial Stability Board.

Rabobank is a Dutch multinational banking and financial services company headquartered in Utrecht, Netherlands. The group comprises 89 local Dutch Rabobanks (2019), a central organisation, and many specialised international offices and subsidiaries. Food and agribusiness constitute the primary international focus of the Rabobank Group. Rabobank is the second-largest bank in the Netherlands in terms of total assets.

Land Bank of the Philippines, is a government-owned bank in the Philippines with a special focus on serving the needs of farmers and fishermen. While it provides the services of a universal bank, it is officially classified as a "specialized government bank" with a universal banking license.

Modern banking in India originated in the mid of 18th century. Among the first banks were the Bank of Hindustan, which was established in 1770 and liquidated in 1829–32; and the General Bank of India, established in 1786 but failed in 1791.

An agricultural cooperative, also known as a farmers' co-op, is a producer cooperative in which farmers pool their resources in certain areas of activity.

Caisse populaire acadienne ltée, operating as UNI Financial Cooperation, is a Francophone credit union based in New Brunswick, Canada whose members are primarily Acadians. UNI's administrative headquarters are in Caraquet on the Acadian Peninsula.

The United Kingdom is home to a widespread and diverse co-operative movement, with over 7,000 registered co-operatives owned by 17 million individual members and which contribute £34bn a year to the British economy. Modern co-operation started with the Rochdale Pioneers' shop in the northern English town of Rochdale in 1844, though the history of co-operation in Britain can be traced back to before 1800. The British co-operative movement is most commonly associated with The Co-operative brand which has been adopted by several large consumers' co-operative societies; however, there are many thousands of registered co-operative businesses operating in the UK. Alongside these consumers' co-operatives, there exist many prominent agricultural co-operatives (621), co-operative housing providers (619), health and social care cooperatives (111), cooperative schools (834), retail co-operatives, co-operatively run community energy projects, football supporters' trusts, credit unions, and worker-owned businesses.

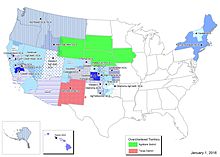

The Farm Credit System (FCS) in the United States is a nationwide network of borrower-owned lending institutions and specialized service organizations. The Farm Credit System provides more than $343 billion in loans, leases, and related services to farmers, ranchers, rural homeowners, aquatic producers, timber harvesters, agribusinesses, and agricultural and rural utility cooperatives.

AgFirst, part of the US Farm Credit System, serves as a wholesale lender and business-service provider to a network of local farm credit associations in 15 southern and eastern states, Washington, D.C., and Puerto Rico. It was formed in 1995 by the merger of the Farm Credit Bank of Baltimore and the Farm Credit Bank of Columbia. The lender is cooperatively owned by 16 local associations. These associations, operating as Farm Credit and Ag Credit associations, provide real estate and production financing to about 80,000 farmers, agribusinesses, and rural homeowners.

Farm Credit Bank of Texas, part of the US Farm Credit System, serves as a wholesale lender and business-service provider to 14 local borrower-owned Farm Credit associations in Alabama, Louisiana, Mississippi, New Mexico and Texas.

Cooperative banking is retail and commercial banking organized on a cooperative basis. Cooperative banking institutions take deposits and lend money in most parts of the world.

National Bank for Agriculture and Rural Development (NABARD) is an apex regulatory body for overall regulation of regional rural banks and apex cooperative banks in India. It is under the jurisdiction of Ministry of Finance, Government of India. The bank has been entrusted with "matters concerning policy, planning, and operations in the field of credit for agriculture and other economic activities in rural areas in India". NABARD is active in developing and implementing financial inclusion.

The history of the cooperative movement concerns the origins and history of cooperatives across the world. Although cooperative arrangements, such as mutual insurance, and principles of cooperation existed long before, the cooperative movement began with the application of cooperative principles to business organization.

AgStar Financial Services is a US Farm Credit System Agricultural Credit Association (ACA) that delivers a wide range of farm and rural credit programs and services in 67 counties located in Minnesota and northwest Wisconsin. AgStar provides financial products including agricultural loans, leases, crop insurance, life insurance, and home mortgages. The financial services offered include appraisals, money market accounts, online banking, and other consulting services.

Fish Legal, based at Leominster, Herefordshire, is a not-for-profit organisation of dedicated lawyers who use the law on behalf of anglers to fight polluters and others who damage or threaten the water environment. It was founded in 1948 by Patrick Shumack, Esq. as the Anglers Cooperative Association (ACA), but changed its name in 1994 to Anglers Conservation Association.

The Farm Credit Act of 1971 recodified all previous acts governing the Farm Credit System (FCS), a cooperatively owned government-sponsored enterprise (GSE) that provides credit primarily to farmers and ranchers.