The Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System.

The monetary policy of the United States is the set of policies which the Federal Reserve follows to achieve its twin objectives of high employment and stable inflation.

A Federal Reserve Bank is a regional bank of the Federal Reserve System, the central banking system of the United States. There are twelve in total, one for each of the twelve Federal Reserve Districts that were created by the Federal Reserve Act of 1913. The banks are jointly responsible for implementing the monetary policy set forth by the Federal Open Market Committee, and are divided as follows:

Paul Adolph Volcker Jr. was an American economist who served as the 12th chairman of the Federal Reserve from 1979 to 1987. During his tenure as chairman, Volcker was widely credited with having ended the high levels of inflation seen in the United States throughout the 1970s and early 1980s, with measures known as the Volcker shock. He previously served as the president of the Federal Reserve Bank of New York from 1975 to 1979.

In the United States, the federal funds rate is the interest rate at which depository institutions lend reserve balances to other depository institutions overnight on an uncollateralized basis. Reserve balances are amounts held at the Federal Reserve. Institutions with surplus balances in their accounts lend those balances to institutions in need of larger balances. The federal funds rate is an important benchmark in financial markets and central to the conduct of monetary policy in the United States as it influences a wide range of market interest rates.

Reserve requirements are central bank regulations that set the minimum amount that a commercial bank must hold in liquid assets. This minimum amount, commonly referred to as the commercial bank's reserve, is generally determined by the central bank on the basis of a specified proportion of deposit liabilities of the bank. This rate is commonly referred to as the cash reserve ratio or shortened as reserve ratio. Though the definitions vary, the commercial bank's reserves normally consist of cash held by the bank and stored physically in the bank vault, plus the amount of the bank's balance in that bank's account with the central bank. A bank is at liberty to hold in reserve sums above this minimum requirement, commonly referred to as excess reserves.

Excess reserves are bank reserves held by a bank in excess of a reserve requirement for it set by a central bank.

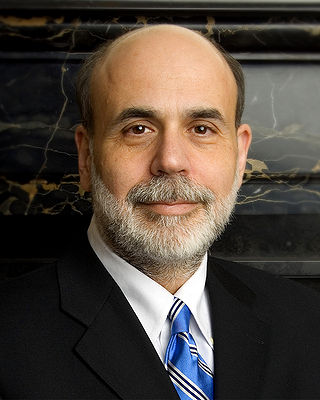

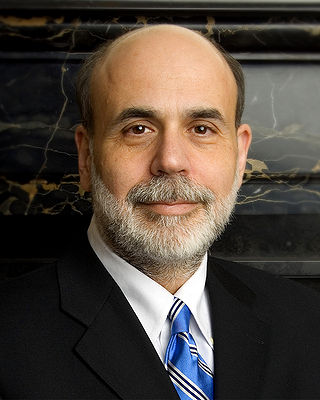

Ben Shalom Bernanke is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014. After leaving the Federal Reserve, he was appointed a distinguished fellow at the Brookings Institution. During his tenure as chairman, Bernanke oversaw the Federal Reserve's response to the 2007–2008 financial crisis, for which he was named the 2009 Time Person of the Year. Before becoming Federal Reserve chairman, Bernanke was a tenured professor at Princeton University and chaired the Department of Economics there from 1996 to September 2002, when he went on public service leave. Bernanke was awarded the 2022 Nobel Memorial Prize in Economic Sciences, jointly with Douglas Diamond and Philip H. Dybvig, "for research on banks and financial crises", more specifically for his analysis of the Great Depression.

The Federal Reserve Bank of Atlanta,, is the sixth district of the 12 Federal Reserve Banks of the United States and is headquartered in midtown Atlanta, Georgia.

The National Fed Challenge is an academic competition that provides high school students with an insider's view of how the United States central bank, the Federal Reserve, makes monetary policy.

Frederic Stanley "Rick" Mishkin is an American economist and Alfred Lerner professor of Banking and Financial Institutions at the Graduate School of Business, Columbia University. He was a member of the Federal Reserve Board of Governors from 2006 to 2008.

Jeffrey M. Lacker is an American economist and was president of the Federal Reserve Bank of Richmond until April 4, 2017. He was a Distinguished Professor in the Department of Economics at the Virginia Commonwealth University School of Business in Richmond, Virginia.

Thomas Michael Hoenig is a Distinguished Senior Fellow at the Mercatus Center. He became a director of the Federal Deposit Insurance Corporation on April 16, 2012, and served as vice chairman from November 30, 2012 to April 30, 2018. From 1991 to 2011, he served as the eighth chief executive of the Tenth District Federal Reserve Bank, in Kansas City, United States. In 2010, he was serving as a voting member of the Federal Open Market Committee, as one of five of the twelve Federal Reserve Bank presidents that sit on the Committee on a yearly rotating basis. He is known as an "anti-inflation hawk".

The Term Auction Facility (TAF) was a temporary program managed by the United States Federal Reserve designed to "address elevated pressures in short-term funding markets." Under the program the Fed auctions collateralized loans with terms of 28 and 84 days to depository institutions that are "in generally sound financial condition" and "are expected to remain so over the terms of TAF loans." Eligible collateral is the same as that accepted for discount window loans and includes a wide range of financial assets. The program was instituted in December 2007 in response to problems associated with the subprime mortgage crisis and was motivated by a desire to address a widening spread between interest rates on overnight and term interbank lending, indicating a retreat from risk-taking by banks. The action was in coordination with simultaneous and similar initiatives undertaken by the Bank of Canada, the Bank of England, the European Central Bank and the Swiss National Bank.

Lael Brainard is an American economist serving as the 14th director of the National Economic Council since February 21, 2023. She previously served as the 22nd vice chair of the Federal Reserve between May 2022 and February 2023. Prior to her term as vice chair, Brainard served as a member of the Federal Reserve Board of Governors, taking office in 2014. Before her appointment to the Federal Reserve, she served as the under secretary of the treasury for international affairs from 2010 to 2013.

The U.S. central banking system, the Federal Reserve, in partnership with central banks around the world, took several steps to address the subprime mortgage crisis. Federal Reserve Chairman Ben Bernanke stated in early 2008: "Broadly, the Federal Reserve’s response has followed two tracks: efforts to support market liquidity and functioning and the pursuit of our macroeconomic objectives through monetary policy." A 2011 study by the Government Accountability Office found that "on numerous occasions in 2008 and 2009, the Federal Reserve Board invoked emergency authority under the Federal Reserve Act of 1913 to authorize new broad-based programs and financial assistance to individual institutions to stabilize financial markets. Loans outstanding for the emergency programs peaked at more than $1 trillion in late 2008."

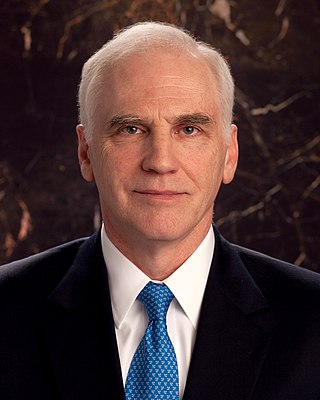

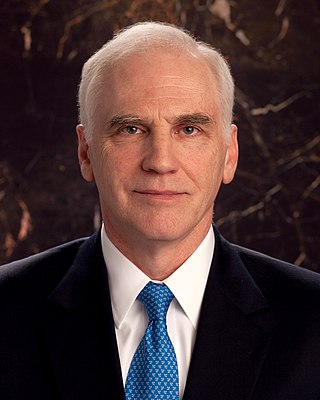

Daniel K. Tarullo is an American law professor who served as a member of the Federal Reserve Board of Governors from 2009 to 2017. Tarullo concurrently served as the chairman of the Federal Financial Institutions Examination Council (FFIEC). In February 2017, he announced his intention to resign from the Board of Governors in early April 2017.

The Federal Reserve Bank of Richmond Baltimore Branch Office is one of the two Federal Reserve Bank of Richmond branch offices. The Federal Reserve Bank of Richmond's Baltimore Branch is an operational and regional center for Maryland, the metropolitan Washington D.C. area, Northern Virginia, and northeastern West Virginia. The Baltimore branch is part of the Fifth District and has the code E5. It supports Check 21 operations, supplies coin and currency to financial institutions and works to maintain stability in the financial sector throughout the Fifth District and also works with local elected officials and non-profit organizations to support fair housing initiatives throughout the Fifth District. The Baltimore branch was founded in March 1918 and is currently headed by William R. Roberts.

The Structure of the Federal Reserve System is unique among central banks in the world, with both public and private aspects. It is described as "independent within the government" rather than "independent of government".

Robert P. Black, a native of Hickman, Kentucky, was the fifth president (1973–1992) of the Federal Reserve Bank of Richmond, the headquarters of the Fifth District of the Federal Reserve System. He was preceded in that position by Aubrey N. Heflin and succeeded by J. Alfred Broaddus (1993–2004) and Jeffrey Lacker.