Federal Reserve Seal | |

Headquarters | |

| Headquarters | Federal Reserve Bank Building 600 Atlantic Avenue Boston, Massachusetts, U.S. |

|---|---|

| Established | May 18, 1914 |

| President | Susan Collins |

| Central bank of | First District |

| Preceded by | Eric S. Rosengren |

| Succeeded by | Susan Collins |

| Website | bostonfed.org |

| The Federal Reserve Bank of Boston is one of twelve regional banks that make up the Federal Reserve System | |

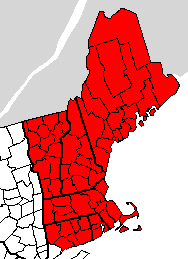

The Federal Reserve Bank of Boston, commonly known as the Boston Fed, is responsible for the First District of the Federal Reserve, which covers New England: Maine, Massachusetts, New Hampshire, Rhode Island, Vermont and all of Connecticut except Fairfield County. [1] [2] [3] The code of the Bank is A1, meaning that dollar bills from this Bank will have the letter A on them. The Boston Fed describes its mission as promoting "growth and financial stability in New England and the nation". [4] The Boston Fed also includes the New England Public Policy Center. [5]

Contents

- Board of directors

- Class A

- Class B

- Class C

- Governors and presidents

- Image gallery

- See also

- References

- External links

Current Federal Reserve Bank of Boston president is Susan Collins, who is the first Black woman and the first woman of color to lead any of the 12 regional Federal bank branches. [6]

It has been headquartered since 1977 in the distinctive 614-foot (187 m) tall, 32-story Federal Reserve Bank Building at 600 Atlantic Avenue, Boston. Designed by architecture firm Hugh Stubbins & Associates, the tower portion of the building is suspended between two towers on either side. From 1922 to 1977, the bank's headquarters were located at 250 Franklin Street, currently occupied by the Langham Hotel Boston. This building was designated a Boston Landmark by the Boston Landmarks Commission in 1978.