The Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System.

In macroeconomics, money supply refers to the total volume of money held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include currency in circulation and demand deposits. Money supply data is recorded and published, usually by the national statistical agency or the central bank of the country. Empirical money supply measures are usually named M1, M2, M3, etc., according to how wide a definition of money they embrace. The precise definitions vary from country to country, in part depending on national financial institutional traditions.

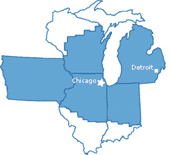

A Federal Reserve Bank is a regional bank of the Federal Reserve System, the central banking system of the United States. There are twelve in total, one for each of the twelve Federal Reserve Districts that were created by the Federal Reserve Act of 1913. The banks are jointly responsible for implementing the monetary policy set forth by the Federal Open Market Committee, and are divided as follows:

The Federal Open Market Committee (FOMC) is a committee within the Federal Reserve System that is charged under United States law with overseeing the nation's open market operations. This Federal Reserve committee makes key decisions about interest rates and the growth of the United States money supply. Under the terms of the original Federal Reserve Act, each of the Federal Reserve banks was authorized to buy and sell in the open market bonds and short term obligations of the United States Government, bank acceptances, cable transfers, and bills of exchange. Hence, the reserve banks were at times bidding against each other in the open market. In 1922, an informal committee was established to execute purchases and sales. The Banking Act of 1933 formed an official FOMC.

Reserve requirements are central bank regulations that set the minimum amount that a commercial bank must hold in liquid assets. This minimum amount, commonly referred to as the commercial bank's reserve, is generally determined by the central bank on the basis of a specified proportion of deposit liabilities of the bank. This rate is commonly referred to as the cash reserve ratio or shortened as reserve ratio. Though the definitions vary, the commercial bank's reserves normally consist of cash held by the bank and stored physically in the bank vault, plus the amount of the bank's balance in that bank's account with the central bank. A bank is at liberty to hold in reserve sums above this minimum requirement, commonly referred to as excess reserves.

In the United States, federal funds are overnight borrowings between banks and other entities to maintain their bank reserves at the Federal Reserve. Banks keep reserves at Federal Reserve Banks to meet their reserve requirements and to clear financial transactions. Transactions in the federal funds market enable depository institutions with reserve balances in excess of reserve requirements to lend reserves to institutions with reserve deficiencies. These loans are usually made for one day only, that is, "overnight". The interest rate at which these transactions occur is called the federal funds rate. Federal funds are not collateralized; like eurodollars, they are an unsecured interbank loan.

The Federal Reserve Bank of San Francisco is the federal bank for the twelfth district in the United States. The twelfth district is made up of nine western states—Alaska, Arizona, California, Hawaii, Idaho, Nevada, Oregon, Utah, and Washington—plus the Northern Mariana Islands, American Samoa, and Guam. The San Francisco Fed has branch offices in Los Angeles, Portland, Salt Lake City, and Seattle. It also has a cash processing center in Phoenix.

The Federal Reserve Bank of New York is one of the 12 Federal Reserve Banks of the United States. It is responsible for the Second District of the Federal Reserve System, which encompasses the State of New York, the 12 northern counties of New Jersey, Fairfield County in Connecticut, Puerto Rico, and the U.S. Virgin Islands. Located at 33 Liberty Street in Lower Manhattan, it is the largest, the most active, and the most influential of the Reserve Banks.

The Federal Reserve Bank of Kansas City is located in Kansas City, Missouri, and covers the 10th District of the Federal Reserve, which includes Colorado, Kansas, Nebraska, Oklahoma, Wyoming, and portions of western Missouri and northern New Mexico. It is second only to the Federal Reserve Bank of San Francisco in size of geographic area served. Missouri is the only state with two main Federal Reserve Banks; the other is located in St. Louis.

The Federal Reserve Bank of St. Louis is one of 12 regional Reserve Banks that, along with the Board of Governors in Washington, D.C., make up the United States' central bank. Missouri is the only state to have two main Federal Reserve Banks.

The Federal Reserve Bank of Cleveland is the Cleveland-based headquarters of the U.S. Federal Reserve System's Fourth District. The district is composed of Ohio, western Pennsylvania, eastern Kentucky, and the northern panhandle of West Virginia. It has branch offices in Cincinnati and Pittsburgh. The check processing center in Columbus, Ohio, was closed in 2005. The interim chief executive officer and president is Mark Meder. Since August 21, 2024, Beth M. Hammack has been serving as the bank's chief executive officer and president.

The Federal Reserve Bank of Dallas covers the Eleventh Federal Reserve District of the United States, which includes Texas, northern Louisiana and southern New Mexico, a district sometimes referred to as the Oil Patch. The Federal Reserve Bank of Dallas is one of 12 regional Reserve Banks that, along with the Board of Governors in Washington, D.C., make up the U.S. central bank. The Dallas Fed is the only one where all external branches reside in the same state . The Dallas Fed has branch offices in El Paso, Houston, and San Antonio. The Dallas bank is located at 2200 Pearl St. in the Uptown neighborhood of Oak Lawn, just north of downtown Dallas and the Dallas Arts District. Prior to 1992, the bank was located at 400 S. Akard Street, in the Government District in Downtown Dallas. The older Dallas Fed building, which opened in 1921, was built in the Beaux-arts style, with large limestone structure with massive carved eagles and additional significant detailing; it is a City of Dallas Designated Landmark structure. The current Dallas Fed building, opened in September 1992, was designed by three architectural firms: Kohn Pedersen Fox Associates, New York; Sikes Jennings Kelly & Brewer, Houston; and John S. Chase, FAIA, Dallas and Houston, Dallas-based Austin Commercial Inc. served as project manager and general contractor.

The Federal Reserve Bank of Atlanta,, is the sixth district of the 12 Federal Reserve Banks of the United States and is headquartered in midtown Atlanta, Georgia.

Austan Dean Goolsbee is an American economist and writer. He is the president of the Federal Reserve Bank of Chicago. Goolsbee formerly served as the Robert P. Gwinn Professor of Economics at the University of Chicago's Booth School of Business. He was the chairman of the Council of Economic Advisers from 2010 to 2011 and a member of President Barack Obama's cabinet. He served as a member of the Chicago Board of Education from 2018 to 2019.

The Federal Reserve Bank of Chicago Detroit Branch Building, commonly called the Federal Reserve Building, is a bank building located at 160 West Fort Street in downtown Detroit, Michigan. It was listed on the National Register of Historic Places in 2008.

The Federal Reserve Bank of Richmond Baltimore Branch Office is one of the two Federal Reserve Bank of Richmond branch offices. The Federal Reserve Bank of Richmond's Baltimore Branch is an operational and regional center for Maryland, the metropolitan Washington D.C. area, Northern Virginia, and northeastern West Virginia. The Baltimore branch is part of the Fifth District and has the code E5. It supports Check 21 operations, supplies coin and currency to financial institutions and works to maintain stability in the financial sector throughout the Fifth District and also works with local elected officials and non-profit organizations to support fair housing initiatives throughout the Fifth District. The Baltimore branch was founded in March 1918 and is currently headed by William R. Roberts.

The Federal Reserve Bank of Chicago Detroit Branch Office is the only branch office of the Federal Reserve Bank of Chicago. It is part of the 7th district and its code is 7-G. It is currently located at 1600 East Warren Avenue, near I-75 in Detroit's Eastern Market Historic District. The office occupies 17 acres (6.9 ha) and cost $80 million to build. The Detroit branch was founded in 1927 and is currently headed by Robert Wiley. Each branch of the Federal Reserve Banks has a board of either seven or five directors, a majority of whom are appointed by the parent Federal Reserve Bank; the others are appointed by the Board of Governors. Branch directors serve staggered three-year terms. One of the members appointed by the Federal Reserve Board is designated annually as chairman of the board of that Branch in a manner prescribed by the parent Federal Reserve Bank.

The Federal Reserve Bank of Kansas City Denver Branch is second largest of three branches of the Federal Reserve Bank of Kansas City. The Denver branch opened January 14, 1918 on 17th Street before moving in 1968 to the 16th Street Mall.

The Federal Reserve Bank Building, also known as the Federal Reserve Bank of San Francisco, Seattle Branch, served as the offices of the Seattle branch of the Federal Reserve Bank of San Francisco for over 50 years, from 1951 to 2008.

The real bills doctrine says that as long as bankers lend to businessmen only against the security (collateral) of short-term 30-, 60-, or 90-day commercial paper representing claims to real goods in the process of production, the loans will be just sufficient to finance the production of goods. The doctrine seeks to have real output determine its own means of purchase without affecting prices. Under the real bills doctrine, there is only one policy role for the central bank: lending commercial banks the necessary reserves against real customer bills, which the banks offer as collateral. The term "real bills doctrine" was coined by Lloyd Mints in his 1945 book, A History of Banking Theory. The doctrine was previously known as "the commercial loan theory of banking".