Related Research Articles

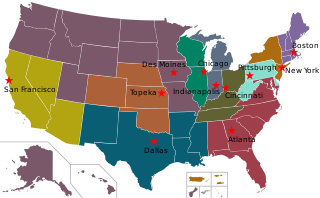

The Federal Reserve System is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System.

A repurchase agreement, also known as a repo, RP, or sale and repurchase agreement, is a form of short-term borrowing, mainly in government securities. The dealer sells the underlying security to investors and, by agreement between the two parties, buys them back shortly afterwards, usually the following day, at a slightly higher price.

The Bear Stearns Companies, Inc. was a New York-based global investment bank, securities trading and brokerage firm that failed in 2008 as part of the global financial crisis and recession, and was subsequently sold to JPMorgan Chase. The company's main business areas before its failure were capital markets, investment banking, wealth management, and global clearing services, and it was heavily involved in the subprime mortgage crisis.

In the United States, federal funds are overnight borrowings between banks and other entities to maintain their bank reserves at the Federal Reserve. Banks keep reserves at Federal Reserve Banks to meet their reserve requirements and to clear financial transactions. Transactions in the federal funds market enable depository institutions with reserve balances in excess of reserve requirements to lend reserves to institutions with reserve deficiencies. These loans are usually made for one day only, that is, "overnight". The interest rate at which these deals are done is called the federal funds rate. Federal funds are not collateralized; like eurodollars, they are an unsecured interbank loan.

A mortgage-backed security (MBS) is a type of asset-backed security which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals that securitizes, or packages, the loans together into a security that investors can buy. Bonds securitizing mortgages are usually treated as a separate class, termed residential; another class is commercial, depending on whether the underlying asset is mortgages owned by borrowers or assets for commercial purposes ranging from office space to multi-dwelling buildings.

The Federal Home Loan Banks are 11 U.S. government-sponsored banks that provide liquidity to the members of financial institutions to support housing finance and community investment.

The discount window is an instrument of monetary policy that allows eligible institutions to borrow money from the central bank, usually on a short-term basis, to meet temporary shortages of liquidity caused by internal or external disruptions. The term originated with the practice of sending a bank representative to a reserve bank teller window when a bank needed to borrow money.

The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 2007–2008 global financial crisis. It was triggered by a large decline in US home prices after the collapse of a housing bubble, leading to mortgage delinquencies, foreclosures, and the devaluation of housing-related securities. Declines in residential investment preceded the Great Recession and were followed by reductions in household spending and then business investment. Spending reductions were more significant in areas with a combination of high household debt and larger housing price declines.

The Term Auction Facility (TAF) was a temporary program managed by the United States Federal Reserve designed to "address elevated pressures in short-term funding markets." Under the program the Fed auctions collateralized loans with terms of 28 and 84 days to depository institutions that are "in generally sound financial condition" and "are expected to remain so over the terms of TAF loans." Eligible collateral is the same as that accepted for discount window loans and includes a wide range of financial assets. The program was instituted in December 2007 in response to problems associated with the subprime mortgage crisis and was motivated by a desire to address a widening spread between interest rates on overnight and term interbank lending, indicating a retreat from risk-taking by banks. The action was in coordination with simultaneous and similar initiatives undertaken by the Bank of Canada, the Bank of England, the European Central Bank and the Swiss National Bank.

The shadow banking system is a term for the collection of non-bank financial intermediaries (NBFIs) that provide services similar to traditional commercial banks but outside normal banking regulations. Examples of NBFIs include insurance firms, pawn shops, cashier's check issuers, check cashing locations, payday lending, currency exchanges, and microloan organizations. The phrase "shadow banking" is regarded by some as pejorative, and the term "market-based finance" has been proposed as an alternative.

The Term Securities Lending Facility (TSLF) was a 28-day facility managed by the United States Federal Reserve offering Treasury general collateral (GC) to the primary dealers in exchange for other program-eligible collateral. It was created to combat the liquidity crisis in American banks that had begun in late 2007, part of the broader financial crisis of 2007-2008. The facility was open from March 2008 through January 2010.

This article provides background information regarding the subprime mortgage crisis. It discusses subprime lending, foreclosures, risk types, and mechanisms through which various entities involved were affected by the crisis.

The U.S. central banking system, the Federal Reserve, in partnership with central banks around the world, took several steps to address the subprime mortgage crisis. Federal Reserve Chairman Ben Bernanke stated in early 2008: "Broadly, the Federal Reserve’s response has followed two tracks: efforts to support market liquidity and functioning and the pursuit of our macroeconomic objectives through monetary policy." A 2011 study by the Government Accountability Office found that "on numerous occasions in 2008 and 2009, the Federal Reserve Board invoked emergency authority under the Federal Reserve Act of 1913 to authorize new broad-based programs and financial assistance to individual institutions to stabilize financial markets. Loans outstanding for the emergency programs peaked at more than $1 trillion in late 2008."

The interbank lending market is a market in which banks lend funds to one another for a specified term. Most interbank loans are for maturities of one week or less, the majority being over day. Such loans are made at the interbank rate. A sharp decline in transaction volume in this market was a major contributing factor to the collapse of several financial institutions during the financial crisis of 2007–2008.

The Term Asset-Backed Securities Loan Facility (TALF) is a program created by the U.S. Federal Reserve to spur consumer credit lending. The program was announced on November 25, 2008, and was to support the issuance of asset-backed securities (ABS) collateralized by student loans, auto loans, credit card loans, and loans guaranteed by the Small Business Administration (SBA). Under TALF, the Federal Reserve Bank of New York authorized up to $200 billion of loans on a non-recourse basis to holders of certain AAA-rated ABS backed by newly and recently originated consumer and small business loans. As TALF money did not originate from the U.S. Treasury, the program did not require congressional approval to disburse funds, but an act of Congress forced the Fed to reveal how it lent the money. The TALF began operation in March 2009 and was closed on June 30, 2010. TALF 2 was initiated in 2020 during the COVID-19 pandemic.

The Subprime mortgage crisis solutions debate discusses various actions and proposals by economists, government officials, journalists, and business leaders to address the subprime mortgage crisis and broader financial crisis of 2007–08.

On March 23, 2009, the United States Federal Deposit Insurance Corporation (FDIC), the Federal Reserve, and the United States Treasury Department announced the Public–Private Investment Program for Legacy Assets. The program is designed to provide liquidity for so-called "toxic assets" on the balance sheets of financial institutions. This program is one of the initiatives coming out of the implementation of the Troubled Asset Relief Program (TARP) as implemented by the U.S. Treasury under Secretary Timothy Geithner. The major stock market indexes in the United States rallied on the day of the announcement rising by over six percent with the shares of bank stocks leading the way. As of early June 2009, the program had not been implemented yet and was considered delayed. Yet, the Legacy Securities Program implemented by the Federal Reserve has begun by fall 2009 and the Legacy Loans Program is being tested by the FDIC. The proposed size of the program has been drastically reduced relative to its proposed size when it was rolled out.

Central bank liquidity swap is a type of currency swap used by a country's central bank to provide liquidity of its currency to another country's central bank. In a liquidity swap, the lending central bank uses its currency to buy the currency of another borrowing central bank at the market exchange rate, and agrees to sell the borrower's currency back at a rate that reflects the interest accrued on the loan. The borrower's currency serves as collateral.

The financial crisis of 2007–2008, or global financial crisis (GFC), was a severe worldwide economic crisis that occurred in the late 2000's. It was the most serious financial crisis since the Great Depression. Predatory lending targeting low-income homebuyers, excessive risk-taking by global financial institutions, and the bursting of the United States housing bubble culminated in a "perfect storm." Mortgage-backed securities (MBS) tied to American real estate, as well as a vast web of derivatives linked to those MBS, collapsed in value. Financial institutions worldwide suffered severe damage, reaching a climax with the bankruptcy of Lehman Brothers on September 15, 2008, and a subsequent international banking crisis.

On September 17, 2019, interest rates on overnight repurchase agreements, which are short-term loans between financial institutions, experienced a sudden and unexpected spike. A measure of the interest rate on overnight repos in the United States, the Secured Overnight Financing Rate (SOFR), increased from 2.43% on September 16 to 5.25% on September 17. During the trading day, interest rates reached as high as 10%. The activity also affected the interest rates on unsecured loans between financial institutions, and the Effective Federal Funds Rate (EFFR), which serves as a measure for such interest rates, moved above its target range determined by the Federal Reserve.

References

- ↑ FRBNY."Federal Reserve Bank of New York, Primary Dealer Credit Facility FAQ". Retrieved March 20, 2008.

- ↑ FRBNY. "Understanding Changes to Fed Liquidity Provision", May 2008. Retrieved January 30, 2009.

- ↑ Portfolio:Should the Fed lend to Investment Banks?. Retrieved January 30, 2009.

- ↑ Federal Reserve, factors supplying reserve balances. Retrieved January 30, 2009.

- ↑ Forbes [ dead link ] Thomson Financial News, Investors borrow 28.8 bln usd from Fed's new primary dealer credit facility, Retrieved March 20, 2008

- ↑ The Wall Street Journal, Wall Street Taps Fed's New Loan Program, Sudeep Reddy, March 21, 2008, p. A3, accessed March 21, 2008

- ↑ Federal Reserve Transaction data. Retrieved June 23, 2011.

- ↑ Federal Reserve."Press Release, July 30, 2008". Retrieved January 30, 2009.

- ↑ Federal Reserve."Press Release, September 14, 2008". Retrieved January 30, 2009.

- ↑ Federal Reserve."Press Release, December 2, 2008". Retrieved January 30, 2009.

- ↑ Federal Reserve Bank of New York Federal Reserve Bank of New York, FAQs: Primary Dealer Credit Facility. Retrieved March 23, 2020.

- ↑ Wilder, Rebecca.The Fed has been rather sneaky, Part 2, RGE Monitor. December 14, 2008. Retrieved January 30, 2009.

- ↑ Naked Capitalism.WSJ: The Fed Expands Liquidity Facilities to Include Equities, September 14, 2008. Retrieved January 30, 2009.

- ↑ Moore N., Heidi. The Fed Has to Keep Lending to Investment Banks. The Markets, um, Need It., The Wall Street Journal. July 30, 2008. Retrieved January 30, 2009.

- ↑ Naked Capitalism.Fed Opens Discount Window to Broker Dealers, March 17, 2008. Retrieved January 30, 2009.

- ↑ Izzo, Phil."Fed Pre-emptively Ends Regulatory Debate", Wall Street Journal. September 22, 2008. Retrieved January 30, 2009.

- ↑ Youtube. $1.2 Trillion Slush Fund: Congressman Alan Grayson Grills Fed Vice Chair Donald Kohn, January 13, 2009. Retrieved January 30, 2009.

- ↑ Regulatory Reform - PDCF description