The Federal Deposit Insurance Corporation (FDIC) is a United States government corporation supplying deposit insurance to depositors in American commercial banks and savings banks. The FDIC was created by the Banking Act of 1933, enacted during the Great Depression to restore trust in the American banking system. More than one-third of banks failed in the years before the FDIC's creation, and bank runs were common. The insurance limit was initially US$2,500 per ownership category, and this has been increased several times over the years. Since the enactment of the Dodd–Frank Wall Street Reform and Consumer Protection Act in 2010, the FDIC insures deposits in member banks up to $250,000 per ownership category. FDIC insurance is backed by the full faith and credit of the government of the United States, and according to the FDIC, "since its start in 1933 no depositor has ever lost a penny of FDIC-insured funds".

In the United States, banking had begun by the 1780s, along with the country's founding. It has developed into a highly influential and complex system of banking and financial services. Anchored by New York City and Wall Street, it is centered on various financial services, such as private banking, asset management, and deposit security.

A financial institution, sometimes called a banking institution, is a business entity that provides service as an intermediary for different types of financial monetary transactions. Broadly speaking, there are three major types of financial institution:

- Depository institution – deposit-taking institution that accepts and manages deposits and makes loans, including bank, building society, credit union, trust company, and mortgage broker;

- Contractual institution – insurance company and pension fund

- Investment institution – investment bank, underwriter, and other different types of financial entities managing investments.

A savings and loan association (S&L), or thrift institution, is a financial institution that specializes in accepting savings deposits and making mortgage and other loans. The terms "S&L" and "thrift" are mainly used in the United States; similar institutions in the United Kingdom, Ireland and some Commonwealth countries include building societies and trustee savings banks. They are often mutually held, meaning that the depositors and borrowers are members with voting rights, and have the ability to direct the financial and managerial goals of the organization like the members of a credit union or the policyholders of a mutual insurance company. While it is possible for an S&L to be a joint-stock company, and even publicly traded, in such instances it is no longer truly a mutual association, and depositors and borrowers no longer have membership rights and managerial control. By law, thrifts can have no more than 20 percent of their lending in commercial loans—their focus on mortgage and consumer loans makes them particularly vulnerable to housing downturns such as the deep one the U.S. experienced in 2007.

The savings and loan crisis of the 1980s and 1990s was the failure of 32% of savings and loan associations (S&Ls) in the United States from 1986 to 1995. An S&L or "thrift" is a financial institution that accepts savings deposits and makes mortgage, car and other personal loans to individual members.

The Community Reinvestment Act is a United States federal law designed to encourage commercial banks and savings associations to help meet the needs of borrowers in all segments of their communities, including low- and moderate-income neighborhoods. Congress passed the Act in 1977 to reduce discriminatory credit practices against low-income neighborhoods, a practice known as redlining.

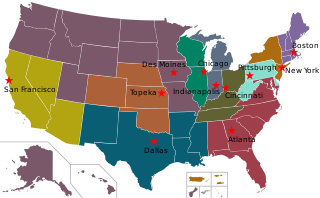

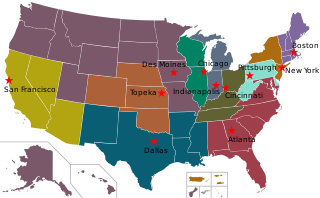

The Federal Home Loan Banks are 11 U.S. government-sponsored banks that provide liquidity to financial institutions to support housing finance and community investment.

The Federal Home Loan Bank Board (FHLBB) was a U.S. board created by the Federal Home Loan Bank Act in 1932 that governed the Federal Home Loan Banks, also created by the act; the Federal Savings and Loan Insurance Corporation (FSLIC); and nationally-chartered thrifts. It was abolished and superseded by the Federal Housing Finance Board and the Office of Thrift Supervision in 1989 due to the savings and loan crisis of the 1980s, as Federal Home Loan Banks gave favorable lending to the thrifts it regulated, leading to regulatory capture.

An industrial loan company (ILC) or industrial bank is a financial institution in the United States that lends money, and may be owned by non-financial institutions. They provide niche financial services nationwide. ILCs offer FDIC-insured deposits and are subject to FDIC and state regulator oversight. All "FDIC-insured entities are subject to Sections 23A and 23B of the Federal Reserve Act, which limits bank transactions with affiliates, including the non-bank parent company." ILCs are permitted to have branches in multiple states. They are regulated and supervised by state charters and insured by the Federal Deposit Insurance Corporation. They are authorized to make consumer and commercial loans and accept federally insured deposits. Banks may not accept demand deposits if the bank has total assets greater than $100 million. ILCs are exempted from the Bank Holding Company Act.

The Federal Financial Institutions Examination Council (FFIEC) is a formal U.S. government interagency body composed of five banking regulators that is "empowered to prescribe uniform principles, standards, and report forms to promote uniformity in the supervision of financial institutions". It also oversees real estate appraisal in the United States. Its regulations are contained in title 12 of the Code of Federal Regulations.

The Federal Savings and Loan Insurance Corporation (FSLIC) was an institution that administered deposit insurance for savings and loan institutions in the United States.

The Federal Deposit Insurance Reform Act of 2005, was an act of the United States Congress on banking regulation. It contained a number of changes to the Federal Deposit Insurance Corporation (FDIC).

All regulated financial institutions in the United States are required to file periodic financial and other information with their respective regulators and other parties. For banks in the U.S., one of the key reports required to be filed is the quarterly Consolidated Report of Condition and Income, generally referred to as the call report or RC report. Specifically, every National Bank, State Member Bank and insured Nonmember Bank is required by the Federal Financial Institutions Examination Council (FFIEC) to file a call report as of the close of business on the last day of each calendar quarter, i.e. the report date. The specific reporting requirements depend upon the size of the bank and whether or not it has any foreign offices. Call reports are due no later than 30 days after the end of each calendar quarter. Revisions may be made without prejudice up to 30 days after the initial filing period. Form FFIEC 031 is used for banks with both domestic (U.S.) and foreign (non-U.S.) offices; Forms FFIEC 041 and 051 is for banks with domestic (U.S.) offices only.

IndyMac, a contraction of Independent National Mortgage Corporation, was an American bank based in California that failed in 2008 and was seized by the United States Federal Deposit Insurance Corporation (FDIC).

The Federal Housing Finance Board (FHFB) was an independent agency of the United States government established in 1989 in the aftermath of the savings and loan crisis to take over management of the Federal Home Loan Banks from the Federal Home Loan Bank Board (FHLBB), and was superseded by the Federal Housing Finance Agency (FHFA) in 2008.

The Appraisal Foundation (TAF) is the United States organization responsible for setting standards for the real estate valuation profession. The organization sets the congressionally authorized standards and qualifications for real estate appraisers, and provides voluntary guidance on recognized valuation methods and techniques for all valuation professionals. The aim is to ensure appraisals are impartial, objective and independent, are conducted without bias and are performed in an ethical and competent manner.

Bank regulation in the United States is highly fragmented compared with other G10 countries, where most countries have only one bank regulator. In the U.S., banking is regulated at both the federal and state level. Depending on the type of charter a banking organization has and on its organizational structure, it may be subject to numerous federal and state banking regulations. Apart from the bank regulatory agencies the U.S. maintains separate securities, commodities, and insurance regulatory agencies at the federal and state level, unlike Japan and the United Kingdom. Bank examiners are generally employed to supervise banks and to ensure compliance with regulations.

Benj. Franklin Savings and Loan was a thrift based in Portland, in the U.S. state of Oregon. Founded in 1925, the company was seized by the United States Government in 1990. In 1996 the United States Supreme Court found that this and similar seizures were based on an unconstitutional provision of the Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA). Shareholders of the thrift sued the federal government for damages caused by the seizure, with the shareholders winning several rounds in the courts. In 2013, $9.5 million was allocated for disbursement to shareholders.

The New York State Banking Department was created by the New York Legislature on April 15, 1851, with a chief officer to be known as the Superintendent. The New York State Banking Department was the oldest bank regulatory agency in the United States.

The Financing Corporation (FICO) was a federally established mixed-ownership corporation that assumed all the assets and liabilities of the insolvent Federal Savings and Loan Insurance Corporation (FSLIC) and operated as a financing vehicle for the FSLIC Resolution Fund after the former was abolished by the Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA).