Related Research Articles

The Federal Deposit Insurance Corporation (FDIC) is a United States government corporation supplying deposit insurance to depositors in American commercial banks and savings banks. The FDIC was created by the Banking Act of 1933, enacted during the Great Depression to restore trust in the American banking system. More than one-third of banks failed in the years before the FDIC's creation, and bank runs were common. The insurance limit was initially US$2,500 per ownership category, and this has been increased several times over the years. Since the enactment of the Dodd–Frank Wall Street Reform and Consumer Protection Act in 2010, the FDIC insures deposits in member banks up to $250,000 per ownership category. FDIC insurance is backed by the full faith and credit of the government of the United States, and according to the FDIC, "since its start in 1933 no depositor has ever lost a penny of FDIC-insured funds".

In the United States, banking had begun by the 1780s, along with the country's founding. It has developed into a highly influential and complex system of banking and financial services. Anchored by New York City and Wall Street, it is centered on various financial services, such as private banking, asset management, and deposit security.

A savings and loan association (S&L), or thrift institution, is a financial institution that specializes in accepting savings deposits and making mortgage and other loans. While the terms "S&L" and "thrift" are mainly used in the United States, similar institutions in the United Kingdom, Ireland and some Commonwealth countries include building societies and trustee savings banks. They are often mutually held, meaning that the depositors and borrowers are members with voting rights, and have the ability to direct the financial and managerial goals of the organization like the members of a credit union or the policyholders of a mutual insurance company. While it is possible for an S&L to be a joint-stock company, and even publicly traded, in such instances it is no longer truly a mutual association, and depositors and borrowers no longer have membership rights and managerial control. By law, thrifts can have no more than 20 percent of their lending in commercial loans—their focus on mortgage and consumer loans makes them particularly vulnerable to housing downturns such as the deep one the U.S. experienced in 2007.

The savings and loan crisis of the 1980s and 1990s was the failure of 32% of savings and loan associations (S&Ls) in the United States from 1986 to 1995. An S&L or "thrift" is a financial institution that accepts savings deposits and makes mortgage, car and other personal loans to individual members.

The Community Reinvestment Act is a United States federal law designed to encourage commercial banks and savings associations to help meet the needs of borrowers in all segments of their communities, including low- and moderate-income neighborhoods. Congress passed the Act in 1977 to reduce discriminatory credit practices against low-income neighborhoods, a practice known as redlining.

The Federal Home Loan Banks are 11 U.S. government-sponsored banks that provide liquidity to financial institutions to support housing finance and community investment.

The Federal Home Loan Bank Board (FHLBB) was a U.S. board created by the Federal Home Loan Bank Act in 1932 that governed the Federal Home Loan Banks, also created by the act; the Federal Savings and Loan Insurance Corporation (FSLIC); and nationally-chartered thrifts. It was abolished and superseded by the Federal Housing Finance Board and the Office of Thrift Supervision in 1989 due to the savings and loan crisis of the 1980s, as Federal Home Loan Banks gave favorable lending to the thrifts it regulated, leading to regulatory capture.

Deposit insurance or deposit protection is a measure implemented in many countries to protect bank depositors, in full or in part, from losses caused by a bank's inability to pay its debts when due. Deposit insurance systems are one component of a financial system safety net that promotes financial stability.

The Resolution Trust Corporation (RTC) was a U.S. government-owned asset management company run by Lewis William Seidman and charged with liquidating assets, primarily real estate-related assets such as mortgage loans, that had been assets of savings and loan associations (S&Ls) declared insolvent by the Office of Thrift Supervision (OTS) as a consequence of the savings and loan crisis of the 1980s. It also took over the insurance functions of the former Federal Home Loan Bank Board (FHLBB).

The Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA), is a United States federal law enacted in the wake of the savings and loan crisis of the 1980s.

The Federal Savings and Loan Insurance Corporation (FSLIC) was an institution that administered deposit insurance for savings and loan institutions in the United States.

The Federal Deposit Insurance Reform Act of 2005, was an act of the United States Congress on banking regulation. It contained a number of changes to the Federal Deposit Insurance Corporation (FDIC).

The Federal Deposit Insurance Corporation Improvement Act of 1991, passed during the savings and loan crisis in the United States, strengthened the power of the Federal Deposit Insurance Corporation.

The National Housing Act of 1934, H.R. 9620, Pub. L.Tooltip Public Law 73–479, 48 Stat. 1246, enacted June 27, 1934, also called the Better Housing Program, was part of the New Deal passed during the Great Depression in order to make housing and home mortgages more affordable. It created the Federal Housing Administration (FHA) and the Federal Savings and Loan Insurance Corporation (FSLIC).

The Korea Deposit Insurance Corporation (KDIC) is a South Korean deposit insurance corporation, established in 1996 to protect depositors and maintain the stability of the financial system. The main functions of KDIC are insurance management, risk surveillance, resolution, recovery, and investigation.

The Federal Housing Finance Board (FHFB) was an independent agency of the United States government established in 1989 in the aftermath of the savings and loan crisis to take over management of the Federal Home Loan Banks from the Federal Home Loan Bank Board (FHLBB), and was superseded by the Federal Housing Finance Agency (FHFA) in 2008.

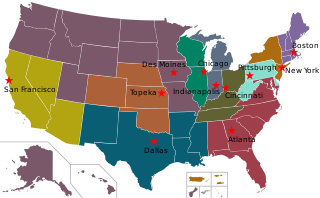

Bank regulation in the United States is highly fragmented compared with other G10 countries, where most countries have only one bank regulator. In the U.S., banking is regulated at both the federal and state level. Depending on the type of charter a banking organization has and on its organizational structure, it may be subject to numerous federal and state banking regulations. Apart from the bank regulatory agencies the U.S. maintains separate securities, commodities, and insurance regulatory agencies at the federal and state level, unlike Japan and the United Kingdom. Bank examiners are generally employed to supervise banks and to ensure compliance with regulations.

Benj. Franklin Savings and Loan was a thrift based in Portland, in the U.S. state of Oregon. Founded in 1925, the company was seized by the United States Government in 1990. In 1996 the United States Supreme Court found that this and similar seizures were based on an unconstitutional provision of the Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA). Shareholders of the thrift sued the federal government for damages caused by the seizure, with the shareholders winning several rounds in the courts. In 2013, $9.5 million was allocated for disbursement to shareholders.

The Resolution Funding Corporation (REFCORP) is a government-sponsored enterprise that provides funds to the Resolution Trust Corporation, which was established to finance the bailout of savings and loan associations in the wake of the savings and loan crisis of the 1980s in the United States. It was established by the United States Congress in the summer of 1989, as part of the Financial Institutions Reform, Recovery, and Enforcement Act of 1989. The Resolution Funding Corporation is a 501(c)(1) organization. As of July 1997, the Resolution Funding Corporation's debt stood at $30 billion.

This article details the history of banking in the United States. Banking in the United States is regulated by both the federal and state governments.

References

- Leggett, Keith J.; Strand, Robert W. (Fall 1997). "The Financing Corporation, Government-Sponsored Enterprises, and Moral Hazard" (PDF). Cato Journal . 17 (2). Cato Institute. Archived from the original (PDF) on 2011-03-28. Retrieved 2011-06-03.

- Appendix, Budget of the United States Government, Fiscal Year 2010, Office of Management and Budget (OMB), 2010, archived from the original on 2011-02-18, retrieved 2011-06-03