In economics, a recession is a business cycle contraction that occurs when there is a period of broad decline in economic activity. Recessions generally occur when there is a widespread drop in spending. This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale anthropogenic or natural disaster. But there is no official definition of a recession, according to the IMF.

Unemployment, according to the OECD, is people above a specified age not being in paid employment or self-employment but currently available for work during the reference period.

The United States is a highly developed social market economy. It is the world's largest economy by nominal GDP; it is also the second largest by purchasing power parity (PPP), behind China. It has the world's sixth highest per capita GDP (nominal) and the eighth highest per capita GDP (PPP) as of 2024. The U.S. accounted for 26% of the global economy in 2023 in nominal terms, and about 15.5% in PPP terms. The U.S. dollar is the currency of record most used in international transactions and is the world's reserve currency, backed by a large U.S. treasuries market, its role as the reference standard for the petrodollar system, and its linked eurodollar. Several countries use it as their official currency and in others it is the de facto currency. Since the end of World War II, the economy has achieved relatively steady growth, low unemployment and inflation, and rapid advances in technology.

The early 1990s recession describes the period of economic downturn affecting much of the Western world in the early 1990s. The impacts of the recession contributed in part to the 1992 U.S. presidential election victory of Bill Clinton over incumbent president George H. W. Bush. The recession also included the resignation of Canadian prime minister Brian Mulroney, the reduction of active companies by 15% and unemployment up to nearly 20% in Finland, civil disturbances in the United Kingdom and the growth of discount stores in the United States and beyond.

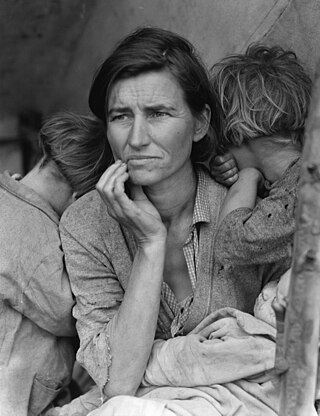

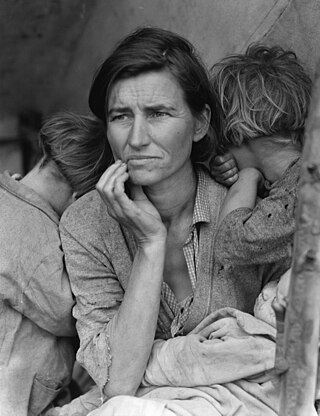

In the United States, the Great Depression began with the Wall Street Crash of October 1929 and then spread worldwide. The nadir came in 1931–1933, and recovery came in 1940. The stock market crash marked the beginning of a decade of high unemployment, poverty, low profits, deflation, plunging farm incomes, and lost opportunities for economic growth as well as for personal advancement. Altogether, there was a general loss of confidence in the economic future.

The recession of 1937–1938 was an economic downturn that occurred during the Great Depression in the United States.

The early 1980s recession was a severe economic recession that affected much of the world between approximately the start of 1980 and 1982. It is widely considered to have been the most severe recession since World War II until the 2007–2008 financial crisis.

The recession of 1953 was a period of economic downturn in the United States that began in the second quarter of 1953 and lasted until the first quarter of 1954. The total recession cost roughly $56 billion. It has been described by James L. Sundquist, a staff member of the Bureau of the Budget and speechwriter for President Harry S. Truman, as "relatively mild and brief." The 1953 recession is an example of a V-shaped recession, with a sharp three quarter decline that is followed by a sharp recovery.

The Great Depression (1929–1939) was a severe global economic downturn that affected many countries across the world. It became evident after a sharp decline in stock prices in the United States, the largest economy in the world at the time, leading to a period of economic depression. The economic contagion began around September 1929 and led to the Wall Street stock market crash of October. This crisis marked the start of a prolonged period of economic hardship characterized by high unemployment rates and widespread business failures.

The Depression of 1920–1921 was a sharp deflationary recession in the United States, United Kingdom and other countries, beginning 14 months after the end of World War I. It lasted from January 1920 to July 1921. The extent of the deflation was not only large, but large relative to the accompanying decline in real product.

North America was one of the focal points of the global Great Recession. While Canada has managed to return its economy nearly to the levels it enjoyed prior to the recession, the United States and Mexico are still under the influence of the worldwide economic slowdown. The cost of staple items dropped dramatically in the United States as a result of the recession.

The initial economic collapse which resulted in the Great Depression can be divided into two parts: 1929 to mid-1931, and then mid-1931 to 1933. The initial decline lasted from mid-1929 to mid-1931. During this time, most people believed that the decline was merely a bad recession, worse than the recessions that occurred in 1923 and 1927, but not as bad as the Depression of 1920-21. Economic forecasters throughout 1930 optimistically predicted an economic rebound come 1931, and felt vindicated by a stock market rally in the spring of 1930.

The 1973–1975 recession or 1970s recession was a period of economic stagnation in much of the Western world during the 1970s, putting an end to the overall post–World War II economic expansion. It differed from many previous recessions by involving stagflation, in which high unemployment and high inflation existed simultaneously.

The post–World War II economic expansion, also known as the postwar economic boom or the Golden Age of Capitalism, was a broad period of worldwide economic expansion beginning with the aftermath of World War II and ending with the 1973–1975 recession. The United States, the Soviet Union and Western European and East Asian countries in particular experienced unusually high and sustained growth, together with full employment.

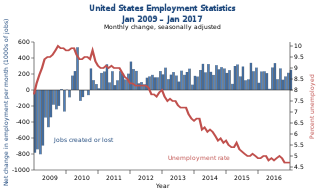

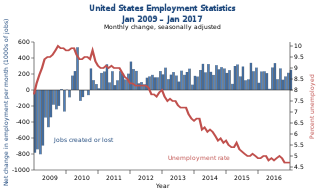

Unemployment in the United States discusses the causes and measures of U.S. unemployment and strategies for reducing it. Job creation and unemployment are affected by factors such as economic conditions, global competition, education, automation, and demographics. These factors can affect the number of workers, the duration of unemployment, and wage levels.

The United States entered a recession in 1990, which lasted 8 months through March 1991. Although the recession was mild relative to other post-war recessions, it was characterized by a sluggish employment recovery, most commonly referred to as a jobless recovery. Unemployment continued to rise through June 1992, even though a positive economic growth rate had returned the previous year.

The United States entered recession in January 1980 and returned to growth six months later in July 1980. Although recovery took hold, the unemployment rate remained unchanged through the start of a second recession in July 1981. The downturn ended 16 months later, in November 1982. The economy entered a strong recovery and experienced a lengthy expansion through 1990.

The early 1990s recession saw a period of economic downturn affect much of the world in the late 1980s and early 1990s. The economy of Australia suffered its worst recession since the Great Depression.

Job creation and unemployment are affected by factors such as aggregate demand, global competition, education, automation, and demographics. These factors can affect the number of workers, the duration of unemployment, and wage rates.