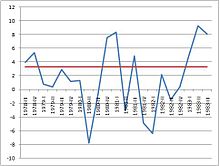

In economics, a recession is a business cycle contraction that occurs when there is a period of broad decline in economic activity. Recessions generally occur when there is a widespread drop in spending. This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale anthropogenic or natural disaster. There is no official definition of a recession, according to the IMF.

The economy of Slovenia is a developed mixed economy. The country enjoys a high level of prosperity and stability as well as above-average GDP per capita by purchasing power parity at 91% of the EU average in 2023. The nominal GDP in 2023 is 68.108 billion USD, nominal GDP per capita (GDP/pc) in 2023 is USD 32,350. The highest GDP/pc is in central Slovenia, where the capital city Ljubljana is located. It is part of the Western Slovenia statistical region, which has a higher GDP/pc than eastern Slovenia.

The economy of Spain is a highly developed social market economy. It is the world's 15th largest by nominal GDP and the sixth-largest in Europe. Spain is a member of the European Union and the eurozone, as well as the Organization for Economic Co-operation and Development and the World Trade Organization. In 2023, Spain was the 18th-largest exporter in the world. Meanwhile, in 2022, Spain was the 15th-largest importer in the world. Spain is listed 27th in the United Nations Human Development Index and 36th in GDP per capita by the World Bank. Some main areas of economic activity are the automotive industry, medical technology, chemicals, shipbuilding, tourism and the textile industry. Among OECD members, Spain has a highly efficient and strong social security system, which comprises roughly 23% of GDP.

An economic depression is a period of carried long-term economic downturn that is the result of lowered economic activity in one or more major national economies. It is often understood in economics that economic crisis and the following recession that may be named economic depression are part of economic cycles where the slowdown of the economy follows the economic growth and vice versa. It is a result of more severe economic problems or a downturn than the recession itself, which is a slowdown in economic activity over the course of the normal business cycle of growing economy.

The accelerator effect in economics is a positive effect on private fixed investment of the growth of the market economy. Rising GDP implies that businesses in general see rising profits, increased sales and cash flow, and greater use of existing capacity. This usually implies that profit expectations and business confidence rise, encouraging businesses to build more factories and other buildings and to install more machinery. This may lead to further growth of the economy through the stimulation of consumer incomes and purchases, i.e., via the multiplier effect.

Household debt is the combined debt of all people in a household, including consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and subsequent European economic crises of 2007–2012. Several economists have argued that lowering this debt is essential to economic recovery in the U.S. and selected Eurozone countries.

The Japanese asset price bubble was an economic bubble in Japan from 1986 to 1991 in which real estate and stock market prices were greatly inflated. In early 1992, this price bubble burst and Japan's economy stagnated. The bubble was characterized by rapid acceleration of asset prices and overheated economic activity, as well as an uncontrolled money supply and credit expansion. More specifically, over-confidence and speculation regarding asset and stock prices were closely associated with excessive monetary easing policy at the time. Through the creation of economic policies that cultivated the marketability of assets, eased the access to credit, and encouraged speculation, the Japanese government started a prolonged and exacerbated Japanese asset price bubble.

The Great Recession was a period of market decline in economies around the world that occurred from late 2007 to mid-2009. The scale and timing of the recession varied from country to country. At the time, the International Monetary Fund (IMF) concluded that it was the most severe economic and financial meltdown since the Great Depression.

This article gives the timeline of the Great Recession, which hit many developed economies in the wake of the 2007–2008 financial crisis.

The European recession is part of the Great Recession that began in mid-2007. The crisis spread rapidly and affected much of the region, with several countries already in recession as of February 2009, and most others suffering marked economic setbacks. The global recession was first seen in Europe, as Ireland was the first country to fall into recession from Q2-Q3 2007 – followed by temporary growth in Q4 2007 – and then a two-year-long recession.

The Lost Decades are a lengthy period of economic stagnation in Japan precipitated by the asset price bubble's collapse beginning in 1990. The singular term Lost Decade originally referred to the 1990s, but the 2000s and the 2010s have been included by commentators as the phenomenon continued.

The 2008 Latvian financial crisis, which stemmed from the 2007–2008 financial crisis, was a major economic and political crisis in Latvia. The crisis was generated when an easy credit market burst, resulting in an unemployment crisis, along with the bankruptcy of many companies. Since 2010, economic activity has recovered and Latvia's economic growth rate was the fastest among the EU member states in the first three quarters of 2012.

In the United States, the Great Recession was a severe financial crisis combined with a deep recession. While the recession officially lasted from December 2007 to June 2009, it took many years for the economy to recover to pre-crisis levels of employment and output. This slow recovery was due in part to households and financial institutions paying off debts accumulated in the years preceding the crisis along with restrained government spending following initial stimulus efforts. It followed the bursting of the housing bubble, the housing market correction and subprime mortgage crisis.

An economic recovery is the phase of the business cycle following a recession. The overall business outlook for an industry looks optimistic during the economic recovery phase.

The 2010–2014 Portuguese financial crisis was part of the wider downturn of the Portuguese economy that started in 2001 and possibly ended between 2016 and 2017. The period from 2010 to 2014 was probably the hardest and more challenging part of the entire economic crisis; this period includes the 2011–14 international bailout to Portugal and was marked by intense austerity policies, more intense than the wider 2001-2017 crisis. Economic growth stalled in Portugal between 2001 and 2002, and following years of internal economic crisis, the worldwide Great Recession started to hit Portugal in 2008 and eventually led to the country being unable to repay or refinance its government debt without the assistance of third parties. To prevent an insolvency situation in the debt crisis, Portugal applied in April 2011 for bail-out programs and drew a cumulated €78 billion from the IMF, the EFSM, and the EFSF. Portugal exited the bailout in May 2014, the same year that positive economic growth re-appeared following three years of recession. The government achieved a 2.1% budget deficit in 2016 and in 2017 the economy grew 2.7%.

The European debt crisis, often also referred to as the eurozone crisis or the European sovereign debt crisis, was a multi-year debt crisis that took place in the European Union (EU) from 2009 until the mid to late 2010s that made it difficult or impossible for some countries in the euro area to repay or refinance their government debt without the assistance of third parties.

Abenomics refers to the economic policies implemented by the Government of Japan led by the Liberal Democratic Party (LDP) since the December 2012 general election. They are named after Shinzō Abe (1954–2022), who had been appointed as Prime Minister of Japan in his second term from 2012 to 2020. Abe was the longest-serving prime minister in Japanese history. After Abe resigned in September 2020, his successor, Yoshihide Suga, stated that his premiership would focus on continuing the policies and goals of the Abe administration, including the Abenomics suite of economic policies.

The proposed long-term solutions for the Eurozone crisis address ways to deal with the European debt crisis that took place in the European Union from 2009 till the late 2010s, including risks to Eurozone country governments and the Euro.

The COVID-19 recession was a global economic recession caused by COVID-19 lockdowns. The recession began in most countries in February 2020. After a year of global economic slowdown that saw stagnation of economic growth and consumer activity, the COVID-19 lockdowns and other precautions taken in early 2020 drove the global economy into crisis. Within seven months, every advanced economy had fallen to recession.

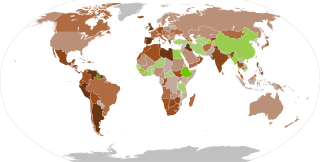

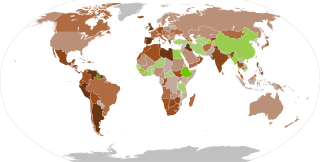

Green recovery packages are proposed environmental, regulatory, and fiscal reforms to rebuild prosperity in the wake of an economic crisis, such as the COVID-19 recession or the 2007–2008 financial crisis. They pertain to fiscal measures that intend to recover economic growth while also positively benefitting the environment, including measures for renewable energy, efficient energy use, nature-based solutions, sustainable transport, green innovation and green jobs, amongst others.